EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

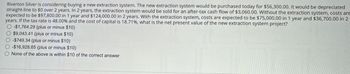

Transcribed Image Text:Riverton Silver is considering buying a new extraction system. The new extraction system would be purchased today for $56,300.00. It would be depreciated

straight-line to $0 over 2 years. In 2 years, the extraction system would be sold for an after-tax cash flow of $3,060.00. Without the extraction system, costs are

expected to be $97,800.00 in 1 year and $124,000.00 in 2 years. With the extraction system, costs are expected to be $75,000.00 in 1 year and $36,700.00 in 2

years. If the tax rate is 48.00% and the cost of capital is 18.71%, what is the net present value of the new extraction system project?

-$1,764.29 (plus or minus $10)

$9,043.41 (plus or minus $10)

-$749.34 (plus or minus $10)

-$16,928.65 (plus or minus $10)

None of the above is within $10 of the correct answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Dauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6 years, and an estimated salvage value of 800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase- The replacement machine would permit an output expansion, so sales would rise by 1,000 per year; even so, the new machines much greater efficiency would cause operating expenses to decline by 1,500 per year The new machine would require that inventories be increased by 2,000, but accounts payable would simultaneously increase by 500. Dautens marginal federal-plus-state tax rate is 25%, and its WACC is 11%. Should it replace the old machine?arrow_forwardThe Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500, and it is expected to generate net after-tax operating cash flows, including depreciation, of $6,250 per year. The truck has a 5-year expected life. The expected salvage values after tax adjustments for the truck are given here. The company’s cost of capital is 10%. Should the firm operate the truck until the end of its 5-year physical life? If not, then what is its optimal economic life? Would the introduction of salvage values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project?arrow_forwardAlthough the Chen Company’s milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standards, though, and so the company is considering replacing it. The new milling machine, at a cost of $110,000 delivered and installed, would also last for 10 years and would produce after-tax cash flows (labor savings and depreciation tax savings) of $19,000 per year. It would have zero salvage value at the end of its life. The project cost of capital is 10%, and its marginal tax rate is 25%. Should Chen buy the new machine?arrow_forward

- Each of the following scenarios is independent. All cash flows are after-tax cash flows. Required: 1. Patz Corporation is considering the purchase of a computer-aided manufacturing system. The cash benefits will be 800,000 per year. The system costs 4,000,000 and will last eight years. Compute the NPV assuming a discount rate of 10 percent. Should the company buy the new system? 2. Sterling Wetzel has just invested 270,000 in a restaurant specializing in German food. He expects to receive 43,470 per year for the next eight years. His cost of capital is 5.5 percent. Compute the internal rate of return. Did Sterling make a good decision?arrow_forwardCaduceus Company is considering the purchase of a new piece of factory equipment that will cost $565,000 and will generate $135,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return In Excel, see Appendix C.arrow_forwardShao Airlines is considering the purchase of two alternative planes. Plane A has an expected life of 5 years, will cost $100 million, and will produce net cash flows of $30 million per year. Plane B has a life of 10 years, will cost $132 million, and will produce net cash flows of $25 million per year. Shao plans to serve the route for only 10 years. Inflation in operating costs, airplane costs, and fares are expected to be zero, and the company’s cost of capital is 12%. By how much would the value of the company increase if it accepted the better project (plane)? What is the equivalent annual annuity for each plane?arrow_forward

- The Rodriguez Company is considering an average-risk investment in a mineral water spring project that has an initial after-tax cost of 170,000. The project will produce 1,000 cases of mineral water per year indefinitely, starting at Year 1. The Year-1 sales price will be 138 per case, and the Year-1 cost per case will be 105. The firm is taxed at a rate of 25%. Both prices and costs are expected to rise after Year 1 at a rate of 6% per year due to inflation. The firm uses only equity, and it has a cost of capital of 15%. Assume that cash flows consist only of after-tax profits because the spring has an indefinite life and will not be depreciated. a. What is the present value of future cash flows? (Hint: The project is a growing perpetuity, so you must use the constant growth formula to find its NPV.) What is the NPV? b. Suppose that the company had forgotten to include future inflation. What would they have incorrectly calculated as the projects NPV?arrow_forwardFriedman Company is considering installing a new IT system. The cost of the new system is estimated to be 2,250,000, but it would produce after-tax savings of 450,000 per year in labor costs. The estimated life of the new system is 10 years, with no salvage value expected. Intrigued by the possibility of saving 450,000 per year and having a more reliable information system, the president of Friedman has asked for an analysis of the projects economic viability. All capital projects are required to earn at least the firms cost of capital, which is 12 percent. Required: 1. Calculate the projects internal rate of return. Should the company acquire the new IT system? 2. Suppose that savings are less than claimed. Calculate the minimum annual cash savings that must be realized for the project to earn a rate equal to the firms cost of capital. Comment on the safety margin that exists, if any. 3. Suppose that the life of the IT system is overestimated by two years. Repeat Requirements 1 and 2 under this assumption. Comment on the usefulness of this information.arrow_forwardThe Ham and Egg Restaurant is considering an investment in a new oven that has a cost of $60,000, with annual net cash flows of $9,950 for 8 years. The required rate of return is 6%. Compute the net present value of this investment to determine whether or not you would recommend that Ham and Egg invest in this oven.arrow_forward

- Talbot Industries is considering launching a new product. The new manufacturing equipment will cost $17 million, and production and sales will require an initial $5 million investment in net operating working capital. The company’s tax rate is 25%. What is the initial investment outlay? The company spent and expensed $150,000 on research related to the new product last year. What is the initial investment outlay? Rather than build a new manufacturing facility, the company plans to install the equipment in a building it owns but is not now using. The building could be sold for $1.5 million after taxes and real estate commissions. What is the initial investment outlay?arrow_forwardXYZ is considering buying a new, high efficiency interception system. The new system would be purchased today for $47,700.00. It would be depreciated straight-line to SO over 2 years. In 2 years, the system would be sold for an after-tax cash flow of $14,600.00. Without the system, costs are expected to be $100,000.00 in 1 year and $100,000.00 in 2 years. With the system, costs are expected to be $79,000.00 in 1 year and $69,700.00 in 2 years. If the tax rate is 46.50% and the cost of capital is 8.40%, what is the net present value of the new interception system project? a. $11893.11 (plus or minus $50) b. $12724.27 (plus or minus $50) c. $8553.76 (plus or minus $50) d. $9953.14 (plus or minus $50) e. None of the above is within $50 of the correct answerarrow_forwardTripp Industries is considering buying a new recycling system. The new recycling system would be purchased today for $7,760.00. It would be depreciated straight-line to $1,060.00 over 2 years. In 2 years, the recycling system would be sold and the after-tax cash flow from capital spending in year 2 would be $1,290.00. The recycling system is expected to reduce costs by $2,810.00 in year 1 and by $8,610.00 in year 2. If the tax rate is 59.00 % and the cost of capital is 7.16%, what is the net present value of the new recycling system project? $426.49 (plus or minus $10) $331.08 (plus or minus $10) $1,078.26 (plus or minus $10) -$2,115.95 (plus or minus $10) None of the above is within $10 of the correct answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning