EBK CFIN

6th Edition

ISBN: 9781337671743

Author: BESLEY

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Please Write Step by Step Solution

Otherwise i give DISLIKE !!

Transcribed Image Text:Question 17 of 30

< >

View Policies

-/0.35 E

Current Attempt in Progress

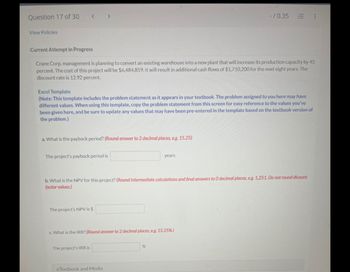

Crane Corp. management is planning to convert an existing warehouse into a new plant that will increase its production capacity by 45

percent. The cost of this project will be $6,484,859. It will result in additional cash flows of $1,710,200 for the next eight years. The

discount rate is 12.92 percent.

Excel Template

(Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have

different values. When using this template, copy the problem statement from this screen for easy reference to the values you've

been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of

the problem.)

a. What is the payback period? (Round answer to 2 decimal places, e.g. 15.25)

The project's payback period is

years

b. What is the NPV for this project? (Round intermediate calculations and final answers to O decimal places, eg. 1,251. Do not round dicount

factor values.)

The project's NPV is $

c. What is the IRR? (Round answer to 2 decimal places, e.g. 15.25%.)

The project's IRR is

%

eTextbook and Media

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Question 17 of 30 View Policies -/0.35 : Current Attempt in Progress Crane Corp. management is planning to convert an existing warehouse into a new plant that will increase its production capacity by 45 percent. The cost of this project will be $6,484,859. It will result in additional cash flows of $1,710,200 for the next eight years. The discount rate is 12.92 percent. Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) a. What is the payback period? (Round answer to 2 decimal places, e.g. 15.25) The project's payback period is years b. What is the NPV for this project? (Round intermediate calculations and final answers to O…arrow_forwardCurrent Attempt in Progress Sandhill Corp. management is planning to convert an existing warehouse into a new plant that will increase its production capacity by 45 percent. The cost of this project will be $9,965,338. It will result in additional cash flows of $2,080,200 for the next eight years. The discount rate is 13.19 percent. Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) a. What is the payback period? (Round answer to 2 decimal places, e.g. 15.25) The project's payback period is years b. What is the NPV for this project? (Round intermediate calculations and final answers to 0 decimal places, e.g. 1,251. Do not round…arrow_forwardQuestion Content Area There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $35,000 and is expected to generate the following cash flows: First Year Second Year Third Year Total Alpha Project $31,500 $22,500 $5,000 $59,000 Beta Project 7,000 23,000 28,000 58,000 (Click here to see present value and future value tables) A. If the discount rate is 12%, compute the NPV of each project. Round your present value factor to three decimal places and final answer to answer to 2 decimal places. Alpha Project $fill in the blank 1 Beta Project $fill in the blank 2 B. Which project should be recommended. .Please round off anwsers. Thank youarrow_forward

- kararrow_forwardAnswer thi questions step by steparrow_forward4 Book Consider two mutually exclusive new product launch projects that Nagano Golf is considering. Assume that the discount rate for Nagano Golf is 16 percent Project A Nagano NP-30. Professional clubs that will take an initial investment of $971,000 at time 0. Next five years (years 1-5) of sales will generate a consistent cash flow of $440,000 per year. Introduction of new product at year 6 will terminate further cash flows from this project Project B Nagano NX-20 High-end amateur clubs that will take an initial investment of $700,000 at time 0. Cash flow at year 1 is $290,000. In each subsequent year, cash flow will grow at 10 percent per year. Introduction of new product at year 6 will terminate further cash flows from this project. Year e 1 2 3 4 NP-30 -$971,000 440,000 440,000 440,000 440,000 440,000 NX-20 -$700,000 290,000 319,000 350,900 Net present value Internal rate of return 385,990 424,589 Complete the following table: (Do not round intermediate calculations. Round the…arrow_forward

- Hi expert please provide correct answer general general Accountingarrow_forwardSM5arrow_forwardQuestion 29 of 30. View Policies Show Attempt History Current Attempt in Progress X Your answer is incorrect. 0/0.1 E E Strange Manufacturing Company is purchasing a production facility at a cost of $21 million. The firm expects the project to generate annual cash flows of $7 million over the next five years. Its cost of capital is 18 percent. What is the internal rate of return on this project? (Do not round intermediate computations. Round final answer to the nearest percent.) 19% 18% 20% 17% eTextbook and Media D Save for Later Attempts: 1 of 3 used Submit Answer Using multiple attempts will impact your score. 20% score reduction after attempt 2 Searcharrow_forward

- question for myarrow_forwardic Yo NS io cer ist bun ngs nnée Current Attempt in Progress Blossom Manufacturing Co. is evaluating two projects. The company uses payback criteria of three years or less. Project A has a cost of $905,000, and project B's cost is $1,247,300. Cash flows from both projects are given in the following table. Year 1 2 3 4 Project A $86,212 313,562 427,594 285,552 Project B $586,212 413,277 231,199 What are their discounted payback periods? (Round answers to 2 decimal places, e.g. 15.25. If discounted payback period exceeds life of the project, enter 0.00 for the answer.) Discounted payback period of project A Discounted payback period of project B will he accepted with a discount rate of 8 percent? átv zoomarrow_forward_please helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you