International Financial Management

14th Edition

ISBN: 9780357130698

Author: Madura

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

am. 131.

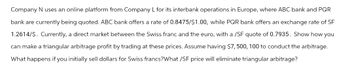

Transcribed Image Text:Company N uses an online platform from Company L for its interbank operations in Europe, where ABC bank and PQR

bank are currently being quoted. ABC bank offers a rate of 0.8475/$1.00, while PQR bank offers an exchange rate of SF

1.2614/$. Currently, a direct market between the Swiss franc and the euro, with a /SF quote of 0.7935. Show how you

can make a triangular arbitrage profit by trading at these prices. Assume having $7,500, 100 to conduct the arbitrage.

What happens if you initially sell dollars for Swiss francs?What /SF price will eliminate triangular arbitrage?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following exchange rates are available to you. (You can buy or sell at the stated rates.) Mt Fuji Bank ¥120.00/A$ Mt Rushmore Bank SF1.6000/A$ Mt Blanc Bank ¥80.00/SF Assume that you have SF10, 000,000. Can you make a profit via triangular arbitrage? If so, show the steps that you will follow and calculate the amount of profit in Swiss francs.arrow_forward1. The foreign exchange market for Swiss francs (CHF) is shown below; the U.S. dollar is the pricing currency and the current exchange rate is $1.05/CHF. es/CHF 1.05/CHF = e D QCHF millionsarrow_forwardAssume that you are a trader with Deutsche Bank. From the quote system on your computer terminal, you notice that Dresdner Bank is quoting €0.7536/$1 and Credit Suisse is offering SFr1.1802/$1. You learn that USB is making a direct market between the Swiss franc and the euro, with a current €/SFr quote of 0.6397. What €/SFr price will eliminate triangular arbitrage?arrow_forward

- Suppose the following exchange rate quotations are available: Citibank quotes U.S. dollars per Euro: $1.2223/€Barclays Bank quotes U.S. dollars per pound sterling: $1.8410/£ Dresdner Bank quotes Euros per pound sterling: €1.5100/£ You are a market trader with $1,000,000. Will you be able to make an arbitrage profit using these quotes? If yes, why? What will be the profit? Show your calculations.arrow_forwardPlease Help The Swiss Franc is trading at 1.1464 $/ SFr, the euro is trading at 1.0828 $/euro. If you can buy or sell SFr/euro at 0.9451, is there an arbitrage? If so, how much can you make with one round - trip using $1,000,000 ? Please Helparrow_forwardPeter Sheffield has Euros (€) amounting to €500,000 and is provided with the following quotes: Bank A: Euro/US dollar = €0.8418/$ Bank A: British pound /US dollar = £0.7538/S Bank B: British pound/Euro = £0.8863/€ Determine whether an arbitrage opportunity exists. Show your calculation in the space below and briefly explain (in one or two sentences) why the arbitrage opportunity exists or not. For example, show your calculation as follows (The currencies used in the example are not applicable to your calculation. It just provide you with information how you should show your calculation): Yen/ZAR = 11.7654/1.3954 = 8.4316 (Round your answer to 4 decimals) Reason why arbitrage opportunity exists/ does not exist:arrow_forward

- A bank is quoting the following exchange rates against the dollar for the Swiss franc and the Australian dollar: SFr/$ 1.4970 - 80 A$/$ 1.6237 - 47 An Australian firm asks the bank for an SFr/A$ quote. What cross-rate would the bank quote? (Round your answers to 4 decimal places.) Cross-rate Bid Price Ask Pricearrow_forwardAn Australian firm asks the bank for an AS/SFr quote because it received SFr and wants to change it to A$. A bank is quoting the following exchange rates against the US dollar for the Swiss franc and the Australian dollar: SFr/US$ = 1.4950-60 AS/USS = 1.5245-50 Calculate the cross ask rate for the A$/SFR by identifying the correct formula in the attached formula sheet. One of the following answers will be correct: a. 1.0201 b. 1.0213 c. 0.9813 d. 0.9803 Show your workings in the space provided as well as the correct answer. For example write your answer as follows in the space provided below: Spot ask rate (AS/SFR) = 1.4670/1.3980 = 1.0494arrow_forwardA bank is quoting the following exchange rates against the dollar for the Swiss franc and the Australian dollar: SFr/$ = 1.4970 − 80 A$/$ = 1.6237 − 47 An Australian firm asks the bank for an SFr/A$ quote. What cross-rate would the bank quote? (Round your answers to 4 decimal places.)arrow_forward

- From the following data provided, ascertain what would be the exchange rates that the Bank would quote for an FDI transaction amounting to USD 2 Mn for value cash basis, assuming a margin of 3 paise where., Spot USD/INR = 75.0900/75.1000 ., Cash/Spot : 4/5 paise. Arrive at the exchange rate up to 4 decimal places. Adhere to the steps involved in calculation.arrow_forwardAssume your firm has transferred you to Zurich Switzerland. You work in the triangular arbitrage division. View the following exchange rates. Is an arbitrage opportunity available? If not, explain why an opportunity does not exist. If so, from the Swiss point of view show how to exploit the opportunity. CHF .8976 = $1.00, $.0130 = INR 1.00, INR 92.7904 = CHF 1 Now say instead of working in Zurich, you were employed in Mumbai, India. How does that change your thinking on the arbitrage? PLEASE ANWSER CORRECTLY AND SHOW WORKarrow_forwardSuppose quotes for the dollar–euro exchange rate E$/€ are as follows: in New York $1.05 per euro, and in Tokyo $1.15 per euro. Describe how investors use arbitrage to take advantage of the difference in exchange rates. Explain how this process will affect the dollar price of the euro in New York and Tokyo.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning