FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

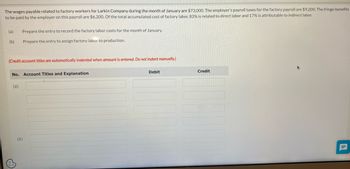

Transcribed Image Text:The wages payable related to factory workers for Larkin Company during the month of January are $73,000. The employer's payroll taxes for the factory payroll are $9,200. The fringe benefits

to be paid by the employer on this payroll are $6,200. Of the total accumulated cost of factory labor, 83% is related to direct labor and 17% is attributable to indirect labor.

(a)

(b)

Prepare the entry to record the factory labor costs for the month of January.

Prepare the entry to assign factory labor to production.

(Credit account titles are automatically indented when amount is entered. Do not indent manually.)

No. Account Titles and Explanation

(a)

(b)

Debit

Credit

II

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During the month, Job #2 used specialized machinery for 350 hours and incurred $700 in utilities on account, $400 in factory depreciation expense, and $200 in property tax on the factory. Prepare journal entries for the following: Record the expenses incurred. Record the allocation of overhead at the predetermined rate of $1.50 per machine hour.arrow_forward1. Purchased $75,180 in materials on account. Check my work 2. Issued $2,100 in supplies from the materials inventory to the production department. 3. Paid for the materials purchased in transaction (1) 4. Issued $35,700 in direct materials to the production department. 5. Incurred wage costs of $58,800, which were debited to Payroll, a temporary account. Of this amount, $18,900 was withheld for payroll taxes and credited to Payroll Taxes Payable. The remaining $39,900 was paid in cash to the employees. See transactions (6) and (7) for additional information about Payroll. 5. Recognized $29,400 in fringe benefit costs, incurred as a result of the wages paid in (5). This $29,400 was debited to Payroll and credited to Fringe Benefits Payable 7. Analyzed the Payroll account and determined that 60 percent represented direct labor; 30 percent, indirect manufacturing labor, and 10 percent, administrative and marketing costs. 8. Paid for utilities, power, equipment maintenance, and other…arrow_forwardCalculate the total cost of the employee's wages during the week described above.arrow_forward

- A review of the accounting records of Benson Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president-$31,400. 2. Salary of the vice president of manufacturing—$15,100. 3. Salary of the chief financial officer-$17,900. 4. Salary of the vice president of marketing-$14,800. 5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant—$186,000. 6. Wages of production workers-$933,000. 7. Salaries of administrative personnel-$106,000. 8. Salaries of engineers and other personnel responsible for maintaining production equipment-$171,000. 9. Commissions paid to sales staff-$261,000. Required a. What amount of payroll cost would be classified as SG&A (selling, general, and administrative) expense? b. Assuming that Benson made 3,100 units of product and sold 2,170 of them during the month of March,…arrow_forwardIn addition to wages, direct manufacturing labor-related costs include pension contributions of $0.40 per hour, worker’s compensation insurance of $0.10 per hour, employee medical insurance of $0.50 per hour, and Social Security taxes. Assume that as of January 1, 2018, the Social Security tax rates are 7.5% for employers and 7.5% for employees. The cost of employee benefits paid by DeWitt on its direct manufacturing employees is treated as a direct manufacturing labor cost. DeWitt has a labor contract that calls for a wage increase to $12 per hour on April 1, 2018. New laborsaving machinery has been installed and will be fully operational by March 1, 2018. DeWitt expects to have 16,000 frames on hand at December 31, 2017, and it has a policy of carrying an end-of-month inventory of 100% of the following month’s sales plus 50% of the second following month’s sales. Q1. Prepare a production budget and a direct manufacturing labor cost budget for DeWitt Company by month and for the first…arrow_forwardA review of the accounting records of Finch Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president—$32,300.2. Salary of the vice president of manufacturing—$16,700.3. Salary of the chief financial officer—$19,000.4. Salary of the vice president of marketing—$14,900.5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant—$189,000.6. Wages of production workers—$929,000.7. Salaries of administrative secretaries—$105,000.8. Salaries of engineers and other personnel responsible for maintaining production equipment—$183,000.9. Commissions paid to sales staff—$243,000. Requireda. What amount of payroll cost would be classified as SG&A expense?b. Assuming that Finch made 3,400 units of product and sold 3,060 of them during the month of March, determine the amount of payroll cost…arrow_forward

- The following information is available for Wonderway, Incorporated, for the current year: Factory rent Company advertising Wages paid to laborers Depreciation for president's vehicle Indirect production labor Utilities for factory Production supervisor's salary President's salary Direct materials used Sales commissions Factory insurance Depreciation on factory equipment $ 29,300 20,800 85,200 8,050 1,880 31,900 30,700 60,800 34,900 7,530 13,100 26,500 Required: 1. Calculate the direct labor cost for Wonderway. 2. Calculate the manufacturing overhead cost for Wonderway. 3. Calculate the prime cost for Wonderway. 4. Calculate the conversion cost for Wonderway. 5. Calculate the total manufacturing cost for Wonderway. 6. Calculate the period expenses for Wonderway. 4arrow_forwardEdwin Parts, a job shop, recorded the following transactions in May: Purchased $87,200 in materials on account. Issued $3,650 in supplies from the materials inventory to the production department. Issued $43,600 in direct materials to the production department. Paid for the materials purchased in transaction (1). Incurred wage costs of $67,200, which were debited to Payroll, a temporary account. Of this amount, $22,300 was withheld for payroll taxes and credited to Payroll Taxes Payable. The remaining $44,900 was paid in cash to the employees. See transactions (6) and (7) for additional information about Payroll. Recognized $34,700 in fringe benefit costs, incurred as a result of the wages paid in (5). This $34,700 was debited to Payroll and credited to Fringe Benefits Payable. Analyzed the Payroll account and determined that 65 percent represented direct labor; 15 percent, indirect manufacturing labor; and 20 percent, administrative and marketing costs. Applied overhead on the basis…arrow_forwardThe gross earnings of factory workers for Blossom Company during the month of January are $320,000. The employer's payroll taxes for the factory payroll are $64,000. Of the total accumulated cost of factory labor, 75% is related to direct labor and 25% is attributable to indirect labor. (a) Prepare the entry to record the factory labor costs for the month of January. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Your answer has been saved. See score details after the due date. Account Titles and Explanation (b) (c) Factory Labor Payroll Liabilities Your answer has been saved. See score details after the due date. Account Titles and Explanation Work in Process Inventory Manufacturing Overhead Prepare the entry to assign factory labor to production. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit…arrow_forward

- E3-3 Modified wage plan Randy Wetzel earns $25 per hour for up to 400 units of produc- tion per day. If he produces more than 400 units per day, he will receive an additional piece rate of $.50 per unit. Assume LO1arrow_forwardA review of the accounting records of Stuart Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president-$31,200. 2. Salary of the vice president of manufacturing-$16,600. 3. Salary of the chlef financial officer-$17,900. 4. Salary of the vice president of marketing-$15,900. 5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant-$194,000. 6. Wages of production workers-$937,000. 7. Salaries of administrative personnel-$105,000. 8. Salaries of engineers and other personnel responsible for maintaining production equipment-$173,000. 9. Commissions paid to sales staff-$252,000. Required a. What amount of payroll cost would be classified as SG&A (selling, general, and administrative) expense? b. Assuming that Stuart made 3,600 units of product and sold 3,240 of them during the month of March,…arrow_forwardCavy Company estimates that the factory overhead for the following year will be $1,066,000. The company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 41,000 hours. The machine hours for the month of April for all of the jobs were 5,400. Journalize the entry to record the factory overhead applied in April. If an amount box does not require an entry, leave it blank. Work in Process Factory Overheadarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education