FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

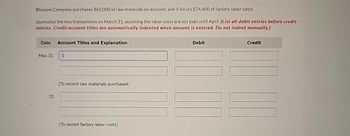

Transcribed Image Text:Blossom Company purchases $62,000 of raw materials on account, and it incurs $74,400 of factory labor costs.

Journalize the two transactions on March 31, assuming the labor costs are not paid until April. (List all debit entries before credit

entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date Account Titles and Explanation

Mar. 31

31

(To record raw materials purchased)

(To record factory labor costs)

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- attend allarrow_forwardPrepare journal entries to record the following production activities. 1. Incurred $53,000 of direct labor in the Roasting department and $29,000 of direct labor in the Blending department. Credit Factory Wages Payable. 2. Incurred $19,000 of indirect labor in production. Credit Factory Wages Payable. View transaction list Journal entry worksheet < A B Record direct labor incurred, but not yet paid. Note: Enter debits before credits. Transaction 1 General Journal Debit Credit Record entry Clear entry View general journalarrow_forwardFrom the account balances listed below, prepare a schedule of cost of goods manufactured for Sur Manufacturing Company for the month ended December 31, 2019. Finished Goods Inventory, December 31 Factory Supervisory Salaries Raw Materials Inventory, December 1 Work In Process Inventory, December 31 Sales Salaries Expense Factory Depreciation Expense Finished Goods Inventory, December 1 Raw Materials Purchases Work In Process Inventory, December 1 Factory Utilities Expense Direct Labor Account Balances OMR 42,000 12,000 12,000 15,000 14,000 8,000 35,000 105,000 25,000 6,000 70,000 19,000 21,000 Raw Materials Inventory, December 31 Indirect Labor Sur Manufacturing Company Cost of Goods Manufactured Schedule For the Month Ended December 31, 2019arrow_forward

- View Policies Show Attempt History Current Attempt in Progress Your answer is partially correct. In January, Oriole Tool & Die requisitions raw materials for production as follows: Job 1 $970, Job 2 $1,700, Job 3 $730, and general factory use $620. Prepare a summary journal entry to record raw materials used. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Jan. 31 Account Titles and Explanation Work in Process Inventory Manufacturing Overhead Raw Materials Inventory Debit $3,040 $630 Creditarrow_forwardOn June 30 a company finished job 110 with total costs of $119,000 and transferred the costs to finished goods inventory. On april 10 the company completed the sale of the goods to a customer for 135,000 on account. How would the journal entry be recorded to show the costs of goods sold?arrow_forwardJournalize the entries for the following transactions: March 10: 600 units of raw materials were purchased on account at $6.00 per unit. March 15: 500 units of raw materials were requisitioned at $6.50 per unit for production, Job 872. March 25: 400 units of raw materials were requisitioned at $6.00 per unit for production, Job 879. If an amount box does not require an entry, leave it blank. Date Account Debit Credit March 10 March 15 March 25arrow_forward

- Journalize the entries for the following transactions: March 10: 500 units of raw materials were purchased on account at $4.00 per unit. March 15: 250 units of raw materials were requisitioned at $ 4.50 per unit for production, Job 872. March 25: 215 units of raw materials were requisitioned at $5.00 per unit for production, Job 879. If an amount box does not require an entry, leave it blank. Date AccountDebitCredit March 10 March 15 March 25arrow_forwardEdwin Parts, a job shop, recorded the following transactions in May: Purchased $87,200 in materials on account. Issued $3,650 in supplies from the materials inventory to the production department. Issued $43,600 in direct materials to the production department. Paid for the materials purchased in transaction (1). Incurred wage costs of $67,200, which were debited to Payroll, a temporary account. Of this amount, $22,300 was withheld for payroll taxes and credited to Payroll Taxes Payable. The remaining $44,900 was paid in cash to the employees. See transactions (6) and (7) for additional information about Payroll. Recognized $34,700 in fringe benefit costs, incurred as a result of the wages paid in (5). This $34,700 was debited to Payroll and credited to Fringe Benefits Payable. Analyzed the Payroll account and determined that 65 percent represented direct labor; 15 percent, indirect manufacturing labor; and 20 percent, administrative and marketing costs. Applied overhead on the basis…arrow_forwardThe gross earnings of factory workers for Blossom Company during the month of January are $320,000. The employer's payroll taxes for the factory payroll are $64,000. Of the total accumulated cost of factory labor, 75% is related to direct labor and 25% is attributable to indirect labor. (a) Prepare the entry to record the factory labor costs for the month of January. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Your answer has been saved. See score details after the due date. Account Titles and Explanation (b) (c) Factory Labor Payroll Liabilities Your answer has been saved. See score details after the due date. Account Titles and Explanation Work in Process Inventory Manufacturing Overhead Prepare the entry to assign factory labor to production. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education