FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

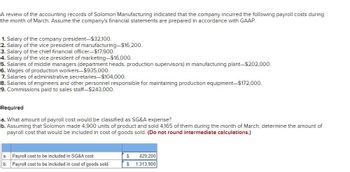

Transcribed Image Text:A review of the accounting records of Solomon Manufacturing indicated that the company incurred the following payroll costs during

the month of March. Assume the company's financial statements are prepared in accordance with GAAP.

1. Salary of the company president-$32,100.

2. Salary of the vice president of manufacturing-$16,200.

3. Salary of the chief financial officer-$17,900.

4. Salary of the vice president of marketing-$16,000.

5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant-$202,000.

6. Wages of production workers-$935,000.

7. Salaries of administrative secretaries-$104,000.

8. Salaries of engineers and other personnel responsible for maintaining production equipment-$172,000.

9. Commissions paid to sales staff-$243,000.

Required

a. What amount of payroll cost would be classified as SG&A expense?

b. Assuming that Solomon made 4,900 units of product and sold 4,165 of them during the month of March, determine the amount of

payroll cost that would be included in cost of goods sold. (Do not round intermediate calculations.)

a.

Payroll cost to be included in SG&A cost

b. Payroll cost to be included in cost of goods sold

$

429,200

$ 1,313,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Buckhorn Company's accounting records noted the following amounts for company payroll costs. What amount of payroll would be categorized as a period cost? Payroll Costs: Marketing director salary Factory manager salary Commissions paid to sales staff Administrative personnel wages Wages of production workers Multiple Choice C $302,000 $327,000 $615,000 $376,000 $164,000 $99,000 $74,000 $64,000 $214,000arrow_forwardRooney Manufacturing Company began operations on January 1. During the year, it started and completed 1,700 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: 1. Raw materials purchased and used-$3,190. 2. Wages of production workers-$3,560. 3. Salaries of administrative and sales personnel-$1,975, 4. Depreciation on manufacturing equipment-$4,810. 5. Depreciation on administrative equipment-$1,755. Rooney sold 1,110 units of product. Required a. Determine the total product cost for the year. b. Determine the total cost of the ending inventory. Note: Do not round intermediate calculations. c. Determine the total of cost of goods sold.. Note: Do not round intermediate calculations. a. Total product cost b. Total cost of ending inventory e. Total cost of goods sold $ $ 11,560 4,012arrow_forwardA review of the accounting records of Benson Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president-$31,400. 2. Salary of the vice president of manufacturing—$15,100. 3. Salary of the chief financial officer-$17,900. 4. Salary of the vice president of marketing-$14,800. 5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant—$186,000. 6. Wages of production workers-$933,000. 7. Salaries of administrative personnel-$106,000. 8. Salaries of engineers and other personnel responsible for maintaining production equipment-$171,000. 9. Commissions paid to sales staff-$261,000. Required a. What amount of payroll cost would be classified as SG&A (selling, general, and administrative) expense? b. Assuming that Benson made 3,100 units of product and sold 2,170 of them during the month of March,…arrow_forward

- attend allarrow_forwardThe following data summarizes in part the results of operations for 2021 of Diamond Company. Of the total cost of goods manufactured for 2021, 38% was for materials used, 30% for direct labor, and 32% for manufacturing overhead. During 2021, the company paid 90% of the materials purchased, leaving P293,000 of unpaid invoices for materials at year end.The company commenced 2021 operations with materials inventory of P421,000. All materials were purchased FOB company’s plant. The company disbursed P2,101,500 for direct labor during 2021. As of December 31, 2021, the accrued liability for direct labor amounted to P144,000, which was twice as much as last year’s accrual. The inventory of finished goods on December 31, 2021, was 10% of the cost of the units finished during the year, and goods in process on that date were one-half the finished goods inventory. This year’s finished goods inventory was 150% of last year. There are no in process last year. The manufacturing overhead, except for…arrow_forwardGadubhaiarrow_forward

- During January, its first month of operations, Sheridan Company accumulated the following manufacturing costs: raw materials purchased $5,200 on account, factory labor incurred $6,600, and factory utilities payable $2,400. Prepare separate journal entries for each type of manufacturing cost. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Jan. 31 31 31 I (To record purchase of raw materials on account) (To record factory labor costs) (To record entry for utilities payable) eTextbook and Media Debit Creditarrow_forwardThe following financial information about the manufacturing plant of Continental Company for the year-to-date and the month of July appears on the company's records: Materials inventory, June 30 Work-in-process inventory, June 30 Finished goods inventory, June 30 Cost of goods sold through June 30 Accounts payable (materials suppliers), June 30 Manufacturing overhead through June 30 Payroll payable, June 30 Withholding and other payroll liabilities, June 30 Overhead applied through June 30 A count of the inventories on hand July 31 shows the following: Materials inventory Work-in-process inventory Finished goods inventory $ 44,500 ? 42,000 • Manufacturing overhead incurred through July was $233,900. Cost of goods sold through July 31 was $417,800. Interviews with various plant administrative employees August 1 reveal some additional information: • The company currently owes materials suppliers $54,600. • The company paid suppliers $40,800 cash during July. Plant payroll during July…arrow_forwardThornton Manufacturing Company began operations on January 1. During the year, it started and completed 1,730 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: 1. Raw materials purchased and used-$3,140. 2. Wages of production workers-$3,540. 3. Salaries of administrative and sales personnel-$1,975. 4. Depreciation on manufacturing equipment-$5,430. 5. Depreciation on administrative equipment-$1,825. Thornton sold 1,130 units of product. Required a. Determine the total product cost for the year. b. Determine the total cost of the ending inventory. Note: Do not round intermediate calculations. c. Determine the total of cost of goods sold. Note: Do not round intermediate calculations. a. Total product cost b. Total cost of ending inventory c. Total cost of goods soldarrow_forward

- A review of the accounting records of Stuart Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president-$31,200. 2. Salary of the vice president of manufacturing-$16,600. 3. Salary of the chlef financial officer-$17,900. 4. Salary of the vice president of marketing-$15,900. 5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant-$194,000. 6. Wages of production workers-$937,000. 7. Salaries of administrative personnel-$105,000. 8. Salaries of engineers and other personnel responsible for maintaining production equipment-$173,000. 9. Commissions paid to sales staff-$252,000. Required a. What amount of payroll cost would be classified as SG&A (selling, general, and administrative) expense? b. Assuming that Stuart made 3,600 units of product and sold 3,240 of them during the month of March,…arrow_forwardThe following account balances and other information were taken from the accounting records of Langga Corporation for the year ended Dec. 31, 2019. Use the information to prepare a schedule of manufacturing overhead costs, a manufacturing statement (show only the total overhead cost), and a statement of comprehensive income. Advertising Expense Amortization of Patents Uncollectible Accounts Expense P 85,000 16,000 28,000 37,000 133,000 78,000 250,000 62,000 74,000 21,000 Depreciation Expense-Office Equipment Depreciation Expense-Factory Building Depreciation Expense-Factory Equipment Direct Labor Factory Insurance Expense Factory Supervision Factory Supplies Expense Factory Utilities Finished Goods Inventory, Dec. 31, 2018 Finished Goods Inventory, Dec. 31, 2019 Work in Process Inventory, Dec. 31, 2018 Work in Process Inventory, Dec. 31, 2019 Indirect Labor 115,000 15,000 12,500 8,000 9,000 26,000 25,000 55,000 14,000 60,000 78,000 313,000 Interest Expense Miscellaneous Expenses…arrow_forwardDuring January, its first month of operations, Ivanhoe Company accumulated the following manufacturing costs: raw materials purchased $5,400 on account, factory labor incurred $7,300, and factory utilities payable $2,600.Prepare separate journal entries for each type of manufacturing cost. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education