FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Edwin Parts, a job shop, recorded the following transactions in May:

- Purchased $87,200 in materials on account.

- Issued $3,650 in supplies from the materials inventory to the production department.

- Issued $43,600 in direct materials to the production department.

- Paid for the materials purchased in transaction (1).

- Incurred wage costs of $67,200, which were debited to Payroll, a temporary account. Of this amount, $22,300 was withheld for payroll taxes and credited to Payroll Taxes Payable. The remaining $44,900 was paid in cash to the employees. See transactions (6) and (7) for additional information about Payroll.

- Recognized $34,700 in fringe benefit costs, incurred as a result of the wages paid in (5). This $34,700 was debited to Payroll and credited to

Fringe Benefits Payable. - Analyzed the Payroll account and determined that 65 percent represented direct labor; 15 percent, indirect manufacturing labor; and 20 percent, administrative and marketing costs.

- Applied

overhead on the basis of 140 percent of direct labor costs. - Paid for utilities, power, equipment maintenance, and other miscellaneous items for the manufacturing plant totaling $41,300.

- Recognized

depreciation of $26,300 on manufacturing property, plant, and equipment.

Required:

-

Prepare

journal entries to record these transactions. -

The balances that appeared in the accounts of Edwin Parts are shown as follows.

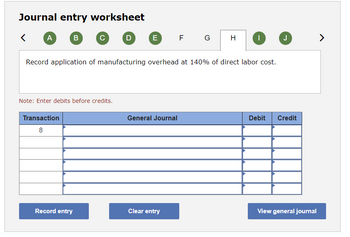

Transcribed Image Text:Journal entry worksheet

<

A

B

Transaction

8

с

Note: Enter debits before credits.

Record entry

D

E

Record application of manufacturing overhead at 140% of direct labor cost.

General Journal

F G

Clear entry

H

I

→

Debit Credit

View general journal

>

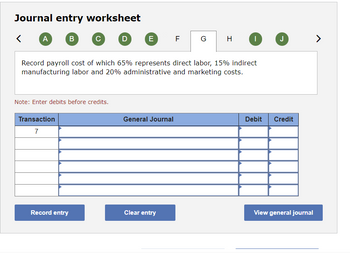

Transcribed Image Text:Journal entry worksheet

<

A

B

Transaction

7

с

Note: Enter debits before credits.

Record entry

D

E

Record payroll cost of which 65% represents direct labor, 15% indirect

manufacturing labor and 20% administrative and marketing costs.

General Journal

F

Clear entry

G

H

|

J

Debit Credit

View general journal

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dacosta Corporation had only one job in process on May 1. The job had been charged with $1,950 of direct materials, $6,990 of direct labor, and $9,978 of manufacturing overhead cost. The company assigns overhead cost to jobs using the predetermined overhead rate of $18.70 per direct labor-hour. During May, the following activity was recorded: Raw materials (all direct materials): Beginning balance Purchased during the month Used in production Labor: Direct labor-hours worked during the month Direct labor cost incurred Actual manufacturing overhead costs incurred Inventories: Raw materials, May 30 $ 8,650 $ 38,150 $ 39,450 2,050 $ 24,660 $ 33,450 Work in process, May 30 $ 16,976 Work in process inventory on May 30 contains $3,768 of direct labor cost. Raw materials consist solely of items that are classified as direct materials. The cost of goods manufactured for May was: Multiple Choice O $97,140 $104,387 $102,445 $110,630arrow_forwardWildhorse Manufacturing Company uses a job order cost system and keeps perpetual inventory records. June 1 Purchased raw materials for $20,000 on account. 8 Raw materials requisitioned by production: Direct materials $8,000 Indirect 1,000 materials 15 Paid factory utilities, $2,100 and repairs for factory equipment, $8,000. 25 Incurred $88,000 of factory labor. 25 Time tickets indicated the following: (7,000 hrs x $10 per Direct Labor $70,000 hr) (3,000 hrs x $6 per Indirect Labor 18,000 hr) $88,000 25 Applied manufacturing overhead to production based on a predetermined overhead rate of $5 per direct labor hour worked. 28 Goods costing $18,150 were completed in the factory and were transferred to finished goods inventory. 30 Goods costing $15,150 were sold for $20,150 on account. Prepare journal entries to record the above transactions during the month of June. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries…arrow_forwardattend allarrow_forward

- During the current month, Sheridan Company incurs the following manufacturing costs. (a) Purchased raw materials of $17,700 on account. (b) Incurred factory labor of $38,400. (c) Factory utilities of $3,200 are payable, prepaid factory property taxes of $2,660 have expired, and depreciation on the factory building is $9,600. Record the company's manufacturing costs in its job order costing system. Purchased raw materials Incurred factory labor Factory utilities Factory property taxes Factory depreciation Balance $ LA $ Raw Materials Inventory $ $ Manufacturing Costs Factory Labor Manufacturing Overhead $arrow_forwardPost the journal entries for the transactions to the following T-accounts, each of which started the month with a zero balance.arrow_forwardPlease help me with show all calculation thankuarrow_forward

- Jiminez Company engaged in the following transactions during May: a. Purchased raw materials for cash, $570 b. Used raw materials to begin jobs, $454 c. Paid wages of production employees, $350 d. Applied overhead at rate of $1.25 per direct labor dollar e. Completed job that had cost $490 f. Sold for $610 cash goods that had cost $465 to complete Required: Use the horizontal statements model provided to indicate how each of these events affected Jiminez's financial statements. Show dollar amounts of increases and decreases. Note: Round final answers to the nearest whole dollar. Enter decreases with a minus sign. Leave answer cells blank for any item not affected by the transaction. Event a. b. C. d. e. f. Cash + Raw Materials + + + + + + + + + + + BALANCE SHEET Assets Work in Process + + + + + Finished Goods + + + + + Manufacturing Overhead Stockholders' Equity = = Net Incomearrow_forwardEdwin Parts, a job shop, recorded the following transactions in May: Purchased $87,200 in materials on account. Issued $3,650 in supplies from the materials inventory to the production department. Issued $43,600 in direct materials to the production department. Paid for the materials purchased in transaction (1). Incurred wage costs of $67,200, which were debited to Payroll, a temporary account. Of this amount, $22,300 was withheld for payroll taxes and credited to Payroll Taxes Payable. The remaining $44,900 was paid in cash to the employees. See transactions (6) and (7) for additional information about Payroll. Recognized $34,700 in fringe benefit costs, incurred as a result of the wages paid in (5). This $34,700 was debited to Payroll and credited to Fringe Benefits Payable. Analyzed the Payroll account and determined that 65 percent represented direct labor; 15 percent, indirect manufacturing labor; and 20 percent, administrative and marketing costs. Applied overhead on the basis…arrow_forwardJournal Entries, T-Accounts Lincoln Brothers Company makes jobs to customer order. During the month of May, the following occurred: a. Materials were purchased on account for $45,760. b. Materials totaling $40,880 were requisitioned for use in producing various jobs. c. Direct labor payroll for the month was $19,200 with an average wage of $12 per hour. d. Actual overhead of $8,860 was incurred and paid in cash. e. Manufacturing overhead is charged to production at the rate of $5.40 per direct labor hour. f. Completed jobs costing $59,000 were transferred to Finished Goods. g. Jobs costing $58,000 were sold on account for $ 73,850. Make the entry to record the revenue from the sale first, followed by the entry to record the cost of the jobs. Beginning balances as of May 1 were: Materials Inventory Work-in-Process Inventory Finished Goods Inventory Required: $1,300 3,400 2,640 1 more notification 1. Prepare the journal entries for the preceding events.arrow_forward

- During January, its first month of operations, Sheridan Company accumulated the following manufacturing costs: raw materials purchased $5,200 on account, factory labor incurred $6,600, and factory utilities payable $2,400. Prepare separate journal entries for each type of manufacturing cost. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Jan. 31 31 31 I (To record purchase of raw materials on account) (To record factory labor costs) (To record entry for utilities payable) eTextbook and Media Debit Creditarrow_forwardDuring the month, Barrera Manufacturing incurred (not paid) $49,000 in direct labor costs in Department 1, $24,000 in direct labor costs in Department 2, and $3,500 of indirect laber costs. Which of the following is NOT part of the summary journal entry to record these transactions? Process costing is used. OA. debit to Work-in-Process Inventory Department 1 for $40,000 OB. credit to Wages Payable for $76,500 OC. debit to Work-in-Process Inventory for $76,500 OD. debit to Manufacturing Overhead for $3,500 CHICarrow_forwardDuring January, time tickets show that the factory labor of $6,000 was used as follows: Job 1 $2,200, Job 2 $1,600, Job 3 $1,400, and general factory use (indirect labor) $800.Prepare a summary journal entry to record factory labor used. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 31arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education