FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

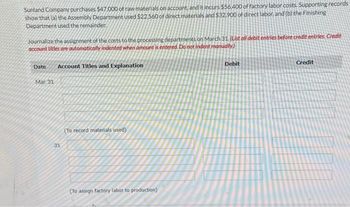

Transcribed Image Text:Sunland Company purchases $47,000 of raw materials on account, and it incurs $56,400 of factory labor costs. Supporting records

show that (a) the Assembly Department used $22.560 of direct materials and $32.900 of direct labor, and (b) the Finishing

Department used the remainder.

Journalize the assignment of the costs to the processing departments on March 31. (List oll debit entries before credit entries. Credit

account titles are automatically indented when amount is entered. Do not indent manually.)

Date Account Titles and Explanation

Mar. 31

31

(To record materials used).

(To assign factory labor to production)

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Weatarrow_forwardSweet Catering completed the following selected transactions during May 2016: • May 1: Prepaid rent for three months, $1,500 ● May 5: Received and paid electricity bill, $180 May 9: Received cash for meals served to customers, $3,940 ● ● May 14: Paid cash for kitchen equipment, $3,860 • May 23: Served a banquet on account, $1,900 • May 31: Made the adjusting entry for rent (from May 1). ● May 31: Accrued salary expense, $2,200 • May 31: Recorded depreciation for May on kitchen equipment, $240 If Sweet Catering had recorded transactions using the Cash method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign. If Sweet Catering had recorded transactions using the Accrual method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign.arrow_forwardX Company manufactures cakes in two departments: Mixing and Packaging. The company uses a process cost accounting system. All materials are entered at the beginning of each process. During April 2020, the following transactions were completed: Assigned raw materials of $60,000 and $50,000 to Work in Process Mixing and Packaging respectively. Factory labor costs of $20,000 and $40,000 were assigned to Work in Process Mixing and Packaging respectively. The company applied manufacturing overhead on the basis of $15 per machine hour. Machine hours used were 1,000 in Mixing and 2,000 in Packaging. During April, the company transferred units costing S80,000 from Mixing to Packaging. In addition, it trans ferred units costing $160,000 from Packaging to Finished Goods.arrow_forward

- The Harriott manufacturing company uses job order costing system. The company uses machine hours to apply overhead cost to jobs. At the beginning of 2020, the company estimated that 31,400 machine hours would be worked and s5,024,000 overhead cost would be incurred during 2020. The following activities took place in the work in process inventory during February: WIP Inventory A/C November i Bal. b/f $51,250 Direct Materials Used 256,400 Other transactions incurred: • Indirect material issued to production was s40,360 • Total manufacturing labour incurred in November was $368,000, 75% of this amount represented direct labour. • Other manufacturing overhead costs incurred for November amounted to s340,490. • Two jobs were completed with total costs of s384,000 & s270,000 respectively. They were sold on account at a margin of 33%% on sales. Required: i) ii) Compute Harriott's predetermined manufacturing overhead rate for 2020. State the journal entries necessary to record the above…arrow_forwardOn May 7, Lockmiller Company purchased on account 12,000 units of materials at $6 per unit. During May, raw materials were requisitioned for production as follows: 8,400 units for Job 275 at $6 per unit and 2,150 units for Job 310 at $4 per unit. Required: Journalize the entry on May 7 to record the purchase and on May 31 to record the requisition from the materials storeroom. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Chart of Accounts CHART OF ACCOUNTS Lockmiller Company General Ledger ASSETS 110 Cash 121 Accounts Receivable 125 Notes Receivable 126 Interest Receivable 131 Materials 132 Work in Process 133 Factory Overhead 134 Finished Goods 141 Supplies 142 Prepaid Insurance…arrow_forwardCerrone Inc. has provided the following data for the month of July. The balance in the Finished Goods inventory account at the beginning of the month was $50,400 and at the end of the month was $38,400. The cost of goods manufactured for the month was $291,000. The actual manufacturing overhead cost incurred was $165,400 and the manufacturing overhead cost applied to Work in Process was $154,000. The adjusted cost of goods sold that would appear on the income statement for July is: $279,000 $303,000 $291,600 $314,400arrow_forward

- Ivanhoe Company purchases $54,000 of raw materials on account, and it incurs $64,800 of factory labor costs. Supporting records show that (a) the Assembly Department used $25,920 of direct materials and $37,800 of direct labor, and (b) the Finishing Department used the remainder. Journalize the assignment of the costs to the processing departments on March 31. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Mar. 31 31 (To record materials used) (To assign factory labor to production) Debit Creditarrow_forwardNizar Inc. has provided the following data for the month of July. The balance in the Finished Goods inventory account at the beginning of the month was Rs. 50,000 and at the end of the month was Rs. 40,000. The cost of goods manufactured for the month was Rs. 220,000. The actual manufacturing overhead cost incurred was 75,000 and the manufacturing overhead cost applied to Work in Process was Rs. 70,000. The adjusted cost of goods sold that would appear on the income statement for July is?arrow_forwardPuddleby Company had the following transactions in October: (Click the icon to view the transactions.) Prepare the journal entries for Puddleby Company. (Record debits first, then credits. Exclude explanations from any journal entries.) 1. Purchased raw materials on account, $75,000 Used materials in production: $28,000 in the Mixing Department; $7,000 in the Packaging 2. Department; $1,100 in indirect materials Incurred labor costs: $8,500 in the Mixing Department; $5,600 in the Packaging 3. Department; $2,400 in indirect labor Incurred manufacturing overhead costs: $5,500 in machinery depreciation; paid $3,000 for 4. rent and $1,750 for utilities 1. Purchased raw materials on account, $75,000 Date Accounts Debit Creditarrow_forward

- Munoz Manufacturing Company began operations on January 1. During the year, it started and completed 1,730 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: Raw materials purchased and used—$3,080. Wages of production workers—$3,510. Salaries of administrative and sales personnel—$1,970. Depreciation on manufacturing equipment—$5,520. Depreciation on administrative equipment—$1,755. Munoz sold 1,210 units of product. Required Determine the total product cost for the year. Determine the total cost of the ending inventory. (Do not round intermediate calculations.) Determine the total of cost of goods sold. (Do not round intermediate calculations.) a. Total product cost b. Total cost of ending inventory c. Total cost of goods soldarrow_forwardWildhorse Company purchases $65,000 of raw materials on account, and it incurs $78,000 of factory labor costs. Supporting records show that (a) the Assembly Department used $31,200 of direct materials and $45,500 of direct labor, and (b) the Finishing Department used the remainder. Journalize the assignment of the costs to the processing departments on March 31. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Mar. 31 31 31 (To record materials used) (To assign factory labor to production) Debit Creditarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education