FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

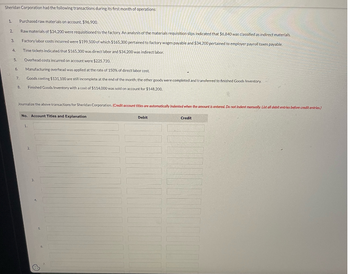

Transcribed Image Text:Sheridan Corporation had the following transactions during its first month of operations:

1. Purchased raw materials on account. $96,900.

Raw materials of $34,200 were requisitioned to the factory. An analysis of the materials requisition slips indicated that $6,840 was classified as indirect materials.

Factory labor costs incurred were $199,500 of which $165,300 pertained to factory wages payable and $34,200 pertained to employer payroll taxes payable.

Time tickets indicated that $165,300 was direct labor and $34,200 was indirect labor.

2.

3

4,

5.

6.

7.

8.

Overhead costs incurred on account were $225,720.

Manufacturing overhead was applied at the rate of 150% of direct labor cost.

Goods costing $131,100 are still incomplete at the end of the month; the other goods were completed and transferred to finished Goods Inventory.

Finished Goods Inventory with a cost of $114,000 was sold on account for $148,200.

Journalize the above transactions for Sheridan Corporation. (Credit account titles are automatically Indented when the amount is entered. Do not indent manually List all debit entries before credit entries.)

No. Account Titles and Explanation

1.

2.

Ⓒ

6.

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Uhtred Manufacturing had the following transactions in October: Purchased raw materials on account, $58,800. Used materials in production: $21,900 in the Mixing Department; $4,800 in the packaging Department; $920 in indirect materials. Incurred labor costs: $7,500 in the Mixing Department; $4,050 in the Packaging Department; $2,520 in indirect labor. Incurred manufacturing overhead costs: $9,540 in machinery depreciation; paid $2,890 for rent and paid for utilities at a cost of $1,920. Prepare the journal entries for Uhtred Manufacturing.arrow_forwardBook Hint Larned Corporation recorded the following transactions for the just completed month. a. $79,000 in raw materials were purchased on account. b. $77,000 in raw materials were used in production. Of this amount, $63,000 was for direct materials and the remainder was for indirect materials. c. Total labor wages of $111,000 were paid in cash. Of this amount, $100,500 was for direct labor and the remainder was for indirect labor. d. Depreciation of $191,000 was incurred on factory equipment.arrow_forwardJurvin Enterprises is a manufacturing company that had no beginning inventories. A subset of the transactions that it recorded during a recent month is shown below. a. $75,600 in raw materials were purchased for cash. b. $72,800 in raw materials were used in production. Of this amount, $66,500 was for direct materials and the remainder was for indirect materials. c. Total labor wages of $151,600 were incurred and paid. Of this amount, $133,100 was for direct labor and the remainder was for indirect labor. d. Additional manufacturing overhead costs of $125,500 were incurred and paid. e. Manufacturing overhead of $125,300 was applied to production using the company's predetermined overhead rate. f. All of the jobs in process at the end of the month were completed. g. All of the completed jobs were shipped to customers. h. Any underapplied or overapplied overhead for the period was closed to Cost of Goods Sold. Required: 1. Post the above transactions to T-accounts. 2. Determine the…arrow_forward

- United Corporation recorded the following transactions for February 2019: a. February 1: $74,000 in raw materials were purchased on account. b. February 7: $63,000 in raw materials were requisitioned for use in production as direct materials c. February 8: $7,000 of raw materials were used as indirect materials. d. February 12: Total labor wages of $97,000 were incurred for direct labor e. February 15: Labor wages of $13.000 were incurred for indirect labor. 1. February 21: Additional manufacturing overhead costs of $180,000 were incurred. All of these costs will be paid in the future. Record the above transactions in United Corporation's journal. Enter the transaction letter as the description when entering the transactions in the journal. Dates must be entered in the format dd/mmm (1.o., January 15 would be 15/Jan). Date + F + m 11 m F T General Journal Account/Explanation Page 02 PR Debit Creditarrow_forwardForest Components makes aircraft parts. The following transactions occurred in July. Purchased $119,000 of materials on account. Issued $117,600 in direct materials to the production department. Issued $8,400 of supplies from the materials inventory. Paid for the materials purchased in transaction (1) using cash. Returned $15,400 of the materials issued to production in (2) to the materials inventory. Direct labor employees earned $217,000, which was paid in cash. Purchased miscellaneous items for the manufacturing plant for $120,400 on account. Recognized depreciation on manufacturing plant of $245,000. Applied manufacturing overhead for the month. Forest uses normal costing. It applies overhead on the basis of direct labor costs using an annual, predetermined rate. At the beginning of the year, management estimated that direct labor costs for the year would be $3,000,000. Estimated overhead for the year was $2,790,000. The following balances appeared in the…arrow_forwardUhtred Manufacturing had the following transactions in October: Purchased raw materials on account, $58,800. Used materials in production: $21,900 in the Mixing Department; $4,800 in the packaging Department; $920 in indirect materials. Incurred labor costs: $7,500 in the Mixing Department; $4,050 in the Packaging Department; $2,520 in indirect labor. Incurred manufacturing overhead costs: $9,540 in machinery depreciation; paid $2,890 for rent and paid for utilities at a cost of $1,920. Prepare the journal entries for Uhtred Manufacturing. Journal Date Description Debit Credit 1 1 2 2 2 2 3 3 3 3 4 4 4arrow_forward

- Larned Corporation recorded the following transactions for the just completed month. Purchased $89,000 of raw materials on account. $87,000 in raw materials were used in production. Of this amount, $74, 000 was direct materials and the remainder was indirect materials. Paid employees $127,500 cash. Of this amount, $104, 400 was direct labor and the remainder was indirect labor. Depreciation of $191,000 was incurred on factory equipment. Required: Record the above transactions in journal entries.arrow_forwardJurvin Enterprises is a manufacturing company with no beginning inventories. A subset of the transactions it recorded during a recent month is shown below. a. Purchased $75,700 in raw materials for cash. b. $72,800 in raw materials were used in production. Of this amount, $65,500 was direct materials and the remainder was indirect materials. c. Paid employees $150,500 cash. Of this amount, $133,400 was direct labor and the remainder was indirect labor. d. Paid $126,100 for additional manufacturing overhead costs. e. Applied manufacturing overhead of $122,500 to production using the company's predetermined overhead rate. f. All of the jobs in process at the end of the month were completed. g. All of the completed jobs were shipped to customers. h. Any underapplied or overapplied overhead was closed to Cost of Goods Sold. Required: 1. Post the above transactions to T-accounts. 2. Calculate the adjusted cost of goods sold for the period. Post the above transactions to T-accounts. Ending…arrow_forwardLarned Corporation recorded the following transactions for the just completed month. Purchased $73, 000 of raw materials on account. $71,000 in raw materials were used in production. Of this amount, $58,000 was direct materials and the remainder was indirect materials. Paid employees $130,000 cash. Of this amount, $102, 400 was direct labor and the remainder was indirect labor. Depreciation of $191,000 was incurred on factory equipment. Required: Record the above transactions in journal entries. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forward

- [The following information applies to the questions displayed below.]Information on Kwon Manufacturing’s activities for its first month of operations follows: Purchased $101,700 of raw materials on credit. Materials requisitions show the following materials used for the month. Job 201 $ 49,900 Job 202 25,300 Total direct materials 75,200 Indirect materials 10,320 Total materials used $ 85,520 Time tickets show the following labor used for the month. Job 201 $ 40,900 Job 202 14,300 Total direct labor 55,200 Indirect labor 25,900 Total labor used $ 81,100 Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate is 80% of direct materials cost. Transferred Job 201 to Finished Goods Inventory. (1) Sold Job 201 for $168,860 on credit. (2) Record cost of goods sold for Job 201. Incurred the following actual other overhead costs for the month. Depreciation of factory equipment $ 33,700 Rent on factory building (payable)…arrow_forwardJurvin Enterprises is a manufacturing company with no beginning inventories. A subset of the transactions it recorded during a recent month is shown below. a. Purchased $75,700 in raw materials for cash. b. $71,700 in raw materials were used in production. Of this amount, $65,200 was direct materials and the remainder was indirect materials. c. Paid employees $152,700 cash. Of this amount, $133,700 was direct labor and the remainder was indirect labor. d. Paid $126,000 for additional manufacturing overhead costs. e. Applied manufacturing overhead of $130,500 to production using the company's predetermined overhead rate. f. All of the jobs in process at the end of the month were completed. g. All of the completed jobs were shipped to customers. h. Any underapplied or overapplied overhead was closed to Cost of Goods Sold. Required: 1. Post the above transactions to T-accounts. 2. Calculate the adjusted cost of goods sold for the period.arrow_forward5. Ehrlich Corporation incurred the following transactions. 1. Purchased raw materials on account $48,000. 2. Raw Materials of $43,900 were requisitioned to the factory. An analysis of the materials requisition slips indicated that $7,000 was classified as indirect materials. 3. Factory labor costs incurred were $87,000. Time tickets indicated that $82,000 was direct labor and the rest was indirect labor. Direct laborers were paid at a rate of $20 per hour. 4. Rent incurred was $79,500. 70% was for the factory and 30% was for the corporate offices. 5. Factory depreciation was $13,000. 6. Administrative salaries accrued were $25,000. 7. Advertising costs of $10,000 were incurred on account. 8. Manufacturing overhead was applied at the rate of $16 per direct labor hour. 9. Goods costing $90,000 were completed and transferred to finished goods. 10. Finished goods costing $80,000 to manufacture were sold at a profit of $40,000. Instructions: Journalize the transactions.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education