FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

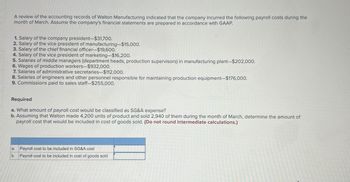

Transcribed Image Text:A review of the accounting records of Walton Manufacturing indicated that the company incurred the following payroll costs during the

month of March. Assume the company's financial statements are prepared in accordance with GAAP.

1. Salary of the company president-$31,700.

2. Salary of the vice president of manufacturing-$15,000.

3. Salary of the chief financial officer-$19,600.

4. Salary of the vice president of marketing-$16,200.

5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant-$202,000.

6. Wages of production workers-$932,000.

7. Salaries of administrative secretaries-$112,000.

8. Salaries of engineers and other personnel responsible for maintaining production equipment-$176,000.

9. Commissions paid to sales staff-$255,000.

Required

a. What amount of payroll cost would be classified as SG&A expense?

b. Assuming that Walton made 4,200 units of product and sold 2,940 of them during the month of March, determine the amount of

payroll cost that would be included in cost of goods sold. (Do not round intermediate calculations.)

a.

Payroll cost to be included in SG&A cost

b. Payroll cost to be included in cost of goods sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rooney Manufacturing Company began operations on January 1. During the year, it started and completed 1,700 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: 1. Raw materials purchased and used-$3,190. 2. Wages of production workers-$3,560. 3. Salaries of administrative and sales personnel-$1,975, 4. Depreciation on manufacturing equipment-$4,810. 5. Depreciation on administrative equipment-$1,755. Rooney sold 1,110 units of product. Required a. Determine the total product cost for the year. b. Determine the total cost of the ending inventory. Note: Do not round intermediate calculations. c. Determine the total of cost of goods sold.. Note: Do not round intermediate calculations. a. Total product cost b. Total cost of ending inventory e. Total cost of goods sold $ $ 11,560 4,012arrow_forwardA review of the accounting records of Benson Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president-$31,400. 2. Salary of the vice president of manufacturing—$15,100. 3. Salary of the chief financial officer-$17,900. 4. Salary of the vice president of marketing-$14,800. 5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant—$186,000. 6. Wages of production workers-$933,000. 7. Salaries of administrative personnel-$106,000. 8. Salaries of engineers and other personnel responsible for maintaining production equipment-$171,000. 9. Commissions paid to sales staff-$261,000. Required a. What amount of payroll cost would be classified as SG&A (selling, general, and administrative) expense? b. Assuming that Benson made 3,100 units of product and sold 2,170 of them during the month of March,…arrow_forwardattend allarrow_forward

- Sandler Company completed the following two transactions. The annual accounting period endsDecember 31.a. On December 31, calculated the payroll, which indicates gross earnings for wages ($260,000),payroll deductions for income tax ($28,000), payroll deductions for FICA ($20,000), payrolldeductions for United Way ($4,000), employer contributions for FICA (matching), and stateand federal unemployment taxes ($2,000). Employees were paid in cash, but payments for thecorresponding payroll deductions have not been made and employer taxes have not yet beenrecorded.b. Collected rent revenue of $1,500 on December 10 for office space that Sandler rented toanother business. The rent collected was for 30 days from December 11 to January 10 and wascredited in full to Unearned Revenue.Required:1. Give the entries required on December 31 to record payroll.2. Give ( a ) the journal entry for the collection of rent on December 10 and ( b ) the adjusting journal entry on December 31.3. Show how any…arrow_forwardThe following data summarizes in part the results of operations for 2021 of Diamond Company. Of the total cost of goods manufactured for 2021, 38% was for materials used, 30% for direct labor, and 32% for manufacturing overhead. During 2021, the company paid 90% of the materials purchased, leaving P293,000 of unpaid invoices for materials at year end.The company commenced 2021 operations with materials inventory of P421,000. All materials were purchased FOB company’s plant. The company disbursed P2,101,500 for direct labor during 2021. As of December 31, 2021, the accrued liability for direct labor amounted to P144,000, which was twice as much as last year’s accrual. The inventory of finished goods on December 31, 2021, was 10% of the cost of the units finished during the year, and goods in process on that date were one-half the finished goods inventory. This year’s finished goods inventory was 150% of last year. There are no in process last year. The manufacturing overhead, except for…arrow_forwardGadubhaiarrow_forward

- On January 14, at the end of the second week of the year, the totals of Castle Company's payroll register showed that its store employees' wages amounted to $40,660 and that its warehouse wages amounted to $12,600. Withholdings consisted of federal income taxes, $6,391, employer's Social Security taxes at the rate of 6.2 percent, and employees' Social Security taxes at a rate of 6.2 percent. Both the employer's and employees' Social Security taxes are based on the first $118,500, and no employee has reached the limit. Additional withholdings were Medicare taxes at the rate of 1.45 percent on all earnings and charitable contributions withheld, $720. Required: a. Calculate the amount of Social Security and Medicare taxes to be withheld and prepare the general journal entry to record the payroll. If an amount box does not require an entry, leave it blank. If required, round your intermediate calculations and final answers to the nearest cent and use the rounded answers in…arrow_forwardDuring the month of March, Oriole Company's employees earned wages of $80,000. Withholdings related to these wages were $6,120 for FICA $9,600 for federal income tax, $4,000 for state income tax, and $480 for union dues. The company incurred no cost related to these earnings for federal unemployment tax but incurred $800 for state unemployment tax. (a) Prepare the necessary March 31 journal entry to record salaries and wages expense and salaries and wages payable. Assume that wages earned during March will be paid during April. (Credit account titles are automatically indented when amount is entered. Do not indent manually) Date Account Titles and Explanation Mar. 31 Debit Credit NOarrow_forwardDuring January, its first month of operations, Sheridan Company accumulated the following manufacturing costs: raw materials purchased $5,200 on account, factory labor incurred $6,600, and factory utilities payable $2,400. Prepare separate journal entries for each type of manufacturing cost. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Jan. 31 31 31 I (To record purchase of raw materials on account) (To record factory labor costs) (To record entry for utilities payable) eTextbook and Media Debit Creditarrow_forward

- During the first full week of 20--, the Payroll Department of Quigley Corporation is preparing the Forms W-2 for distribution to its employees along with their payroll checks on January 10. In this problem, you will complete six of the forms in order to gain some experience in recording the different kinds of information required. Assume each employee earned the same weekly salary for each of the 52 paydays in 20--, the previous year. Using the following information obtained from the personnel and payroll records of the firm, complete Copy A of the last two Forms W-2 reproduced below. Also complete Form W-3. This is the second half of the problem that began with (PR.04.13A.Part1). You will need the data from the first four W-2s on Part 1, along with the two W-2s in this problem to complete the Form W-3. The form is to be signed by the president, Kenneth T. Ford, and is prepared by Ralph I. Volpe. Company Information: Address: 4800 River Road Philadelphia, PA 19113-5548…arrow_forwardThe following financial information about the manufacturing plant of Continental Company for the year-to-date and the month of July appears on the company's records: Materials inventory, June 30 Work-in-process inventory, June 30 Finished goods inventory, June 30 Cost of goods sold through June 30 Accounts payable (materials suppliers), June 30 Manufacturing overhead through June 30 Payroll payable, June 30 Withholding and other payroll liabilities, June 30 Overhead applied through June 30 A count of the inventories on hand July 31 shows the following: Materials inventory Work-in-process inventory Finished goods inventory $ 44,500 ? 42,000 • Manufacturing overhead incurred through July was $233,900. Cost of goods sold through July 31 was $417,800. Interviews with various plant administrative employees August 1 reveal some additional information: • The company currently owes materials suppliers $54,600. • The company paid suppliers $40,800 cash during July. Plant payroll during July…arrow_forwardThornton Manufacturing Company began operations on January 1. During the year, it started and completed 1,730 units of product. The financial statements are prepared in accordance with GAAP. The company incurred the following costs: 1. Raw materials purchased and used-$3,140. 2. Wages of production workers-$3,540. 3. Salaries of administrative and sales personnel-$1,975. 4. Depreciation on manufacturing equipment-$5,430. 5. Depreciation on administrative equipment-$1,825. Thornton sold 1,130 units of product. Required a. Determine the total product cost for the year. b. Determine the total cost of the ending inventory. Note: Do not round intermediate calculations. c. Determine the total of cost of goods sold. Note: Do not round intermediate calculations. a. Total product cost b. Total cost of ending inventory c. Total cost of goods soldarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education