FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

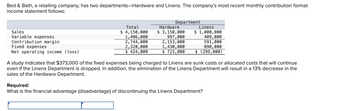

Transcribed Image Text:Bed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format

income statement follows:

Sales

Variable expenses

Contribution margin

Net operating income (loss)

Fixed expenses

Total

$ 4,150,000

1,406,000

2,744,000

2,320,000

$ 424,000

Hardware

$ 3,150,000

Department

Linens

$ 1,000,000

409,000

591,000

890,000

$ (299,000)

997,000

2,153,000

1,430,000

$ 723,000

A study indicates that $373,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue

even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 13% decrease in the

sales of the Hardware Department.

Required:

What is the financial advantage (disadvantage) of discontinuing the Linens Department?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Contribution margin and contribution margin ratio For a recent year, McDonald’s (MCD) company-owned restaurants had the following sales and expenses (in millions): Line Item Description Amount Sales $21,000 Food and paper $(2,500) Payroll and employee benefits (2,200) Occupancy and other expenses (4,100) General, selling, and administrative expenses (4,200) Total $(13,000) Operating income $8,000 Assume that the variable costs consist of food and paper, payroll, 25% of occupancy and other expenses, and 40% of the general, selling, and administrative expenses. a. What is McDonald's contribution margin?fill in the blank 1 of 1$ million b. What is McDonald's contribution margin ratio? Round to one decimal place.fill in the blank 1 of 1 % c. How much would operating income increase if same-store sales increased by $800 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the nearest tenth of a million…arrow_forwardDelisa Corporation has two divisions: Division L and Division Q. Data from the most recent month appear below: Total Company Division L Division Q Sales $587,000 $172,000 $415,000 Variable expenses 376,090 98,040 278,050 Contribution margin 210,910 73,960 136,950 Traceable fixed expenses 105,290 30,870 74,420 Segment margin 105,620 $ 43,090 $ 62,530 Common fixed expenses 68,550 Net operating income $ 37,070 The break-even in sales dollars for Division Q is closest to:arrow_forwardBed & Bath, a retailing company, has two departments—Hardware and Linens. The company’s most recent monthly contribution format income statement follows: Total Department Hardware Linens Sales $ 4,000,000 $ 3,000,000 $ 1,000,000 Variable expenses 1,300,000 900,000 400,000 Contribution margin 2,700,000 2,100,000 600,000 Fixed expenses 2,200,000 1,400,000 800,000 Net operating income (loss) $ 500,000 $ 700,000 $ (200,000) A study indicates that $340,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 10% decrease in the sales of the Hardware Department. Based on the visualization: The relevant fixed cost in the decision to discontinue the Linens Department is: multiple choice 1 $340,000. $460,000. $800,000. $600,000. The total foregone contribution margin associated with dropping…arrow_forward

- Contribution margin and contribution margin ratio For a recent year, McDonald’s (MCD) company-owned restaurants had the following sales and expenses (in millions): Line Item Description Amount Sales $19,207.8 Food and paper $(2,564.2) Payroll and employee benefits (2,416.4) Occupancy and other expenses (4,357.6) General, selling, and administrative expenses (2,545.6) Total $(11,883.8) Operating income $7,324.0 Assume that the variable costs consist of food and paper, payroll, 25% of occupancy and other expenses, and 40% of the general, selling, and administrative expenses. a. What is McDonald's contribution margin? Round to the nearest tenth of a million (one decimal place). b. What is McDonald's contribution margin ratio? Round to one decimal place. c. How much would operating income increase if same-store sales increased by $800 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the nearest tenth…arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,180,000 1,248,000 2,932,000 2,180,000 $ 752,000 Answer is complete but not entirely correct. $ (52,100) Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage) Department Hardware $ 3,100,000 830,000 2,270,000 1,380,000 $ 890,000 A study indicates that $378,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 12% decrease in the sales of the Hardware Department. Linens $ 1,080,000 418,000 662,000 800,000 $ (138,000)arrow_forwardCarlos's Bike Company produces two lines of cycles, Trikes and Bikes. At the end of last year, the income statement was as follows: Trikes $135,000 102,250 32,750 15,000 20,000 $(2,250) Sales revenue Variable expenses Contribution margin Direct expenses Allocated expenses Segment margin What was the company's total operating income? O $29,750 O $25,250 O $2,250 O $27,500 Bikes $250,000 162.500 87,500 35,000 25,000 $27,500arrow_forward

- Bed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Net operating income (loss) Fixed expenses Total $ 4,290,000 1,286,000 3,004,000 2,370,000 $ 634,000 Department Linens $ 1,190,000 418,000 772,000 880,000 Hardware $ 3,100,000 868,000 2,232,000 1,490,000 $ 742,000 $ (108,000) A study indicates that $377,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 13% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage) $ 390,100arrow_forwardThe condensed product-line income statement for Rhinebeck Company for the month of October is as follows: Rhinebeck CompanyProduct-Line Income StatementFor the Month Ended October 31 Hats Gloves Mufflers Sales $65,800 88,500 $27,600 Cost of goods sold (25,800) (32,100) (13,800) Gross profit $40,000 56,400 $13,800 Selling and administrative expenses (29,000) (34,500) (14,500) Operating income (loss) $11,000 $21,900 $(700) Fixed costs are 12% of the cost of goods sold and 36% of the selling and administrative expenses. Rhinebeck Company assumes that fixed costs would not be materially affected if the Gloves line were discontinued. a. Prepare a differential analysis dated October 31 to determine if Mufflers should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to indicate a loss.arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,360,000 1,375,000 2,985,000 2,220,000 $ 765,000 Department Hardware $ 3,160,000 962,000 2,198,000 1,320,000 $ 878,000 Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Linens $ 1,200,000 413,000 787,000 900,000 $ (113,000) A study indicates that $371,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 13% decrease in the sales of the Hardware Department.arrow_forward

- Crane Trivia Co. manufactures and sells two trivia products, the Square Trivia Game and the Round Trivia Game. Last quarter's operating profits, by product, and for the company as a whole, were as follows: Square Round Total Sales revenue $11,000 $6,860 $17,860 Variable expenses 5,000 2,910 7,910 Contribution margin 6,000 3,950 9,950 Fixed expenses 2,750 4,200 6,950 Operating income $ 3,250 $(250) $ 3,000 Forty percent of the Round Game's fixed costs could have been avoided if the game had not been produced or sold. If the Round Game had been discontinued before the last quarter, what would operating income have been for the company as a whole? Operating income without round $arrow_forwardMaryland Novelties Company produces and sells souvenir products. Monthly income statements for two activity levels are provided below: Unit volumes Revenue Less cost of goods sold Gross margin Less operating expenses Salaries and commissions Advertising expenses Administrative expenses Total operating expenses Net income Required 22,000 units $ 165,000 66,000 $ 99,000 22,000 33,000 13,750 68,750 $ 30,250 Required A Required B Required C 33,000 units $ 247,500 99,000 $ 148,500 a. Identify each of the following expenses as fixed, variable, or mixed. b. Use the high-low method to separate the mixed costs into variable and fixed components. c. Prepare a contribution margin income statement at the 22,000-unit level. 27,500 33,000 13,750 74,250 $ 74,250 Complete this question by entering your answers in the tabs below.arrow_forwardA company, has two departments—Hardware and Linens. The company’s most recent monthly contribution format income statement follows: Total Department Hardware Linens Sales $ 4,070,000 $ 3,000,000 $ 1,070,000 Variable expenses 1,350,000 950,000 400,000 Contribution margin 2,720,000 2,050,000 670,000 Fixed expenses 2,320,000 1,470,000 850,000 Net operating income (loss) $ 400,000 $ 580,000 $ (180,000) A study indicates $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 20% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education