Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

cost accounting subject

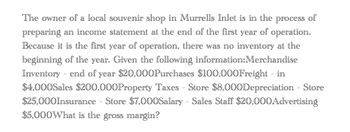

Transcribed Image Text:The owner of a local souvenir shop in Murrells Inlet is in the process of

preparing an income statement at the end of the first year of operation.

Because it is the first year of operation, there was no inventory at the

beginning of the year. Given the following information: Merchandise

Inventory end of year $20,000Purchases $100,000Freight - in

-

$4,000Sales $200,000Property Taxes - Store $8,000Depreciation - Store

$25,000Insurance Store $7,000Salary - Sales Staff $20,000Advertising

$5,000What is the gross margin?

-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- John Neff owns and operates Waikiki Surf Shop. A year-end trial balance is provided on page 561. Year-end adjustment data for the Waikiki Surf Shop are shown below. Neff uses the periodic inventory system. Year-end adjustment data are as follows: (a, b)A physical count shows that merchandise inventory costing 51,800 is on hand as of December 31, 20--. (c, d, e)Neff estimates that customers will be granted 2,000 in refunds of this years sales next year and the merchandise expected to be returned will have a cost of 1,200. (f)Supplies remaining at the end of the year, 600. (g)Unexpired insurance on December 31, 2,600. (h)Depreciation expense on the building for 20--, 5,000. (i)Depreciation expense on the store equipment for 20--, 3,000. (j)Wages earned but not paid as of December 31, 1,800. (k)Neff also offers boat rentals which clients pay for in advance. Unearned boat rental revenue as of December 31 is 3,000. Required 1. Prepare a year-end spreadsheet. 2. Journalize the adjusting entries. 3. Compute cost of goods sold using the spreadsheet prepared for part (1).arrow_forwardCoronado Inc. took a physical inventory at the end of the year and determined that $790000 of goods were on hand. In addition, Coronado, Inc. determined that $62500 of goods that were in transit that were shipped f.o.b. shipping point were actually received two days after the inventory count and that the company had $87000 of goods out on consignment. What amount should Coronado report as inventory at the end of the year? O $790000. O $939500. O $867000. $877000.arrow_forwardBell Inc. took a physical inventory at the end of the year and determined that $780k of goods were on hand. In addition, Bell Inc., determined that $60k of goods that were in transit that were shipped F.O.B. shipping point were actually received two days after the inventory count and that the company had $90k of goods out on consignment. What amount should Bell report as inventory at the end of the year? a.) 780k b.) 860k c.) 870k d.) 930karrow_forward

- Crane Inc. took a physical inventory at the end of the year and determined that $787k of goods were on hand. In addition, Crane Inc. determined that $60,500 of goods that were in transit that were shipped F.0.B. shipping point were actually received two days after the inventory count and that the company had $85,500 of goods out on consignment. What amount should Crane report as inventory at the end of the year? $872,500. $862,500. $787k. $933k.arrow_forwardBell Inc. took a physical inventory at the end of the year and determined that $780,000 of goods were on hand. In addition, the following items were not included in the physical count/ Bell, Inc. determined that $60,000 of goods that were in transit that were shipped f.o.b. destination point were actually received two days after the inventory count and that the company had $90,000 of goods out on consignment. What amount should Bell report as inventory at the end of the year? (When writing your answer do not use commas or sign of the dollar. For example, if your answer is $1,500, write it as 1500) Answer:arrow_forwardMarigold Inc. tookaphysical inventory at the end of the year and determined that $777000 of goods were on hand. In addition, Marigold, Inc. determined that $ 57500 of goods that were in transit that were shipped f.o.b. shipping point were actually received two days after the inventory count and that the company had $ 87000 of goods out on consignment. What amount should Marigold report as inventory at the end of the year? O $ 921500. O $777000. O $854000. O $864000.arrow_forward

- Houghton Limited is trying to determine the value of its ending inventory as of February 28. 2022, the company's year-end. The following transactions occurred, and the accountant asked your help in determining whether they should be recorded or not. For each of the transactions below, specify whether the item in question should be included in ending inventory, and if so, at what amount. On February 26, Houghton shipped goods costing $800 to a customer and charged the customer $1,000. The goods were shipped with terms FOB shipping point and the receiving reportindicates that the customer received the goods on (a) Not Included March 2 On February 26. Crain Inc shipped goods to Houghton under terms FOB shipping point. The invoice price was S600 plus $40 for freight. The receiving report indicates that the goods were received by Houghton on March 2. (b) ncluded Houghton had $750 of inventory isolated in the warehouse The inventory is designated for a customer who has requested that the…arrow_forwardButter Company took a physical inventory at the end of the year and determined that $190,000 of goods were on hand. In addition, the entity determined that $24,000 of goods purchased were in transit shipped FOB destination. The goods were actually received three days after the inventory count. The entity sold $10,000 worth of inventory FOB destination. Such inventory is in transit at year-end. What amount should be reported as inventory at year-end? Select one: a. $214,000 b. $190,000 c. $200,000 d. $224,000arrow_forwardPrepare financial statements for Drake Company for the year. But first...... Calculate and record the Cost of Goods Sold expense: The ending inventory balance currently shows a $279,000 balance before adjustments. After counting and pricing it using FIFO, only $33,000 remains in inventory. Reduce inventory (credit entry) to its proper balance and adjust the COGS for the inventory that is gone. The income tax rate is 30%. LAccounts payable A Accounts receivable LA Building A Cash E Common stock I Cost of Goods Sold expense SORE Dividends LA Equipment Income tax expense Income tax payable Interest Expense Inventory LA Land Long Term Debt LOhio Sales tax payable ORE Retained earnings- beginning Sales Utilities expense Wages and salaries expense ? 246,000 $14,400 $196,200 ? $57,000 $225,680 $62,500 total debits and credits $3,000 33 $279,000 $53,431 $1,001,211 $250,000 ? $14,000 $96,000 $31,000 $78,000 $1,650 $52,561 $588,000 $1,001,211arrow_forward

- At the beginning of the year, Snaplt had $10,000 of inventory. During the year, Snaplt purchased $35, 000 of merchandise and sold $30,000 of merchandise. A physical count of inventory at year-end shows $14,000 of inventory exists. Prepare the entry to record inventory shrinkage.arrow_forward17. Bell Inc. took a physical inventory at the end of the year and determined that $780,000 of goods were on hand. In addition, Bell, Inc. determined that $60,000 of goods that were in transit that were shipped f.o.b. shipping point were actually received two days after the inventory count and that the company had $90,000 of goods out on onsignment. What amount should Bell report as inventory at the end of the year? a. $780,000. b. $840,000. c. $870,000. d. $930,000.arrow_forwardZ Wholesale Company began the year with merchandise inventory of $5,000. During the year, Z purchased $99,000 of goods, had purchase discounts of $150, and returned $6,500 due to damage. Z also paid freight charges of $1,200 on inventory purchases. At year-end, Z's ending merchandise inventory balance stood at $17,800. Assume that Z uses the periodic inventory system. Compute Z's cost of goods sold for the year. Less: Plus: Less: Cost of Goods Soldarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,