Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

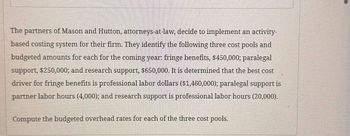

Transcribed Image Text:The partners of Mason and Hutton, attorneys-at-law, decide to implement an activity-

based costing system for their firm. They identify the following three cost pools and

budgeted amounts for each for the coming year: fringe benefits, $450,000; paralegal

support, $250,000; and research support, $650,000. It is determined that the best cost

driver for fringe benefits is professional labor dollars ($1,460,000); paralegal support is

partner labor hours (4,000); and research support is professional labor hours (20,000).

Compute the budgeted overhead rates for each of the three cost pools.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Phoenix Partners provides management consulting services to government and corporate clients. Phoenix has two support departments administrative services (AS) and information systems (IS) and two operating departments-government consulting (GOVT) and corporate consulting (CORP). For the first quarter of 2020, Phoenix's cost records indicate the following: (Click the icon to view the cost records.) Read the requirements. Requirement 1a. Allocate the two support departments' costs to the two operating departments using the direct method. (Do not round intermediary calculations and round your final answers to the nearest whole dollar. Use parentheses or a minus sign when decreasing departments by allocating costs. Enter a "0" for any zero balances.) Operating Departments Support Departments AS GOVT CORP Direct Method Budgeted overhead costs before interdepartment cost allocations Allocation of AS costs Allocation of IS costs Total budgeted overhead of operating departments …………. IS Totalarrow_forwardChance Consulting, a consulting firm, specializes in advising companies on creating business plans. Chance Consulting uses a job cost system with a predetermined indirect cost allocation rate computed as a percentage of expected direct labor costs. At the beginning of the year, managing partner Sarah Chance prepared the following plan, or budget, for the year: Direct labor hours (professionals) 19,000 hours Direct labor costs (professionals) $2,650,000 Office rent $260,000 Support Staff Salaries $870,000 Utilities $340,000 Juda Resources is inviting several consulting firms to bid for work. Chance estimates that this job will require about 220 direct labor hours. Compute Chance Consulting’s hourly direct labor cost rate and their indirect cost allocation rate What is the estimate cost for the Juda Resources Consulting Contract? If Chance Consulting wants to earn a profit that equals 35% of the job’s cost, how much should the company bid…arrow_forwardPhoenix Partners provides management consulting services to government and corporate clients. Phoenix has two support departments administrative services (AS) and information systems (IS) and two operating departments-government consulting (GOVT) and corporate consulting (CORP). For the first quarter of 2020, Phoenix's cost records indicate the following: (Click the icon to view the cost records.) Read the requirements. Requirement 1c. Allocate the two support departments' costs to the two operating departments using the step-down method (Allocate IS first). (Do not round intermediary calculations and round your final answers to the nearest whole dollar. Use parentheses or a minus sign when decreasing departments by allocating costs. Enter a "0" for any zero balances.) Support Departments AS Operating Departments CORP Step-down Method IS GOVT Total Budgeted overhead costs 690,000 $2,100,000 $8,675,000 $12,490,000 $23,955,000 before interdepartment cost allocations Allocation of IS…arrow_forward

- White Consulting, a real estate consulting firm, specializes in advising companies on potential new plant sites. The firm uses a job cost system with a predetermined indirect cost allocation rate computed as a percentage of expected direct labor costs. At the beginning of the year, managing partner Kenna White prepared the following plan, or budget, for the year: Direct labor hours (professionals). . . . 16,000 hours Direct labor costs (professionals). . . . $2,350,000 Office rent. . . . . . . . . . . . . . . . . . . . . . $220,000 Support staff salaries. . . . . . . . . . . . . $940,000 Utilities. . . . . . . . . . . . . . . . . . . . . . . . $350,000 Tibbs Resources is inviting several consulting firms to bid for work. White estimates that this job will require about 200 direct labor hours. Requirements: 1. Compute WhiteConsulting's (a) hourly direct labor cost rate and (b) indirect cost allocation rate. 2. Compute the…arrow_forwardPlease use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: Box Springs estimates there will be four orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forwardPlease use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: It estimates there will be five orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forward

- Omicronie Inc., provides project management services in the construction industry for a variety of clients. Each job is uniquely different and the Lynn Deberghie, the company’s accountant decided to use job costing for the allocation of costs on the current jobs. She will be using construction-labour hours as the basis for overhead allocation. In December 2021, she estimated the following amounts for 2022: Direct Materials $15,650,000 Construction Labour $11,200,000 Overhead $9,800,000 Construction Labour-Hours 600,000 The following results for the first quarter of 2022 for the following jobs that were started and completed in that same period. Library Dental Office Medical Building Direct Materials $924,000 $1,134,600 $1,525,000 Construction Labour-Hours 76,400 47,200 19,500 Rounding all answers to 2 decimal places Calculate the predetermined overhead allocation rate for 2022 and apply overhead to the three (3)…arrow_forwardCrow Design is an interior design firm. The firm uses a job cost system in which each client is a different "job."Crow Design traces direct labor, licensing costs, and travel costs directly to each job (client). It allocates indirect costs to jobs based on a predetermined indirect cost allocation rate computed as a percentage of direct labor costs. At the beginning of the current year, managing partner Brenna Gladstone prepared the following budget: Direct labor hours (professional). . . . . 8,000 hours Direct labor costs (professional). . . . . $1,600,000 Support staff salaries. . . . . . . . . . . . . . . $190,000 Computer lease payments. . . . . . . . . . . $41,000 Office supplies. . . . . . . . . . . . . . . . . . . . . $23,000 Office rent. . . . . . . . . . . . . . . . . . . . . . . . . $66,000 Later that same year in November, Crow Design served several clients. Records for two clients appear here: Fancy Food AllFood.com Direct labor hours. . . . . 680…arrow_forwardKLP provides consulting services and uses a job-order system to accumulate the cost of client projects. Traceable costs are charged directly to individual clients; in contrast, other costs incurred by KLP, but not identifiable with specific clients, are charged to jobs by using a predetermined overhead application rate. Clients are billed for directly chargeable costs, overhead, and a markup. KLP anticipates the following costs for the upcoming year: KLP's partners desire to make a $480,000 profit for the firm and plan to add a percentage markup on total cost to achieve that figure.On May 14, KLP completed work on a project for Lawson Manufacturing. The following costs were incurred: professional staff salaries, $68,000; administrative support staff, $8,900; travel, $10,500; and other operating costs, $2,600.REQUIRED:(a) Determine KLP's total traceable costs for the upcoming year and the firm's total anticipated overhead.(b) Calculate the predetermined overhead rate. The…arrow_forward

- Underwood Company is preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the amount of manufacturing overhead that should be assigned to each of the two product lines from the information given below. Total units produced Total number of material moves Direct labor hours per unit Budgeted material-handling costs are $50,000. The material handling cost per wall mirror under activity-based costing is: Multiple Choice O O $0. $250. Wall Mirrors 50 10 165 $770. Specialty Windows 50 30 165.arrow_forwardYour Company uses activity-based costing and has estimated its costs for next year in the table below. How much of these costs would the company assign to activity cost pools? Plant manager's salary $97,000 Salary of advertising manager $135,000 Salary of electrician in manufacturing plant $62,000 Direct labor $75,000 Salary of janitor in headquarters building $65,000 Sales commission $27,000 Group of answer choices $359,000 $159,000 $461,000 $200,000arrow_forwardWinkle, Kotter, and Zale is a small law firm that contains 10 partners and 12 support persons. The firm employs a job-order costing system to accumulate costs chargeable to each client, and it is organized into two departments-the Research and Documents Department and the Litigation Department. The firm uses predetermined overhead rates to charge the costs of these departments to its clients. At the beginning of the curent year, the firm's management made the following estimates for the year Department Research and Documents 20,400 9,300 $ 17,700 $ 430,100 $714,000 Litigation Research-hours Direct attorney-hours Materials and supplies Direct attorney cost Departmental overhead cost 16.400 $ 5,500 $ 799.400 $ 311,766 The predetermined overhead rate in the Research and Documents Department is based on research-hours, and the rate in the Litigation Department is based on direct attorney cost The costs charged to each client are made up of three elements: materials and supplies used,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning