FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

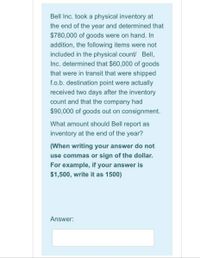

Transcribed Image Text:Bell Inc. took a physical inventory at

the end of the year and determined that

$780,000 of goods were on hand. In

addition, the following items were not

included in the physical count/ Bell,

Inc. determined that $60,000 of goods

that were in transit that were shipped

f.o.b. destination point were actually

received two days after the inventory

count and that the company had

$90,000 of goods out on consignment.

What amount should Bell report as

inventory at the end of the year?

(When writing your answer do not

use commas or sign of the dollar.

For example, if your answer is

$1,500, write it as 1500)

Answer:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- S Vibrant Company had $1,050,000 of sales in each of Year 1, Year 2, and Year 3, and it purchased merchandise costing $575,000 in each of those years. It also maintained a $350,000 physical inventory from the beginning to the end of that three-year period. In accounting for inventory, it made an error at the end of Year 1 that caused its Year 1 ending inventory to appear on its statements as $330,000 rather than the correct $350,000. 1. Determine the correct amount of the company's gross profit in each of Year 1, Year 2, and Year 3. 2. Prepare comparative income statements to show the effect of this error on the company's cost of goods sold and gross profit for each of Year 1, Year 2, and Year 3. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare comparative income statements to show the effect of this error on the company's cost of goods sold and gross profit for each of Year 1, Year 2 Year 3. Cost of goods sold Cost of goods sold Gross…arrow_forwardPacific Company sells electronic test equipment that it acquires from a foreign source. During the year, the inventory records reflected the following: Beginning inventory Purchases Sales (48 units at $24,668 each) P7-4 Part 3 Inventory is valued at cost using the LIFO inventory method. Units 21 40 Unit Cost $11,560 10,060 3a. How much did pretax income change because of the decision on December 31, current year? 3b. Assuming that the unit cost of test equipment is expected to continue to decline during the following year, is there any evidence of income manipulation? Complete this question by entering your answers in the tabs below. Req 38 Pretax income Req 3A How much did pretax income change because of the decision on December 31, current year? by Total Cost $ 242,768 402,400arrow_forwardHenderson Company uses the gross profit method to estimate ending inventory and cost of goods sold when preparing monthly financial statements required by its bank. Inventory on hand at the end of July was $124,000. The following information for the month of August was available from company records: Purchases Freight-in Sales. Sales returns Purchases returns $ 222,000 5,500 353,000 9,300 4,600 In addition, the controller is aware of $10,000 of inventory that was stolen during August from one of the company's warehouses. Required: 1. Calculate the estimated inventory at the end of August, assuming a gross profit ratio of 30%. 2. Calculate the estimated inventory at the end of August, assuming a markup on cost of 25%. 1. Estimated ending inventory 2. Estimated ending inventoryarrow_forward

- Wildhorse Company took a physical inventory on December 31 and determined that goods costing $676,000 were on hand. Not included in the physical count were $9,000 of goods purchased from Sandhill Corporation, f.o.b. shipping point, and $29,000 of goods sold to Ro-Ro Company for $37,000, f.o.b. destination. Both the Sandhill purchase and the Ro-Ro sale were in transit at year-end. What amount should Wildhorse report as its December 31 inventory? December 31 Inventory $ %24arrow_forwardVibrant Company had $1,040,000 of sales in each of Year 1, Year 2, and Year 3, and it purchased merchandise costing $570,000 in each of those years. It also maintained a $340,000 physical inventory from the beginning to the end of that three-year period. In accounting for inventory, it made an error at the end of Year 1 that caused its Year 1 ending inventory to appear on its statements as $320,000 rather than the correct $340,000. 1. Determine the correct amount of the company's gross profit in each of Year 1, Year 2, and Year 3. 2. Prepare comparative income statements to show the effect of this error on the company's cost of goods sold and gross profit for each of Year 1, Year 2, and Year 3. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the correct amount of the company's gross profit in each of Year 1, Year 2, and Year 3. Cost of goods sold Cost of goods sold Gross profit Year 1 0 $ VIBRANT COMPANY Comparative Income Statements…arrow_forwardDengerarrow_forward

- 19.Your review of ABC Company's inventory and related records for the year revealed the following information:Inventory, 1/1 - 450,000Purchases -3,150,000Sales -4,200,000You conducted a physical inventory on December 31 and determined P450,000 was in the company's warehouse. The management suspects some new employees may have pilfered a portion of the merchandise inventory.What is the cost of the missing inventory assuming that ABC's gross profit remains at 30% of sales?arrow_forward(i)The inventory costing $ 150,000 being ordered by customers before the year end was excluded from the ending inventory balance as they are set aside for delivery after year end. The ending balance of inventory as on the statement of financial position was $ 600,000. (ii) Inventory list shows 40 boxes of rice but only 38 boxes were found in the warehouse. (iii) The inventory has a cost of $600,000 and realizable value of $540,000 as the items are outdated. The ending balance of inventory as on the statement of financial position was $ 600,000. Q) For each misstatement above, explain which of the above assertions is violated. (Each assertion can only be used once.) Also, give the relevant audit objective the auditor should focus on when detecting the misstatement if the assertion is "Valuation and Allocation "arrow_forwardYour review of Mine Company's inventory and related records for the year revealed the following information:Inventory, 1/1 - 450,000Purchases -3,150,000Sales -4,200,000You conducted a physical inventory on December 31 and determined P450,000 was in the company's warehouse. The management suspects some new employees may have pilfered a portion of the merchandise inventory.What is the cost of the missing inventory assuming that Mine's gross profit remains at 30% of sales?arrow_forward

- Henderson Company uses the gross profit method to estimate ending inventory and cost of goods sold when preparing monthly financial statements required by its bank. Inventory on hand at the end of July was $119,000. The following information for the month of August was available from company records: Purchases Freight-in Sales Sales returns Purchases returns $ 212,000 4,500 343,000 8,300 3,600 In addition, the controller is aware of $12,000 of inventory that was stolen during August from one of the company's warehouses. 1. Estimated ending inventory 2. Estimated ending inventory Required: 1. Calculate the estimated inventory at the end of August, assuming a gross profit ratio of 25%. 2. Calculate the estimated inventory at the end of August, assuming a markup on cost of 25%.arrow_forwardFalkenberg Company uses the periodic method. They had the following inventory transactions throughout the period. (Assume these are the only transactions for the period). Additionally, Falkenberg had $13,200 of Operating Expenses, $4,500 of Interest Revenue and $3,300 of Interest Expense for the period. March 3: Purchased $160,000 of merchandise from Lin Company under terms 2/10, n/30. March 4: Paid $900 in freight charges to ship goods from Lin Company. March 7: Returned $10,000 of goods to Lin Company that were deemed defective. March 13: Paid the balance due to Lin Company. March 20: Sold goods costing $120,000 to Renner company for $156,000 under terms 1/15, n/30. March 25: Renner returned $14,300 of goods to Falkenberg. The goods cost Falkenberg $11,000. April 4 – Renner paid Falkenberg the balance due. 1.What is Falkenberg’s Net Purchases? What is Falkenberg’s Cost of Goods Purchased? What is Falkenberg’s Cost of Goods Available for sale, assuming that beginning inventory is…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education