FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please Given answer Accounting

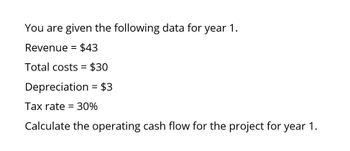

Transcribed Image Text:You are given the following data for year 1.

Revenue = $43

Total costs = $30

Depreciation = $3

Tax rate = 30%

Calculate the operating cash flow for the project for year 1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following table contains the estimated cash flows of a project. Assume the appropriate discount rate (hurdle rate) is 14%. Answer the following questions: Year Operating Cash Flow 0 -$20,000 1 $7,000 2 $8,000 3 $9,000 4 $4,000 b. What is the NPV of project 1?arrow_forwardThe following table contains the estimated cash flows of a project. Assume the appropriate discount rate (hurdle rate) is 14%. Year Operating Cash Flow 0 -$20,000 1 $7,000 2 $8,000 3 $9,000 4 $4,000 a. What is the payback period of project 1?arrow_forwardA project has the following cash flows set out below. What is the profitability index of this project if the relevant discount rate is 2 percent? Enter your final answer to two decimal places. Year Cash flow 0 -1,745 1 537 2 2,066 3 3,912arrow_forward

- Consider the cash flows for the following investment projects: (a) For Project A. find the value of X that makes the equivalent annual receiptsequal the equivalent annual disbursement at i = 13%.(b) Would you accept Project Bat i = 15% based on the AE criterion?arrow_forwardConsider the cash flows for the following investment projects: (a) For Project A. find the value of X that makes the equivalent annual receiptsequal the equivalent annual disbursement at i = 13%.(b) Would you accept Project Bat i = 15% based on the AE criterion?arrow_forwardFor project A, the cash flow effect from the change in net working capital is expected to be $490.00 at time 2 and the level of net working capital is expected to be $750.00 at time 1. What is the level of current assets for project A expected to be at time 2 if the level of current liabilities for project A is expected to be $2,600.00 at time 2? $2,860.00 (plus or minus $10) $3,840.00 (plus or minus $10) $1,360.00 (plus or minus $10) $2,340.00 (plus or minus $10) None of the above is within $10 of the correct answerarrow_forward

- Compute the IRR, NPV, PI, and payback period for the following two projects. Assume the required return is 12%. Project A Project B Year Cash flow Cash flow 0 -2500 -2500 1 900 50 2 800 600 345 1600 150 100 900 50 500 6 300 2500arrow_forwardYou are given the following cash flows for a project. Assuming a cost of capital of 12.84 percent. determine the profitability index for this project. Year 0 1 2 3 4 5 O 14981 O 1.68/7 O1.7508 1.6245 1.5613 Cash Flow -$1,115.00 $554.00 $622.00 $648 00 $426.00 $216.00arrow_forwardYou are given the following information about the cash flows for Projects A and B: Project B $12,643.00 $6,264.00 $5.119.00 $4,284.00 $3,265.00 $2,884.00 Year 0 1 2 3 4 5 Given this information, and assuming a risk-adjusted discount rate of 14.0 percent for both projects, determine the internal rate of return (IRR) for the project with the highest net present value (NPV). 26.0818% 25.6301% 25.1784% Project A -$10,356.00 $2,185.00 $4,294.00 $4,642.00 $6,360.00 $3,125.00 O24.2750%arrow_forward

- Explain all point of question with proper step by step Answer.arrow_forwardA project has estimated annual net cash flows of $63,700. It is estimated to cost $687,960. Determine the cash payback period. Round your answer to one decimal place.arrow_forwardNeed answer with correct calculationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education