SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Hello tutor please solve this question general accounting

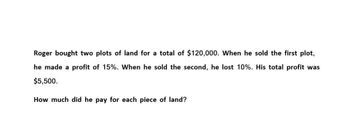

Transcribed Image Text:Roger bought two plots of land for a total of $120,000. When he sold the first plot,

he made a profit of 15%. When he sold the second, he lost 10%. His total profit was

$5,500.

How much did he pay for each piece of land?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- bob bought some lands costing $16,240. Today, that same land is valued at $46,517. how long has Bob owned this land if the price of land has been increasing at 6 percent per yeaarrow_forwardMorgan sold his house for $544,600, which was 100% of the amount he paid for it. Calculate the amount he paid for the property.arrow_forwardDave bought a rental property for $550,000 cash. One year later, he sold it for $530,000. Suppose Dave invested only $75,000 of his own money and borrowed $475,000 interest-free from his rich father. What was his return on investment?arrow_forward

- Five years ago, Teresa purchased an investment property for $189,795. He sold it today for $249,999. Based on this information, what was her annualized rate of return? 5.66% 7.59% 6.18% 5.75%arrow_forwardWhen Barry’s grandmother passed away, she gave Barry a diamond ring that was worth $6,000 at the time of death. Barry’s grandmother had purchased the ring for $5,400. What is Barry’s basis in the ring if he sells it for $7,000? What if he sells it for $5,000? What if he sells it for $5,800?arrow_forwardBrittany purchased an industrial lot in Sudbury for $1,100,000 and it was assessed at 65% of its purchase price. The annual property tax on the lot is 25 mills. a. Calculate the assessed value of the lot. Round to the nearest cent b. Calculate the property tax she would have to pay every year. Round to the nearest centarrow_forward

- Roberto invested 18,000 in a chicken production operation. Using nonrecourse notes, the business purchases 120,000 worth of grain to feed the chickens. If Robertos share of the expense is 26,000, how much can he deduct?arrow_forwardSome time ago. Tracie purchased two acres of land costing $67,900. Today, that land is valued at $64,800. How long has she owned this land if the price of the land has been decreasing by 1.5 percent per year?arrow_forwardBernadette sold her home. She received cash of $40,000, the buyer assumed her mortgage of $180,000, and she paid closing costs of $2,300 and a broker’s commission of $7,000. What is the amount realized on the sale? If she has a basis in the home of $138,000, what is her realized gain or loss on the sale? What is the character of the recognized gain or loss? How would your answer to (c) change if Bernadette sold a building used by her sole proprietorship rather than her personal residence?arrow_forward

- On Robin’s birthday, his grandmother gave him a ring that was worth $6,000 at the time of the gift. Robin’s grandmother had purchased the ring for $5,400. What is Robin’s basis in the ring if he sells it for $7,000? What if he sells it for $5,000? What if he sells it for $5,800? fill in the blank regardless of sales pricearrow_forwardKong originally sold his home for $96,000. At that time, his adjusted basis in the home was $99,000. Five years later, he repossessed the home when the balance of the note was $91,000. He resold it within one year for $105,000. Original sale expenses were $1,250, and resale expenses were $1,550. Repossession costs were $3,000. He incurred $1,000 for improvements prior to the resale. What is Kong's recomputed gain? a. $4,200 b. $6,800 c. $11,000 d. $14,000arrow_forwardLauren purchased a $50,000 T-bill for $46,919. A few months later, Lauren sold the T-bill for $48,453. What was Lauren's return on the T-bill? (Round to two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT