Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need help with this accounting questions

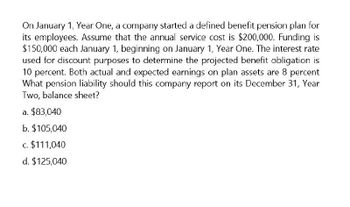

Transcribed Image Text:On January 1, Year One, a company started a defined benefit pension plan for

its employees. Assume that the annual service cost is $200,000. Funding is

$150,000 each January 1, beginning on January 1, Year One. The interest rate

used for discount purposes to determine the projected benefit obligation is

10 percent. Both actual and expected earnings on plan assets are 8 percent

What pension liability should this company report on its December 31, Year

Two, balance sheet?

a. $83,040

b. $105,040

c. $111,040

d. $125,040

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Given the following information for Tyler Companys pension plan at the beginning of the year, calculate the corridor, excess net loss (gain), and amortized net loss (gain). Assume an average remaining service life of 15 years.arrow_forwardLemur Corp. is going to pay three employees a year-end bonus. The amount of the year-end bonus and the amount of federal income tax withholding are as follows. Lemurs payroll deductions include FICA Social Security at 6.2%, FICA Medicare at 1.45%, FUTA at 0.6%, SUTA at 5.4%, federal income tax as previously shown, state income tax at 5% of gross pay, and 401(k) employee contributions at 2% of gross pay. Record the entry for the employee payroll on December 31.arrow_forwardCey Company has a defined benefit pension plan. Cey's policy is to fund net periodic pension cost annually, payment to an independent trustee being made 2 months after the end of each year. Data relating to the pension plan for year 5 are as follows: Net pension cost for year 5 Unrecognized prior service cost, 12/31/Y5 Accumulated benefit obligation, 12/31/Y5 Fair value of plan assets, 12/31/Y5 Projected benefit obligation 12/31/Y5 How much should appear on Cey's balance sheet at December 31, year 5, for pension liability? Current $190,000 $190,000 $0 Noncurrent $150,000 $330,000 $0 $190,000 150,000 480,000 500,000 500,000 $480,000arrow_forward

- Howard, Inc. established a defined benefit pension plan two years ago. Details related to the pension plan are as follows: Defined benefit, noncontributory plan with immediate full vesting. Benefits paid at the end of each retirement year beginning at age60. Expected11% rate of return on plan assets. December 31, 20X4 December 31, 20X5 Projected benefit obligation $840,000 $1,336,000 Fair & market-related value of plan assets $869,800 1,394,176 Accumulated benefit obligation 700,000 800,000 Additional information: Howard funded $440,000to the plan on December 31, 20X5 Howard's discount is10%. Average remaining service period of active employees is20 years. Service cost for20X5 is $432,000. Howard did not award retroactive benefits when the plan was adopted. Unrecognized prior net gain on January1, 20X5 was $4,150. Benefits paid $20,000 Calculate and record Howard's minimum required net periodic pension cost for 20X5.Debit Credit Cash $250,000 Accounts Receivable $757,800…arrow_forwardA company had the following information about the company's defined-benefit pension plan: January 1, 2021 December 31, 2021Projected benefit obligation $80,000 $93,000Fair value of pension plan assets 41,000 51,000Actual return on plan assets is $13,000. The service cost component of pension expense for 2021 is $17,200. The expected rate of return is 11% and the settlement rate is 6%. Given the information provided, what is the amount of pension expense for 2021?arrow_forwardUrban Life Ltd. sponsors a defined benefit pension plan for its employees. It is now the 20X9 fiscal year. An appropriate interest rate for long-term debt is 6%. Information with respect to the plan is as follows: Fair value of plan assets, 31 December 2018 $ 5,478,000 Defined benefit obligation, 31 December 2018 6,659,000 Actual return on plan assets for 2019 62,700 Past service cost from amendment dated 31 December 2019, liability is reduced because benefits were reduced (219,200 ) Actuarial revaluation dated 31 December 20]9; liability is reduced because of changed mortality assumptions (619,700 ) Funding payment at year-end 2019 530,000 Benefits paid to retirees during 2019 121,000 Current service cost for 2019 258,400 Required: 1. Calculate the SFP net defined benefit pension liability as of 31 December 2018. 2. Calculate the net defined benefit pension liability as of 31 December 2019 by calculating the defined benefit obligation and the fair value of plan assets at 31 December…arrow_forward

- Herring Wholesale Company has a defined benefit pension plan. On January 1, 2021, the following pension related data were available: ($ in thousands) Net gain–AOCI $248 Accumulated benefit obligation 1,570 Projected benefit obligation 1,500 Fair value of plan assets 1,500 Average remaining service period of active employees (expected to remain constant for the next several years) 14 years The rate of return on plan assets during 2021 was 8%, although it was expected to be 10%. The actuary revised assumptions regarding the PBO at the end of the year, resulting in a $27,000 decrease in the estimate of that obligation. Required: 1. Calculate any amortization of the net gain that should be included as a component of net pension expense for 2021.2. Assume the net pension expense for 2021, not including the amortization of the net gain component, is $329,000. What is pension expense for the year?3. Determine the net loss—AOCI or net gain—AOCI as of January 1,…arrow_forwardA company's defined benefit pension plan had a projected benefit obligation (PBO) of $350,000 on January 1, Year 1. During Year 1, pension benefits paid were $60,000, The discount rate for the plan for Year 1 was 11%. Service cost for the year was $90,000. Plan assets (fair value) increased during the year by $50,000. What was the PBO at December 31, Year 1? A. $290,000 B. $418,500 C. $380,000 D. $368,500arrow_forwardProvide this question solution general accountingarrow_forward

- Herring Wholesale Company has a defined benefit pension plan. On January 1, 2021, the following pension-related data were available: ($ in thousands) Net gain-AOCI $ 170 Accumulated benefit obligation Projected benefit obligation 1,170 1,400 Fair value of plan assets 1,100 Average remaining service period of active employees (expected to remain constant for the next several years) 15 years The rate of return on plan assets during 2021 was 9%, although it was expected to be 10%. The actuary revised assumptions regarding the PBO at the end of the year, resulting in a $23,000 decrease in the estimate of that obligation. Required: 1. Calculate any amortization of the net gain that should be included as a component of net pension expense for 2021. 2. Assume the net pension expense for 2021, not including the amortization of the net gain component, is $325,000. What is pension expense for the year? 3. Determine the net loss-AOCI or net gain—AOCI as of January 1, 2022. (For all requirements,…arrow_forwardFMC Inc. provides its employees with a defined benefit pension plan. Details are as follows: Present value defined benefit obligation (DBO) — December 31, 2020 $7,000,000 Plan assets — December 31, 2020 $5,900,000 Plan’s actuary confirmed that 4% is the appropriate interest rate to use. Current service costs (CSC) for the year $590,000 Past service costs (PSC) (improvement in benefits) — January 1, 2020 $60,000 Expected ending DBO — December 31, 2020 $7,200,000 Expected ending plan assets — December 31, 2020 $6,500,000 Remitted to pension trustee — evenly throughout year $670,000 Payments to retirees — evenly throughout year $640,000 What journal entry should FMC prepare to record the remeasurement gains/losses and actuarial gains/losses for the year? Assume FMC reports under IFRS. Question 18 options: a) DR OCI — actuarial losses 200,000 DR OCI — losses on remeasurement of plan assets 600,000 CR Net defined benefit liability…arrow_forwardHorizon Inc. has a defined benefit pension plan. The following pension-related data were available for the current calendar year: PBO: Balance, Jan. 1 $ 235,000 Service cost 36,000 Interest cost (5% discount rate) 11,750 Gain from changes in actuarial assumptions in 2021 (4,500 )Benefits paid to retirees (15,000 )Balance, Dec. 31 $ 263,250 Plan assets: Balance, Jan.1 $ 245,000 Actual return (expected return was $22,000) 20,000 Contributions 30,000 Benefits paid (15,000 )Balance, Dec. 31 $ 280,000 ABO, Dec. 31 $ 239,500 January 1, 2021, balances: Prior service cost–AOCI (amortization $5,075/yr.) 5,075 Net gain–AOCI (amortization, if any, over 15 years) 50,750 There were no other relevant data. Required:1. Calculate the 2021 pension expense.2. Prepare the 2021 journal entries to record pension expense and funding.3. Prepare any journal entries to record any 2021 gains or losses.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College