Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

need help about this question please

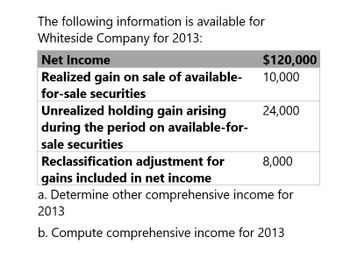

Transcribed Image Text:The following information is available for

Whiteside Company for 2013:

Net Income

$120,000

Realized gain on sale of available-

10,000

for-sale securities

Unrealized holding gain arising

24,000

during the period on available-for-

sale securities

Reclassification adjustment for

gains included in net income

8,000

a. Determine other comprehensive income for

2013

b. Compute comprehensive income for 2013

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Provide Answer for A and Barrow_forwardGive true answerarrow_forwardCullumber Corporation reported the following information for 2021: Sales revenue Cost of goods sold Operating expenses Unrealized holding gain on available-for-sale securities Cash dividends received on the securities $1034000 For 2021, Cullumber would report comprehensive income of $241956. $237820. $200596. O $41360. 723800 113740 41360 4136arrow_forward

- Sunland Company reported the following information for 2025: Sales revenue Cost of goods sold Operating expenses Unrealized holding gain on available-for-sale debt securities Cash dividends received on the securities O $490300. O $404600. $480700. $2420000 O $85700. 1754000 271000 85700 For 2025, Sunland would report comprehensive income (ignoring tax effects) of 9600arrow_forwardWildhorse Company's December 31, 2024 stockholders' equity section reported Accumulated Other Comprehensive Income of $61000 which reflected cumulative gains. The following information is available for Wildhorse for 2025: Net income Realized gain on sale of available-for-sale debt securities Unrealized holding gain on available-for-sale debt securities Unrealized holding loss on available-for-sale equity securities What is Wildhorse's comprehensive income for 2025? O $266500 O $322500 O $307500 O $225500 $266500 36000 41000 21000arrow_forwardPlease help me answerarrow_forward

- Provided below are an analyst's forecasts of revenue, net operating profit after tax (NOPAT), and net operating assets (NOA) as of 12/31/2021 for Amgen for the period 2022 through 2025. ($ millions) Reported 2021 Revenue: NOPAT: NOA: The following additional information is provided (dollar and share amounts in millions). • Common shares outstanding: 558.300 • Net nonoperating obligations (NNO): $26,355.0 • Noncontrolling interest (NCI): $0.0 • Preferred stock: $0.0 • WACC: 6.5% • Revenue growth in 2022-2025: 4.0% • Terminal period growth: 2.0% Use the information above to calculate the terminal period values of revenue, NOPAT, NOA, and ROPI. Do not round intermediate calculations. All values other than per-share amounts are shown in millions. $ millions Forecast Horizon Period 2025 2022 2023 2024 $25.979.0 $27,018.2 $28.098.9 $29.222.8 $30,391.8 $6.624.6 $6,889.6 $7,165.2 $7.451.8 $7,749.9 $33,055.0 $34.377.2 $35,752.3 $37,182.4 $38,669.7 Revenue: NOPAT: NOA: ROPI: Terminal Period…arrow_forwardThe following is from the 2021 annual report of Kaufman Chemicals, Inc.: Statements of Comprehensive Income Net income Other comprehensive income: Change in net unrealized gains on AFS investments, net of tax of $25, ($13), and $22 in 2021, 2020, and 2019, respectively Other Total comprehensive income Shareholders' equity: Common stock Additional paid-in capital Retained earnings Accumulated other comprehensive income Total shareholders' equity Accumulated other comprehensive income, 2020 365 8,777 7,857 119 $17,118 Accumulated other comprehensive income, 2021 Years Ended December 31 2019 365 8,777 7,301 84 $16,527 ($ in millions) 2021 $922 38 (3) Kaufman reports accumulated other comprehensive income in its balance sheet as a component of shareholders' equity as follows: ($ in millions) 2021 2020 $957 2020 $752 (24) (1) $727 $607 Required: 4. From the information provided, determine how Kaufman calculated the $119 million accumulated other comprehensive income in 2021. (Negative…arrow_forwardSubject: accountingarrow_forward

- Use the common-size financial statements found here: ommon-Size Balance Sheet 2016Cash and marketable securities $ 480 1.5 %Accounts receivable 6,030 18.2Inventory 9,540 28.8Total current assets $ 16,050 48.5 %Net property, plant, and equipment 17,020 51.5Total assets $33,070 100.0 %Accounts payable $ 7,150 21.6 %Short-term notes 6,850 20.7Total current liabilities $ 14,000 42.3 %Long-term liabilities 7,010 21.2Total liabilities $ 21,010 63.5 %Total common shareholders’ equity 12,060 36.5Total liabilities and shareholders’ equity $33,070 100.0 %Common-Size Income Statement 2016Revenues $ 30,000 100.0 %Cost of goods sold (20,050) 66.8Gross profit $ 9,950 33.2 %Operating expenses (7,960) 26.5Net operating income $ 1,990 6.6 %Interest expense (940) 3.1Earnings before taxes $ 1,050 3.5 %Income taxes (382) 1.3Net income $668 2.2 % Specifically, write up a brief narrative that responds to the following questions: a. How much cash does Patterson have on hand relative to its total…arrow_forwardDuring 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 lossarrow_forwardCondensed financial data of Pat Metheny Company for 2014 and 2013 are presented below: Pat Metheny Comparative Balance Sheet As of December 31, 2014 and 2013 2014 2013 Cash 1,800 1,100Receivables 1,750 1,300Inventory 1,600 1,900Plant assets…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning