EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

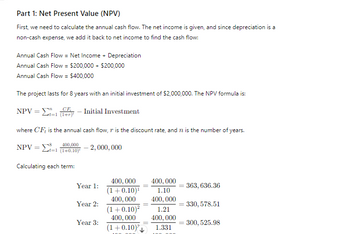

Transcribed Image Text:Part 1: Net Present Value (NPV)

First, we need to calculate the annual cash flow. The net income is given, and since depreciation is a

non-cash expense, we add it back to net income to find the cash flow:

Annual Cash Flow = Net Income + Depreciation

Annual Cash Flow = $200,000+ $200,000

Annual Cash Flow = $400,000

The project lasts for 8 years with an initial investment of $2,000,000. The NPV formula is:

CE

NPV - Initial Investment

=

t=1

where CF, is the annual cash flow, is the discount rate, and 12 is the number of years.

NPV=

400,000

- 2,000,000

t=1 (1+0.10)

Calculating each term:

Year 1:

Year 2:

Year 3:

400,000

(1+0.10)1

400,000

(1+0.10)²

400,000

(1+0.10)

400,000

1.10

400,000

363, 636.36

330, 578.51

1.21

400,000

=

300, 525.98

1.331

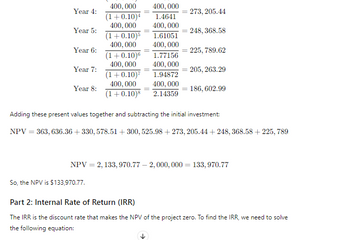

Transcribed Image Text:Year 4:

400,000 400,000

(1+0.10)4 1.4641

400,000 400,000

273, 205.44

Year 5:

248, 368.58

(1+0.10)5 1.61051

Year 6:

Year 7:

Year 8:

400,000 400,000

(1+0.10)6 1.77156

400,000 400,000

(1+0.10)7 1.94872

400,000 400,000

(1+0.10)8 2.14359

225, 789.62

=205, 263.29

= 186, 602.99

Adding these present values together and subtracting the initial investment:

NPV 363, 636.36 + 330, 578.51 +300, 525.98 +273, 205.44 + 248, 368.58 +225,789.

NPV = 2,133,970.77-2, 000, 000 = 133,970.77

So, the NPV is $133,970.77.

Part 2: Internal Rate of Return (IRR)

The IRR is the discount rate that makes the NPV of the project zero. To find the IRR, we need to solve

the following equation:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 6 images

Knowledge Booster

Similar questions

- You've estimated the following cash flows (in $) for a project: A B 1 Year Cash flow The required return for the project is 8%. Part 1 What is the IRR for the project? 3+ decimals Submit 2 0 -5,200 3 1 1,300 4 2 2,100 5 3 4,000 2 Attempt Attemparrow_forwardA project will generate the following cash flows. If the required rate of return is 15%, what is the project’s net present value? Year Cash flow 0 –$50,000 1 $15,000 2 $16,000 3 $17,000 4 $18,000 5 $19,000 Select one: a. $16,790.47 b. $6,057.47 c. $3,460.47 d. $1,487.21 e. –$3,072.47arrow_forwardAn investment project requires an initial cash outlay of $800 and then generates the following cash flows. End of year 1: $200 End of year 2: $ 300 End of year 3: $500 What is the IRR of this project?arrow_forward

- Consider the following cash flows: Year 0 1 2 3 4 5 6 Cash Flow -$9,000 $2,000 $3,600 $2,700 $2,100 $2,100 $1,600 C. IRR. Calculate the IRR for this project. The company’s required rate of return is 10%. Should it be accepted or rejected? D. NPV. Using a 10% required rate of return, calculate the NPV for this project. Should it be accepted or rejected? E. PI. Calculate the Profitability Index (PI) for this project. Should it be accepted or rejected?arrow_forwardNeed answer with correct calculationarrow_forwardUsing the method of your choice calculate the Net Present Value of the following cash flows. Assume that the required return on this project is 15% Project A Initial Cost -$150 Year 1 $175 Yeat 2 $100arrow_forward

- The initial cost of a project is $18 million. If a project returns $3 million at year 1 and that cash flow increases by $2 million each year afterwards, what is the payback period? The initial cost of a project is $18 million. If a project returns $3 million at year 1 and that cash flow increases by $2 million each year afterwards, what is the payback period? 5.77 years 4.25 years 3.33 years 2.66 yearsarrow_forwardA $670 investment has the following expected cash returns: Year Net Cash Flow $500 100 200 1 2 3 Compute the internal rate of return for this project. Round your answer to two decimal places. %arrow_forwardI will rate. Solve correctly and show all works.arrow_forward

- There a project with the following cash flows: Year: 1, 2, 3, 4 Cash Flow: -$21,800 6,300 7,350 6,750 4,400 What is the payback period?arrow_forwardAASBC is considering a project that has the following cash flow stream. Year 3 Cash Flows 0 -$10,000 1 $4,000 2 $3,500 $3,800 a. Calculate the project's IRR. b. What is the project's payback period? c. If the project's cost of capital is equal to 10%, should AASBC accept the project?arrow_forwardFor project A, the cash flow effect from the change in net working capital is expected to be $490.00 at time 2 and the level of net working capital is expected to be $750.00 at time 1. What is the level of current assets for project A expected to be at time 2 if the level of current liabilities for project A is expected to be $2,600.00 at time 2? $2,860.00 (plus or minus $10) $3,840.00 (plus or minus $10) $1,360.00 (plus or minus $10) $2,340.00 (plus or minus $10) None of the above is within $10 of the correct answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning