Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Can you please check my work bc it still showing something not right the

Transcribed Image Text:Auto-Motion is a lean manufacturer of self-driving wheelchairs. The company budgets $646,000 of conversion costs and 1,700

production hours for this year. The manufacturing of each wheelchair requires 25 production hours and raw materials costs of $4,360.

The company started and completed 86 wheelchairs during the year and sold 70. Each wheelchair is sold for $15,600. Actual

conversion costs equal applied conversion costs.

Required:

1. Prepare journal entries to record

(a) the purchase of raw materials on credit to produce 86 units,

(b) applied conversion costs to the production of 86 units,

(c) actual conversion costs of $817,000 (credit "Various Accounts"),

(d) sale of 70 units on credit, and

(e) ending inventory and cost of goods sold.

2. Compute the ending balances of Work in Process Inventory and Finished Goods Inventory. Assume each of these inventory

accounts began the year with a balance of zero.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Prepare journal entries to record (a) the purchase of raw materials on credit to produce 86 units, (b) applied conversion costs to the

production of 86 units, (c) actual conversion costs of $817,000 (credit "Various Accounts"), (d) sale of 70 units on credit, and (e) ending

inventory and cost of goods sold.

View transaction list View journal entry worksheet

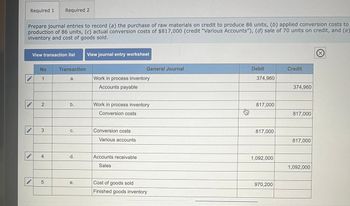

Transcribed Image Text:Required 1

Required 2

Prepare journal entries to record (a) the purchase of raw materials on credit to produce 86 units, (b) applied conversion costs to

production of 86 units, (c) actual conversion costs of $817,000 (credit "Various Accounts"), (d) sale of 70 units on credit, and (e)

inventory and cost of goods sold.

View transaction list

View journal entry worksheet

No

Transaction

General Journal

1

a.

Work in process inventory

Accounts payable

2

b.

Work in process inventory

Conversion costs

3

C.

Conversion costs

Various accounts

4

LO

5

d.

Accounts receivable

Sales

Debit

Credit

374,960

374,960

817,000

817,000

817,000

817,000

1,092,000

1,092,000

e.

Cost of goods sold

970,200

Finished goods inventory

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Jean and Tom Perritz own and manage Happy Home Helpers, Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The following total costs are associated with the total cleanings: Next year, HHH expects to purchase 25,600 of direct materials. Projected beginning and ending inventories for direct materials are as follows: There is no work-in-process inventory and no finished goods inventory; in other words, a cleaning is started and completed on the same day. HHH expects to sell 15,000 cleanings at a price of 45 each next year. Total selling expense is projected at 22,000, and total administrative expense is projected at 53,000. Required: 1. Prepare an income statement in good form. 2. What if Jean and Tom increased the price to 50 per cleaning and no other information was affected? Explain which line items in the income statement would be affected and how.arrow_forwardJean and Tom Perritz own and manage Happy Home Helpers. Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The following total costs are associated with the total cleanings: Next year, HHH expects to purchase 25,600 of direct materials. Projected beginning and ending inventories for direct materials are as follows: There is no work-in-process inventory and no finished goods inventory; in other words, a cleaning is started and completed on the same day. Required: 1. Prepare a statement of cost of services sold in good form. 2. How does this cost of services sold statement differ from the cost of goods sold statement for a manufacturing firm?arrow_forwardBox Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $25 per unit and $40 s used in direct labor, while the direct material for the double is $40 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 9,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forward

- Auto-Motion is a lean manufacturer of self-driving wheelchairs. The company budgets $560,000 of conversion costs and 2,000 production hours for this year. The manufacturing of each wheelchair requires 30 production hours and raw materials costs of $4,480 The company started and completed 98 wheelchairs during the year and sold 85. Each wheelchair is sold for $17,000. Actual conversion costs equal applied conversion costs. Required: 1. Prepare journal entries to record (a) the purchase of raw materials on credit to produce 98 units, (b) applied conversion costs to the production of 98 units, (d) actual conversion costs of $823,200 (credit "Various Accounts"), (d) sale of 85 units on credit, and (e) ending inventory and cost of goods sold. 2. Compute the ending balances of Work in Process Inventory and Finished Goods Inventory. Assume each of these inventory accounts began the year with a balance of zero Complete this question by entering your answers in the tabs below. Required 1…arrow_forwardSagerarrow_forwardCan you please check my woarrow_forward

- Can you please check my workarrow_forwardRobo-Lawn is a lean manufacturer of robotic lawn mowers. Each mower requires $250 of raw materials. Estimated conversion costs to produce 2,000 units in the next year are $800,000. During a recent quarter, the company produced 600 mowers and sold 580 mowers. Each mower is sold for $1,000. Required 1. Compute the conversion cost rate per mower. 2. Prepare journal entries to record (a) purchase of raw materials on credit, (b) applied conversion costs to production, (c) sale of mowers on credit, and (d) cost of goods sold and finished goods inventory.arrow_forwardCan you please check my workarrow_forward

- Hernandez, Inc. manufactures three models of picture frames for a total of 8,000 frames per year. The unit cost to produce a metal frame follows: $ 6 8. Direct materials Direct labor Variable overhead 2 Fixed overhead (70% unavoidable) Total $21 A local company has offered to supply Hernandez the 8,000 metal frames it needs for $17 each. Instructions Create an incremental analysis for the make-or-buy decision. Show your work. What should Hernandez decide?arrow_forwardVintage Audio Inc. manufactures audio speakers. Each speaker requires $96 per unit of direct materials. The speaker manufacturing assembly cell includes the following estimated costs for the period: Speaker assembly cell, estimated costs: Labor Depreciation Supplies Power Total cell costs for the period The operating plan calls for 195 operating hours for the period. Each speaker requires 12 minutes of cell process time. The unit selling price for ach speaker is $260. During the period, the following transactions occurred: 1. Purchased materials to produce 650 speaker units. 2. Applied conversion costs to production of 620 speaker units. 3. Completed and transferred 590 speaker units to finished goods. 4. Sold 565 speaker units. There were no inventories at the beginning of the period. a. Journalize the summary transactions (1)-(4) for the period. Round the per unit cost to the nearest cent and use in subsequent computations. If an amount box does not require an entry, leave it blank.…arrow_forwardSunshade produces a special canvas top for its high quality aluminum gazebo. The costs to produce the 900 units needed each year are as follows: Treated canvas fabric $144,000 Aluminum poles 36,000 Aluminum frame fittings 9,000 Direct labor 72,000 Variable manufacturing overhead 22,500 Fixed manufacturing overhead 58,500 $342,000 Total costs Coolaroo has offered to make the needed canvas tops of comparable quality for $293 each, FOB shipping point. Sunshade would pay for shipping at a cost of $50 per unit. Sunshade's accountant has estimated that 20% of the fixed overhead can be avoided if the tops are purchased. Sunshade should: Select one: a. Buy the part, thereby saving $3 per unit. b. Buy the part, thereby saving $10 per unit. c. Make the part, thereby saving $15 per unit. d. Buy the part, thereby saving $5 per unit.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College