Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Need answer

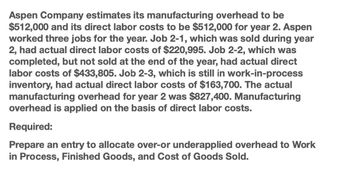

Transcribed Image Text:Aspen Company estimates its manufacturing overhead to be

$512,000 and its direct labor costs to be $512,000 for year 2. Aspen

worked three jobs for the year. Job 2-1, which was sold during year

2, had actual direct labor costs of $220,995. Job 2-2, which was

completed, but not sold at the end of the year, had actual direct

labor costs of $433,805. Job 2-3, which is still in work-in-process

inventory, had actual direct labor costs of $163,700. The actual

manufacturing overhead for year 2 was $827,400. Manufacturing

overhead is applied on the basis of direct labor costs.

Required:

Prepare an entry to allocate over-or underapplied overhead to Work

in Process, Finished Goods, and Cost of Goods Sold.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- York Company Is a machine shop that estimated overhead will be $50,000, consisting of 5,000 hours of direct labor. The cost to make job 0325 is $70 in aluminum and two hours of labor at $20 per hour. During the month. York incurs $50 in indirect material cost. $150 in administrative labor, $300 in utilities, and $250 in depreciation expense. What is the predetermined overhead rate if direct labor hours are considered the cost driver? What is the cost of Job 0325? What is the overhead incurred during the month?arrow_forwardPocono Cement Forms expects $900,000 in overhead during the next year. It does not know whether it should apply overhead on the basis of its anticipated direct labor hours of 60,000 or its expected machine hours of 30,000. Determine the product cost under each predetermined allocation rate if the last job incurred $1,550 in direct material cost, 90 direct labor hours, and 75 machine hours. Wages are paid at $16 per hour.arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forward

- Queen Bees Honey, Inc., estimated its annual overhead to be $110,000 and based its predetermined overhead rate on 27,500 direct labor hours. At the end of the year, actual overhead was $106,000 and the total direct labor hours were 29,000. What is the entry to dispose of the over applied or under applied overhead?arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardComacho Chemical Co. recorded costs for the month of 18,900 for materials, 44,100 for labor, and 26,250 for factory overhead. There was no beginning work in process, 8,000 units were finished, and 3,000 units were in process at the end of the period, two-thirds completed. Compute the months unit cost for each element of manufacturing cost and the total per unit cost. (Round unit costs to three decimal places.)arrow_forward

- Wyandotte Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 256,900, direct labor cost was 176,000, and overhead cost was 308,400. There were 40,000 units produced. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 6.62 is direct materials and 7.71 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardRockford Company has four departmental accounts: Building Maintenance, General Factory Overhead, Machining, and Assembly. The direct labor hour method is used to apply factory overhead to the jobs being worked on in Machining and Assembly. The company expects each production department to use 30,000 direct labor hours during the year. The estimated overhead rates for the year include the following: During the year, both Machining and Assembly used 28,000 direct labor hours. Factory overhead costs incurred during the year follow: In determining application rates at the beginning of the year, cost allocations were made as follows, using the sequential distribution method: Building Maintenance to: General Factory Overhead, 10%; Machining, 50%; Assembly, 40%. General factory overhead was distributed according to direct labor hours. Required: Determine the under- or overapplied overhead for each production department. (Hint: First you must distribute the service department costs.)arrow_forwardA company estimated 100,000 direct labor hours and $800,000 in overhead. The actual overhead was $805,100, and there were 99,900 direct labor hours. What is the predetermined overhead rate, and how much was applied during the year?arrow_forward

- A company estimated 50,000 direct labor hours and $450,000 in overhead. The actual overhead was $445,000, and there were 50,500 direct labor hours. What is the predetermined overhead rate, and how much was applied during the year?arrow_forwardBaldwin Printing Company uses a job order cost system and applies overhead based on machine hours. A total of 150,000 machine hours have been budgeted for the year. During the year, an order for 1,000 units was completed and incurred the following: The accountant computed the inventory cost of this order to be 4.30 per unit. The annual budgeted overhead in dollars was: a. 577,500. b. 600,000. c. 645,000. d. 660,000.arrow_forwardCompute the total job cost for each of the following scenarios: a. If the direct labor cost method is used in applying factory overhead and the predetermined rate is 100%, what amount should be charged to Job 2010 for factory overhead? Assume that direct materials used totaled 5,000 and that the direct labor cost totaled 3,200. b. If the direct labor hour method is used in applying factory overhead and the predetermined rate is 10 an hour, what amount should be charged to Job 2010 for factory overhead? Assume that the direct materials used totaled 5,000, the direct labor cost totaled 3,200, and the number of direct labor hours totaled 250. c. If the machine hour method is used in applying factory overhead and the predetermined rate is 12.50 an hour, what amount should be charged to Job 2010 for factory overhead? Assume that the direct materials used totaled 5,000, the direct labor cost totaled 3,200, the direct labor hours were 250 hours, and the machine hours were 295 hours.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning