Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

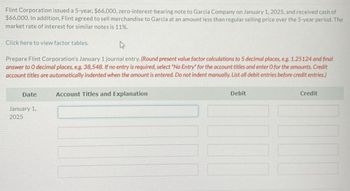

Transcribed Image Text:Flint Corporation issued a 5-year, $66,000, zero-interest-bearing note to Garcia Company on January 1, 2025, and received cash of

$66,000. In addition, Flint agreed to sell merchandise to Garcia at an amount less than regular selling price over the 5-year period. The

market rate of interest for similar notes is 11%.

Click here to view factor tables.

۵

Prepare Flint Corporation's January 1 journal entry. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final

answer to O decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit

account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.)

Date

Account Titles and Explanation

January 1,

2025

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Chemical Enterprises issues a note in the amount of $156,000 to a customer on January 1, 2018. Terms of the note show a maturity date of 36 months, and an annual interest rate of 8%. What is the accumulated interest entry if 9 months have passed since note establishment?arrow_forwardOn June 1, Phillips Corporation sold, with recourse, a note receivable from a customer to a bank. The note has a face value of 15,000 and a maturity value (principal plus interest) of 15,400. The discount is calculated to be 385, and the accrued interest income is 100. The recourse liability is estimated to be 1,000. Prepare the journal entry of Phillips to record the sale of the note receivable.arrow_forwardOn December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan.arrow_forward

- Riverbed Corporation issued a 5-year, $80,000, zero-interest-bearing note to Garcia Company on January 1, 2025, and received cash of $80,000. In addition, Riverbed agreed to sell merchandise to Garcia at an amount less than regular selling price over the 5-year period. The market rate of interest for similar notes is 12%. Click here to view factor tables. Prepare Riverbed Corporation's January 1 journal entry. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date January 1, 2025 Account Titles and Explanation Cash Discount on Notes Payable Notes Payable Unearned Sales Revenue Debit 80000 Credit 110 80000arrow_forwardGrouper Corporation issued a 4-year, $62,000, zero-interest-bearing note to Garcia Company on January 1, 2020, and received cash of $62,000. In addition, Grouper agreed to sell merchandise to Garcia at an amount less than regular selling price over the 4-year period. The market rate of interest for similar notes is 12%. Prepare Grouper Corporation’s January 1 journal entry. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit CreditJanuary 1, 2020arrow_forwardA company sold goods to a customer in exchange for a 5-year, zero-interest-bearing note on January 1, 2021. The note has a face amount of $308,000. The company imputes a 10% interest rate on this zero-interest note transaction. Present value factor for 10% and 5 years, single sum is 0.62. In the journal entry made on 12/31/2022, the company will record Discount on Notes Receivable by $__________. (Please do not use your own present value tables or financial calculator.) (Please do not round your answer in any part of the computation.) (DO NOT put a plus or minus sign in front of the amount.)arrow_forward

- Headland Corporation issued a 5-year, $65,000, zero-interest-bearing note to Brown Company on January 1, 2025, and received cash of $32,317. The implicit interest rate is 15%. Prepare Headland's journal entries for (a) the January 1 issuance and (b) the December 31 recognition of interest. (Round answers to O decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date 1, 2025 31, 2025 Account Titles and Explanation Cash Discount on Notes Payable Notes Payable Interest Expense Discount on Notes Payable IIII Debit 32317 32683 6536.6 Credit 65000 6536.6arrow_forwardHeadland Corporation issued a 5-year, $65,000, zero-interest-bearing note to Brown Company on January 1, 2025, and received cash of $32,317. The implicit interest rate is 15%. Prepare Headland's journal entries for (a) the January 1 issuance and (b) the December 31 recognition of interest. (Round answers to O decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) No. (a) (b) Date Account Titles and Explanation Debit Creditarrow_forwardOn 1 January 2022, Rodney Inc. provided services to Smith Co. in exchange for Smith’s $300,000, 2-year 8% note with interest compounded semi-annually on July 1 and January 1. The current market rate of similar notes is 12%. Rodney Inc. financial year ends December 31. REQUIRED: 1. Provide the following input values from your financial calculator: N = I/Y = PMT = FV = 2. The note was issued at = 3. The present value of the note is =arrow_forward

- Riverbed Corporation issued a 5-year, $82,000, zero-interest-bearing note to Brown Company on January 1,2025 , and received cash of $48,663. The implicit interest rate is 11%. Prepare Riverbed's journal entries for (a) the January 1 issuance and (b) the December 31 recognition of interest. (Round answers to 0 decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) No. (a)arrow_forwardShlee Corporation issued a 4-year, $60,000, zero-interest-bearing note to Garcia Company on January 1, 2020, and received cash of $60,000. In addition, Shlee agreed to sell merchandise to Garcia at an amount less than regular selling price over the 4-year period. The market rate of interest for similar notes is 12%. Prepare Shlee Corporation's January 1 journal entry.arrow_forwardBBY Company loaned $66,116 to Orwell, Inc, accepting Orwell's 2-year, $80,000, zero-interest-bearing note. The implied interest rate is 10%. Prepare BBY's journal entries for the initial transaction, recognition of interest each year, and the collection of $80,000 at maturity. Debit - Notes Receivable $80,000 Credit - Credit - Cash Debit - Credit - Debit - Credit - Interest Revenue 6.026 DEC 16 618 10arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning