FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

not use ai please

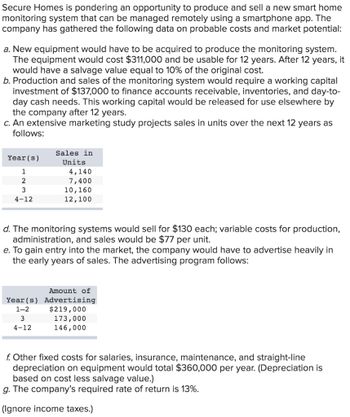

Transcribed Image Text:Secure Homes is pondering an opportunity to produce and sell a new smart home

monitoring system that can be managed remotely using a smartphone app. The

company has gathered the following data on probable costs and market potential:

a. New equipment would have to be acquired to produce the monitoring system.

The equipment would cost $311,000 and be usable for 12 years. After 12 years, it

would have a salvage value equal to 10% of the original cost.

b. Production and sales of the monitoring system would require a working capital

investment of $137,000 to finance accounts receivable, inventories, and day-to-

day cash needs. This working capital would be released for use elsewhere by

the company after 12 years.

c. An extensive marketing study projects sales in units over the next 12 years as

follows:

Sales in

Year(s)

1

2

Units

4,140

7,400

3

10,160

4-12

12,100

d. The monitoring systems would sell for $130 each; variable costs for production,

administration, and sales would be $77 per unit.

e. To gain entry into the market, the company would have to advertise heavily in

the early years of sales. The advertising program follows:

Amount of

Year(s) Advertising

1-2

$219,000

173,000

3

4-12

146,000

f. Other fixed costs for salaries, insurance, maintenance, and straight-line

depreciation on equipment would total $360,000 per year. (Depreciation is

based on cost less salvage value.)

g. The company's required rate of return is 13%.

(Ignore income taxes.)

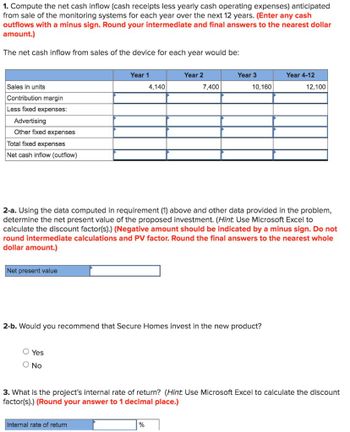

Transcribed Image Text:1. Compute the net cash inflow (cash receipts less yearly cash operating expenses) anticipated

from sale of the monitoring systems for each year over the next 12 years. (Enter any cash

outflows with a minus sign. Round your intermediate and final answers to the nearest dollar

amount.)

The net cash inflow from sales of the device for each year would be:

Sales in units

Contribution margin

Less fixed expenses:

Advertising

Other fixed expenses

Total fixed expenses

Net cash inflow (outflow)

Year 1

Year 2

Year 3

Year 4-12

4,140

7,400

10,160

12,100

2-a. Using the data computed in requirement (1) above and other data provided in the problem,

determine the net present value of the proposed investment. (Hint: Use Microsoft Excel to

calculate the discount factor(s).) (Negative amount should be indicated by a minus sign. Do not

round intermediate calculations and PV factor. Round the final answers to the nearest whole

dollar amount.)

Net present value

2-b. Would you recommend that Secure Homes invest in the new product?

○ Yes

○ No

3. What is the project's internal rate of return? (Hint: Use Microsoft Excel to calculate the discount

factor(s).) (Round your answer to 1 decimal place.)

Internal rate of return

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- jjoijoijuoil;jkjlkkllkmlkmllkarrow_forwardSearch Google images for bad data visualizations. Post a link to the image.Describe what is inaccurate or misleading about the visualization. Replace the inaccurate and misleading information with what you think makes the image a good visualization.arrow_forwardPlease do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forward

- Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forwardExplain with an example why any computer-based application control cannot function on its own and why its effectiveness depends on a set of general controls.arrow_forwardWhat are some strengths and weaknesses in the AIS system and ways to improve any weaknesses identified?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education