FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

No chatgpt use i will dislike

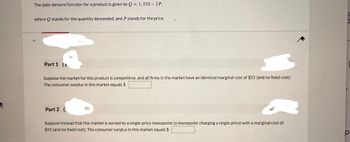

Transcribed Image Text:The daily demand function for a product is given by Q = 1,010-2P,

where stands for the quantity demanded, and P stands for the price.

Part 1

Suppose the market for this product is competitive, and all firms in the market have an identical marginal cost of $55 (and no fixed cost).

The consumer surplus in this market equals $

Part 2 (

Suppose instead that this market is served by a single-price monopolist (a monopolist charging a single price) with a marginal cost of

$55 (and no fixed cost). The consumer surplus in this market equals $

p

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Suppose that the elasticity of demand at a given price level is E(p)=.8. What does that mean? Select both the correct answer to elastic, unit, or inelastic as well as what the company should do to increase revenue. Since 0arrow_forwardInstructions: Enter your answers as a whole number. b. Assume that MC is $13 in both markets and MC = ATC at all output levels. What price will the firm charge in each market? Group 1: units will be produced at a price of $ Group 2: units will be produced at a price of $ c. Based solely on these two prices, which market has the higher price elasticity of demand? The first market has the higher price elasticity of demand. The second market has the higher price elasticity of demand. d. What will be this monopolist's total economic profit? %24arrow_forwardSuppose we have a product with the following conditions: The consumer's maximum willingness to pay is 8 A firm's minimum willingness to accept is 1 The market price is 7 a. What is the consumer surplus? CS = b. What is the producer surplus? PS = c. What is the total surplus TS =arrow_forward2. Consider the production functions given below: a. Suppose that the production function faced by a bread producer is given by Q = 4KL, where MPK = 4L and MP, = 4K. i. Do both labor and capital display diminishing marginal products in the short run? Explain. ii. Find the marginal rate of technical substitution for this production function. (Hint: The MRTS MPL MPK iii. Does this production function display a diminishing marginal rate of technical substitution? iv. Graph isoquants for Q = 20, and Q = 40. Put capital (K) on the y-axis and labor (L) on the x- axis. Label the isoquants with their quantities. v. What are the returns to scale for this firm? Explain. 20 19 18 17 16 15 14 13 12 11 10 9 0 1 2 3 4 5 6 00 9 10 11 12 13 14 15arrow_forwardGiven the demand function D(p) /175 - 3p, Find the Elasticity of Demand at a price of $39 = At this price, we would say the demand is: Elastic Unitary O Inelastic Based on this, to increase revenue we should: Raise Prices Lower Prices Keep Prices Unchangedarrow_forwardConsider a market with the following supply and demand. (It may help to draw a graph for these questions.) P 5 6 7 8 9 10 11 12 13 14 QS 200 300 400 500 600 700 800 900 1000 1100 QD 800 750 700 650 600 550 500 450 400 350 If there is an external cost of $3, what is the efficient quantity? 500 (already answer) If there is an external benefit of $3, what is the efficient quantity? 700 (already answer) For the remaining questions assume that there is a $3 external COST. If the government wants to get the efficient quantity with a per/unit tax, how much should the tax be? 3 (already answer) Now imagine that they use tradable allowances. If they cap the quantity at 400 what would the value of these allowance be in the market? (Assume the…arrow_forwardConsider the following duopoly model and determine profit - maximizing output and price for q_1+ q 2 TC_1 = 10 q_(1) TC_2 = 10 q_2 each firm. P = 200 - Q Industry Demand Q =arrow_forwardAnswer the question on the basis of the following marginal utility data for products X and Y. Assume that the prices of X and Y are $4 and $2, respectively, and that the consumer's income is $18. Units of X 1 2 3 4 5 Marginal Utility, X Multiple Choice 20 16 12 8 6 4 4 of X and 5 of Y What quantities of X and Y should be purchased to maximize utility? O 2 of X and 1 of Y O 2 of X and 6 of Y Units of Y 1 2 3 4 5 6 O2 2 of X and 5 of Y Marginal Utility, Y 16 14 12 10 8 6arrow_forwardThe difference, (Total Revenue - Total Cost) or [(Unit Price x Quantity Sold) - (Fixed Cost + Variable Cost)], represents, O the break-even point O the profit equation O the sales ratio O the market share O the value equationarrow_forwardThe following question is based on the demand and cost data for a pure monopolist given in the table below. Output Price Total Cost 0 $500 $250 12345 300 260 250 290 200 350 150 500 100 680 Refer to the above table. If the monopolist were forced to produce the socially optimal output through the imposition of a ceiling price, the ceiling price would have to be set at: O $100 $150 O $200 $250 www.yout House of High Ant SWEPT his OVER HIMarrow_forwardThe profit maximizing condition for a purely competitive firm is when. Price elasticity of demand is positive. Price average total costs O Price - average total costsarrow_forwardYou are the principal economist at a firm that produces some output y based on the following function: y = f(x1, x2) = x ³ x ² 1. Calculate the marginal product (MP) of both inputs at some arbitrary input bundle (x₁, x₂). Interpret the sign of both. 2. Using your answer in the previous part, calculate OMPT₂/0x₁. Interpret what this means. 3. Calculate the technical rate of substitution between ₁ and x2, i.e., MP/MP₂. 4. Does this production function exhibit increasing, decreasing, or constant returns to scale? Show. 1 5. Lay out a brief, realistic example of x₁, x2, y that fits the dynamics that you calculated.arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education