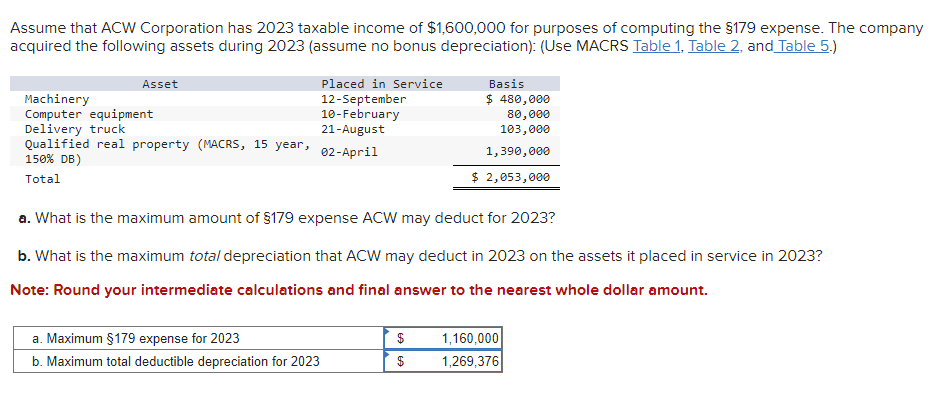

Assume that ACW Corporation has 2023 taxable income of $1,600,000 for purposes of computing the $179 expense. The company acquired the following assets during 2023 (assume no bonus depreciation): (Use MACRS Table 1, Table 2, and Table 5.) Asset Machinery Computer equipment Placed in Service 12-September Basis $ 480,000 10-February 80,000 Delivery truck 21-August Qualified real property (MACRS, 15 year, 02-April 150% DB) Total 103,000 1,390,000 $ 2,053,000 a. What is the maximum amount of §179 expense ACW may deduct for 2023? b. What is the maximum total depreciation that ACW may deduct in 2023 on the assets it placed in service in 2023? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. a. Maximum §179 expense for 2023 $ 1,160,000 b. Maximum total deductible depreciation for 2023 $ 1,269,376

Assume that ACW Corporation has 2023 taxable income of $1,600,000 for purposes of computing the $179 expense. The company acquired the following assets during 2023 (assume no bonus depreciation): (Use MACRS Table 1, Table 2, and Table 5.) Asset Machinery Computer equipment Placed in Service 12-September Basis $ 480,000 10-February 80,000 Delivery truck 21-August Qualified real property (MACRS, 15 year, 02-April 150% DB) Total 103,000 1,390,000 $ 2,053,000 a. What is the maximum amount of §179 expense ACW may deduct for 2023? b. What is the maximum total depreciation that ACW may deduct in 2023 on the assets it placed in service in 2023? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. a. Maximum §179 expense for 2023 $ 1,160,000 b. Maximum total deductible depreciation for 2023 $ 1,269,376

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter17: Business Tax Credits And The Alternative Minimum Tax

Section: Chapter Questions

Problem 7CE

Related questions

Question

Transcribed Image Text:Assume that ACW Corporation has 2023 taxable income of $1,600,000 for purposes of computing the $179 expense. The company

acquired the following assets during 2023 (assume no bonus depreciation): (Use MACRS Table 1, Table 2, and Table 5.)

Asset

Machinery

Computer equipment

Placed in Service

12-September

Basis

$ 480,000

10-February

80,000

Delivery truck

21-August

Qualified real property (MACRS, 15 year,

02-April

150% DB)

Total

103,000

1,390,000

$ 2,053,000

a. What is the maximum amount of §179 expense ACW may deduct for 2023?

b. What is the maximum total depreciation that ACW may deduct in 2023 on the assets it placed in service in 2023?

Note: Round your intermediate calculations and final answer to the nearest whole dollar amount.

a. Maximum §179 expense for 2023

$

1,160,000

b. Maximum total deductible depreciation for 2023

$

1,269,376

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT