EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Hardev

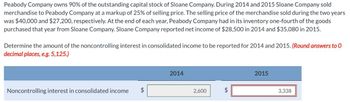

Transcribed Image Text:Peabody Company owns 90% of the outstanding capital stock of Sloane Company. During 2014 and 2015 Sloane Company sold

merchandise to Peabody Company at a markup of 25% of selling price. The selling price of the merchandise sold during the two years

was $40,000 and $27,200, respectively. At the end of each year, Peabody Company had in its inventory one-fourth of the goods

purchased that year from Sloane Company. Sloane Company reported net income of $28,500 in 2014 and $35,080 in 2015.

Determine the amount of the noncontrolling interest in consolidated income to be reported for 2014 and 2015. (Round answers to O

decimal places, e.g. 5,125.)

Noncontrolling interest in consolidated income

+A

$

2014

2,600

+A

2015

3,338

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Haresharrow_forwardOn January 1, 2015, P Company acquired a 90% interest in S Company. During 2016, S Company sold merchandise to P Company at 25% above cost in the amount (selling price) of $203,700. At the end of the year, P Company had in its inventory one-third of the amount of goods purchased from S Company.On January 1, 2016, P Company sold equipment that had a book value of $83,600 to S Company for $118,100. The equipment had an estimated remaining life of four years.S Company reported net income of $116,100, and P Company reported net income of $293,000 from their independent operations (including sales to affiliates) for the year ended December 31, 2016.Calculate controlling interest in consolidated net income for the year ended December 31, 2016.arrow_forwardHide Corporation is a wholly owned subsidiary of Seek Company. During 2015, Hide sold all of its production to Seek Company for $400,000, a price that includes a 25% gross profit. 2015 was the first year that such intercompany sales were made. By year-end, Seek sold, for $416,000, 80% of the goods it had purchased. The balance of the intercompany goods, $80,000, remained in the ending inventory and was adjusted to a lower fair value of $70,000. The adjustment was a charge to the cost of goods sold.1. Determine the gross profit on sales recorded by both companies.2. Determine the gross profit to be shown on the consolidated income statement.arrow_forward

- Tater and Pepper Corp. reported sales for 2018 of $24 million. Tater and Pepper listed $5.7 million of inventory on its balance sheet. How many days did Tater and Pepper's inventory stay on the premises? (Use 365 days a year. Round your answer to 2 declmal places.) Days' sales in inventory days How many times per year did Tater and Pepper's inventory turn over? (Round your answer to 2 declmal aces.) Inventory turnover times ences Mc Graw Hill PType here to search 59 F Mostly cloudy DELLarrow_forwardPinky Company has 80% holdings over Silk Company. During 2018, Pinky Company sold merchandise to Silk Company for P120,000 and in turn, purchased P90,000 from Silk Company. Both sales were made on account. Intercompany sales of merchandise during 2018 were made at the following gross profit rates: Downstream intercompany sale Upstream intercompany sale 25% based on sales 20% based on cost As of December 31, 2018, 30% of all intercompany sales remain in ending inventory of the buying affiliate. The beginning inventory of Pinky includes P2,500 worth of merchandise acquired from Silk on which Silk reported a profit of P1,000 while the beginning inventory of Silk also includes P3,000 of merchandise acquired from Pinky at 35% mark- up. Using cost method, the following results of operations for 2018 are as follows: Pinky Company 198,000 60,000 Silk Company 75,000 10,000 Net income Dividends declared and paid 33. How much of the consolidated net income for 2018 is attributable to the…arrow_forwardFor the period from 2016 through 2016, the Charlie Company had net sales of $500,000 and a gross profit of $200,000. During the first quarter of 2018, the company made purchases of $19,500 and recorded sales of $47,500. The inventory value at the beginning of the year was 15,500. What is the estimated cost of Charlie's inventory on March 31, 2018, using the gross profit method?arrow_forward

- Pine Company owns an 80% interest in Salad Company and a 90% interest in Tuna Company. During 2016 and 2017, intercompany sales of merchandise were made by all three companies. Total sales amounted to $2,400,000 in 2016, and $2,700,000 in 2017. The companies sold their merchandise at the following percentages above cost. Pine 15% Salad 20% Tuna 25% The amount of merchandise remaining in the 2017 beginning and ending inventories of the companies from these intercompany sales is shown below. Reported net incomes (from independent operations including sales to affiliates) of Pine, Salad, and Tuna for 2017 were $3,600,000, $1,500,000, and $2,400,000, respectively. Required: Calculate the amount noncontrolling interest to be deducted from consolidated income in the consolidated income statement for 2017. Calculate the controlling interest in consolidated net income for 2017.arrow_forwardP Corporation owns 90% of the common stock of S Company. During 2013, S Company made intercompany sales of $500,000 with a markup of 20% of selling price. The ending inventory of P Corporation includes goods purchased in 2013 from S Company for $150,000. The unrealized profit in the ending inventory on hand by P in 2013 is: Select one: a. 30000 b. 120000 c. 25000 d. 125000arrow_forwardChastain Corporation is trying to determine the effect of its inventory turnover ratio and days sales outstanding (DSO) on its cash conversion cycle. Chastain's 2016 sales (all on credit) were $285000; its cost of goods sold is 80% of sales; and it earned a net profit of 6%, or $17100. It turned over its inventory 6 times during the year, and its DSO was 35 days. The firm had fixed assets totaling $37000. Chastain's payables deferral period is 40 days. a.Calculate Chastain's cash conversion cycle. Round your answer to two decimal places. Do not round intermediate calculations. b.Assuming Chastain holds negligible amounts of cash and marketable securities, calculate its total assets turnover and ROA. Round your answers to two decimal places. Do not round intermediate calculations. C.Suppose Chastain's managers believe that the inventory turnover can be raised to 8.9 times. What would Chastain's cash conversion cycle, total assets turnover, and ROA have been if the inventory turnover…arrow_forward

- Chastain Corporation is trying to determine the effect of its inventory turnover ratio and days sales outstanding (DSO) on its cash conversion cycle. Chastain's 2016 sales (all on credit) were $285000; its cost of goods sold is 80% of sales; and it earned a net profit of 6%, or $17100. It turned over its inventory 6 times during the year, and its DSO was 35 days. The firm had fixed assets totaling $37000. Chastain's payables deferral period is 40 days. Assume 365 days in year for your calculations. A. Calculate Chastain's cash conversion cycle. Round your answer to two decimal places. Do not round intermediate calculations. B.Assuming Chastain holds negligible amounts of cash and marketable securities, calculate its total assets turnover and ROA. Round your answers to two decimal places. Do not round intermediate calculations. C.Suppose Chastain's managers believe that the inventory turnover can be raised to 8.9 times. What would Chastain's cash conversion cycle, total assets…arrow_forwardChastain Corporation is trying to determine the effect of its inventory turnover ratio and days sales outstanding (DSO) on its cash conversion cycle. Chastain's 2018 sales (all on credit) were $106,000; its cost of goods sold is 80% of sales; and it earned a net profit of 4%, or $4,240. It turned over its inventory 6 times during the year, and its DSO was 40 days. The firm had fixed assets totaling $27,000. Chastain's payables deferral period is 35 days. Assume 365 days in year for your calculations. Calculate Chastain's cash conversion cycle. Do not round intermediate calculations. Round your answer to two decimal places. days Assuming Chastain holds negligible amounts of cash and marketable securities, calculate its total assets turnover and ROA. Do not round intermediate calculations. Round your answers to two decimal places. Total assets turnover ROA % Suppose Chastain's managers believe that the inventory turnover can be raised to 9.4 times. What would…arrow_forwardGive true answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning