Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

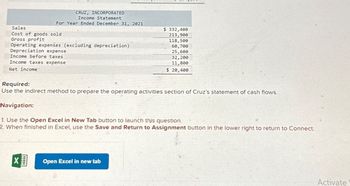

Transcribed Image Text:Sales

CRUZ, INCORPORATED

Income Statement

For Year Ended December 31, 2021

Cost of goods sold

Gross profit

Operating expenses (excluding depreciation)

Depreciation expense

Income before taxes

Income taxes expense

Net income

$ 332,400

213,900

118,500

60,700

25,600

32,200

11,800

$ 20,400

Required:

Use the indirect method to prepare the operating activities section of Cruz's statement of cash flows.

Navigation:

1. Use the Open Excel in New Tab button to launch this question.

2. When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect.

☑

Open Excel in new tab

Activate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Preparing a Statement of Cash Flows Volusia Company reported the following comparative balance sheets for 2019: Required: Prepare a statement of cash flows for Volusia using the indirect method to compute net cash flow from operating activities.arrow_forwardPreparing Net Cash Flows from Operating Activities-Direct Method Refer to the information for Granville Manufacturing Company. Required: Prepare the cash flows from operating activities section of the statement of cash flows using the direct method.arrow_forwardUse the following information from Birch Companys balance sheets to determine net cash flows from operating activities (indirect method), assuming net income for 2018 of $122,000.arrow_forward

- Use the following information from Albuquerque Companys financial statements to determine operating net cash flows (indirect method).arrow_forwardUse the following information from Acorn Companys financial statements to determine operating net cash flows (indirect method).arrow_forwardUse the following information from Eiffel Companys financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018.arrow_forward

- Use the following information from Kentucky Companys financial statements to determine operating net cash flows (indirect method).arrow_forwardUse the following excerpts from Unigen Companys financial information to prepare the operating section of the statement of cash flows (indirect method) for the year 2018.arrow_forwardUse the following information from Chocolate Companys financial statements to determine operating net cash flows (indirect method).arrow_forward

- Financial data for Otto Company follow: a. Compute the ratio of cash to monthly cash expenses. b. Interpret the results computed in (a).arrow_forwardWhich item is added to net income when computing cash flows from operating activities? a. Gain on the disposal of property, plant, and equipment b. Increase in wages payable c. Increase in inventory d. Increase in prepaid rent Use the following information for Multiple-Choice Questions 11-9 and 11-10: Cornett Company reported the following information: cash received from the issuance of common stock, $150,000; cash received from the sale of equipment, $14,800; cash paid to purchase an investment, $20,000; cash paid to retire a note payable, $50,000; and cash collected from sales to customers, $225,000.arrow_forwardCreate a cashflow statement with the followingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College