FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

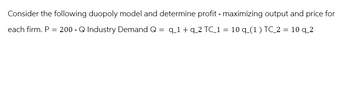

Transcribed Image Text:Consider the following duopoly model and determine profit - maximizing output and price for

q_1+ q 2 TC_1 = 10 q_(1) TC_2 = 10 q_2

each firm. P = 200 - Q Industry Demand Q

=

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The profit maximizing condition for a purely competitive firm is when. Price elasticity of demand is positive. Price average total costs O Price - average total costsarrow_forwardGiven the following notations, what is the breakeven sales level in units? SP =selling price per unit FC = total fixed cost VC = variable cost per unit A. SP / (FC/VC)B. FC/(VC/SP)C. VC/(SP – FC)D. FC/(SP – VC)arrow_forwardGiven market data in Table 2 below Table 2: Market Quantity Supplied and Demanded Data for Good X Market Quantity Prices Supplied (P) (Qs) Quantity Demanded (Qd) $18.00 20 100 $20.00 40 80 $22.00 60 60 $24.00 80 40 $26.00 100 20 The inversed function of QS(P) is OP(QS) = 16.000 + 0.100QS OP(QS) = 20.000 + 0.100Q OP(QS) 16.000 + 10.000Q OP(QS) = 20.000 + 10.000Qarrow_forward

- What is the interpretation of a price-to-book ratio = 1?Select one:a. The selling price of the firms’ products equal to the market value of the productsb. The Market thinks the book value of the firm is greater than the market valuec. None of the given choicesd. The market is valuing the firm at its book valuearrow_forwardAsap plzarrow_forwardDegree of operating leverage (DOL) measures the sensitivity of OCF in response to changes of The higher the DOL, the the volatility of a firm's operating income. Select one: a. sales quantity; lower O b. sales quantity; higher O c. fixed costs; lower O d. fixed costs; higher O e. variable costs; higherarrow_forward

- Helparrow_forwardNow suppose that annual unit sales, variable cost, and unit price are equal to their respective expected values—that is, there is no uncertainty. Determine the company's annual profit for this scenario. Round answer to a whole number, if needed.$arrow_forwardAssume X = $100 and So = $95. With T on the X-axis and $ on the Y-axis, plot the time value (price minus intrinsic value) implied for each of the following long call prices. Pa(So,T1,X) = $6.00; Pa(So,T2,X) = $7.00; Pa(So,T3,X) = $8.20; Pa(So,T4,X) = $12.50arrow_forward

- 1. Consider a pure exchange economy with two goods and two consumers. Let F denote food and C denote clothing. Lacy has the utility function U(F, C) = F 1/3 C 2/3 . Roy has the utility function V (F, C) = F 2/3 C 1/3 . Each consumer has an initial endowment consisting of 9 units of F and 9 units of C. Normalize the price of F to one. Let P denote the price of C. (a) Is the initial endowment a Pareto efcient allocation of F and C between the two con sumers? Explain briefy. (b) What is each consumer’s demand for F and C as a function of P? [Hint: the wealth of each consumer is 9 + 9P.] (c) What is the price of C in a competitive equilibrium? (d) What is the allocation of F and C between the two consumers in a competitive equilibrium?arrow_forward3.3 Using the demand function, Equation 2.2, Q = 8.56 p 0.3ps + 0.1Y, and the supply function, Equation 2.5, Q = 9.6 +0.5p -0.2pc, for coffee, determine the equilibrium price and quantity of coffee if Y = $55,000, ps = 0.20, and pc = $5. Draw the demand and supply curves and illustrate this equilibrium in a diagram.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education