Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

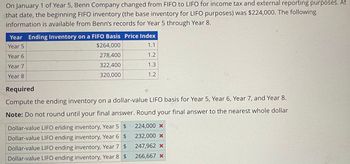

Transcribed Image Text:On January 1 of Year 5, Benn Company changed from FIFO to LIFO for income tax and external reporting purposes. At

that date, the beginning FIFO inventory (the base inventory for LIFO purposes) was $224,000. The following

information is available from Benn's records for Year 5 through Year 8.

Year Ending Inventory on a FIFO Basis Price Index

Year 5

Year 6

Year 7

$264,000

1.1

278,400

1.2

322,400

1.3

320,000

1.2

Year 8

Required

Compute the ending inventory on a dollar-value LIFO basis for Year 5, Year 6, Year 7, and Year 8.

Note: Do not round until your final answer. Round your final answer to the nearest whole dollar

Dollar-value LIFO ending inventory, Year 5 $

224,000 X

Dollar-value LIFO ending inventory, Year 6

$

232,000 X

Dollar-value LIFO ending inventory, Year 7

$

247,962 X

Dollar-value LIFO ending inventory, Year 8 $

266,667 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Refer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a cost and net realizable value of 300,000, prepare the journal entry to record the reductions to NRV for Paul Corporation assuming that Paul uses a periodic inventory system and the direct method. Paul Corporation uses FIFO and reports the following inventory information: Assuming Paul uses a perpetual inventory system and the direct method, prepare the journal entry to record the write-down of inventory.arrow_forwardOn December 31, Pitts Manufacturing Company reports the following assets: What is the total amount of Pitts inventory at year-end?arrow_forwardThe following items were included in Venicio Corporations inventory account on December 31, 2019: What amount should Venicio report as inventory at December 31, 2019? a. 21,000 b. 20,400 c. 26,000 d. 35,000arrow_forward

- Reid Company uses the periodic inventory system. On January 1, it had an inventory balance of 250,000. During the year, it made 613,000 of net purchases. At the end of the year, a physical inventory showed it had ending inventory of 140,000. Calculate Reid Companys cost of goods sold for the year.arrow_forwardHurst Companys beginning inventory and purchases during the fiscal year ended December 31, 20-2, were as follows: There are 1,200 units of inventory on hand on December 31, 20-2. REQUIRED 1. Calculate the total amount to be assigned to the cost of goods sold for 20-2 and ending inventory on December 31 under each of the following periodic inventory methods: (a) FIFO (b) LIFO (c) Weighted-average (round calculations to two decimal places) 2. Assume that the market price per unit (cost to replace) of Hursts inventory on December 31 was 18. Calculate the total amount to be assigned to the ending inventory on December 31 under each of the following methods: (a) FIFO lower-of-cost-or-market (b) Weighted-average lower-of-cost-or-market 3. In addition to taking a physical inventory on December 31, Hurst decides to estimate the ending inventory and cost of goods sold. During the fiscal year ended December 31, 20-2, net sales of 100,000 were made at a normal gross profit rate of 35%. Use the gross profit method to estimate the cost of goods sold for the fiscal year ended December 31 and the inventory on December 31.arrow_forwardInventory Analysis Singleton Inc. reported the following information for the current year: Required: Compute Singletons (a) gross profit ratio, (b) inventory turnover ratio, and (c) average days to sell inventory. (Note: Round all answers to two decimal places.)arrow_forward

- am 111.arrow_forwardOn January 1, 2020, Crow Company changed from FIFO to LIFO for income tax and external reporting purpos- es. On that same date, the beginning FIFO inventory (the base inventory for LIFO purposes) was $95,000. The following information is available from Crow's records for years 2020 through 2023. Year 2020 2021 2022 2023 Ending Inventory on a FIFO Basis Ending Inventory at Base Year Costs $113,600 84,600 85,200 92,900 a. $125,000 110,000 115,000 130,000 Required Compute the price indices used to calculate ending inventory at base year costs. Round to two decimals. Hint: Divide ending inventory on a FIFO basis by ending inventory at base year for each year. b. Compute the ending inventory on a dollar-value LIFO basis for each year, 2020 through 2023. Prepare the journal entry at each year-end, 2020 through 2023, to adjust inventory to LIFO.arrow_forwardMassi pharmacies, Inc. started operations on January 1 2X11. The company used the average cost method t=o value inventory. Effective January 1 2X15, Massi elected to change its inventory method to the FIFO basis for reporting purposes. The following information is available for net income for average cost and for FIFO, Year ended Net Income Using Average cost Net Income Using FIFO After Tax Difference After Tax Cumulative Effect December 31, 2X11 $235,000 $310,000 $75,000 $75,000 December 31, 2X12 $300,000 $376,000 $76,000 $151,000 December 31, 2X13 $310,000 $400,500 $90,500 $241,000 December 31, 2X14 $425,000 $535,000 $109,500 $351,000 December 31, 2X15 $500,000 $585,000 $85,000arrow_forward

- 5. Recording and Reporting a LIFO Reserve At the end of the annual accounting period, the inventory records of Boton Company show the following. The company uses FIFO for internal purposes and LIFO for income tax and external reporting purposes. Ending inventory at FIFO Ending inventory at LIFO Prior Year Current Year $120,000 $216,000 48,000 84,000 b. Show how inventory should be shown on its comparative balance sheets for the prior and current years. Balance Sheet, Dec 31 Prlor Year Current Year Current Assets Inventoryarrow_forwardKirtland Corporation uses a periodic inventory system. At the end of the annual accounting period, December 31, the accounting records for the most popular item in inventory showed the following: Transactions Beginning inventory, January 1 Transactions during the year: a. Purchase, January 30 b. Purchase, May 1 c. Sale ($8 each) d. Sale ($8 each) Units 470 370 530 (230) (770) Req A Req B and C Compute the amount of goods available for sale. Goods available for sale Required: a. Compute the amount of goods available for sale. b. & c. Compute the amount of ending inventory and cost of goods sold at December 31, under Average cost, First-in, first-out, Last-in, first-out and Specific identification inventory costing methods. For Specific identification, assume that the first sale was selected two- fifths from the beginning inventory and three-fifths from the purchase of January 30. Assume that the second sale was selected from the remainder of the beginning inventory, with the balance…arrow_forwardKirtland Corporation uses a periodic inventory system. At the end of the annual accounting period, December 31, the accounting records for the most popular item in inventory showed the following: Transactions Units Unit Cost Beginning inventory, January 1 450 $4.00 Transactions during the year: a. Purchase, January 30 350 3.90 b. Purchase, May 1 510 5.00 c. Sale ($6 each) (210) d. Sale ($6 each) (750)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning