FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

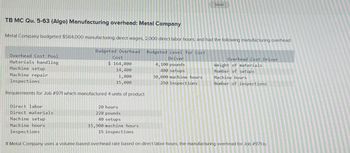

Metal Company budgeted $564,000 manufacturing direct wages, 2,000 direct labor hours, and had the following manufacturing overhead :

Transcribed Image Text:Saved

TB MC Qu. 5-63 (Algo) Manufacturing overhead: Metal Company

Metal Company budgeted $564,000 manufacturing direct wages, 2,000 direct labor hours, and had the following manufacturing overhead:

Budgeted Level for Cost

Driver

Overhead Cost Pool

Materials handling

Budgeted Overhead.

Cost

$164,000

14,400

4,100 pounds

Machine setup

480 setups

Overhead Cost Driver

Weight of materials

Number of setups

Machine hours

Number of inspections

Machine repair

1,800

15,000

30,000 machine hours

250 inspections

Inspections

Requirements for Job # 971 which manufactured 4 units of product:

Direct labor

20 hours

Direct materials

220 pounds

Machine setup

40 setups

Machine hours

15,900 machine hours

Inspections

15 inspections

If Metal Company uses a volume-based overhead rate based on direct labor hours, the manufacturing overhead for Job # 971 is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Metal Company budgeted $565,000 manufacturing direct wages, 2,500 direct labor hours, and had the following manufacturing overhead: Overhead Cost Pool Budgeted Overhead Cost Budgeted Level for Cost Driver Overhead Cost Driver Materials handling $ 168,000 4,200 pounds Weight of materials Machine setup 14,700 490 setups Number of setups Machine repair 1,550 31,000 machine hours Machine hours Inspections 13,000 260 inspections Number of inspections Requirements for Job #971 which manufactured 4 units of product: Direct labor 20 hours Direct materials 230 pounds Machine setup 40 setups Machine hours 16,000 machine hours Inspections 15 inspections Using Activity-Based Costing, overhead cost assigned to Job #971 for inspections is: Multiple Choice $2,440. $750. $9,200. $800. $1,200.arrow_forwardSteel Company uses activity-based costing and reports the following for this year. Allocate overhead costs to a job that uses 40 machine hours and 30 direct labor hours. Activity Budgeted Cost Activity Cost Driver Budgeted Activity Usage Cutting $ 56,000 Machine hours (MH) 2,000 machine hours Assembly 240,000 Direct labor hours (DLH) 6,000 direct labor hours Total $ 296,000arrow_forwardABC Company listed the following data for the current year: Budgeted factory overhead $1,134,000 Budgeted direct labor hours 70,000 Budgeted machine hours 25,000 Actual factory overhead 1,100,900 Actual labor hours 71,100 Actual machine hours 24,000 If overhead is applied based on direct labor hours, the overapplied/underapplied overhead is:arrow_forward

- immy Author Company has the following data for the past year: Actual overhead $512,000 Applied overhead: Work-in-process inventory $125,000 Finished goods inventory 170,000 Cost of goods sold 150,000 Total $445,000 Calculate the overhead variance for the year and close it to cost of goods sold. Provide all the details and working outs.arrow_forwardMountain tops applies overhead on the basis of direct labor hours and reports the following information: Budget Actual Overhead $450,000 $452, 000 Direct Labor Hours 75,000 77,000 Direct Materials $195,000 Direct Labor 333,000 A. What is the predetermined overhead rate? B. How much overhead was applied during the year? C. Was overhead over applied, or under applied and by how much?arrow_forwardActivity-Based Costing: Factory Overhead Costs The total factory overhead for Bardot Marine Company is budgeted for the year at $1,347,400, divided into four activities: fabrication, $660,000; assembly, $276,000; setup, $224,400; and inspection, $187,000. Bardot Marine manufactures two types of boats: speedboats am bass boats. The activity-base usage quantities for each product by each activity are as follows: Fabrication Assembly Setup Inspection Speedboat 11,000 dlh 34,500 dlh 79 setups 138 inspections Bass boat 33,000 11,500 581 962 44,000 dlh 46,000 dlh 660 setups 1,100 inspections Each product is budgeted for 6,500 units of production for the year. a. Determine the activity rates for each activity. Fabrication per direct labor hour Assembly %$4 per direct labor hour Setup %$4 per setup Inspection per inspection b. Determine the activity-based factory overhead per unit for each product. Round to the nearest whole dollar. Speedboat per unit Bass boat %$4 per unitarrow_forward

- Der Company uses a standard cost system in which it applies manufacturing overhead on the basis of direct labor-hours. Two direct labor-hours are required for each unit produced. The budgeted activity was set at 9,000 units. Manufacturing overhead was budgeted at $135,000 for the period; 20 percent of this cost was fixed. The 17,200 hours worked during the period resulted in production of 8,500 units. Variable manufacturing overhead cost incurred was $108,500 and fixed manufacturing overhead cost was $28,000. The fixed overhead production volume variance for the period was: a) $750 unfavorable. b) $2,500 unfavorable. c) $1,500 unfavorable. d) $1,000 unfavorable.arrow_forwardDirect labor hours are estimated as 1,900 in Quarter 1; 2,000 in Quarter 2; 1,800 in Quarter 3; and 2,200 in Quarter 4. Indirect material per hour $1.00 Supervisory salaries $16,000 Indirect labor per hour 1.25 Maintenance Salaries 4,000 Maintenance per hour 0.25 Property taxes and insurance 6,000 Utilities per hour 0.50 Depreciation 3,500 Prepare a manufacturing overhead budget using the above overhead information. Manufacturing Overhead Budget For the Year Ending Dec. 31, 2020 Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Variable Costs Total Variable Manufacturing Costs $ Fixed Costs Total Fixed Manufacturing Costs Total Manufacturing Overheadarrow_forwardActivity-Based Costing: Factory Overhead Costs The total factory overhead for Bardot Marine Company is budgeted for the year at $1,207,500, divided into four activities: fabrication, $595,000; assembly, $266,000; setup, $189,000; and inspection, $157,500. Bardot Marine manufactures two types of boats: speedboats and bass boats. The activity-base usage quantities for each product by each activity are as follows: Inspection Speedboat Bass boat Fabrication Assembly 462 525 setups Each product is budgeted for 7,500 units of production for the year. a. Determine the activity rates for each activity. 17 per direct labor hour 7 per direct labor hour Setup Inspection Fabrication 8,750 dlh $ $ Speedboat Bass boat Assembly Setup 28,500 dlh 9,500 38,000 dlh 26,250 35,000 dlh 63 setups 360 per setup 180 per inspection b. Determine the activity-based factory overhead per unit for each product. Round to the nearest whole dollar. $ per unit $ per unit 109 inspections 766 875 inspectionsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education