FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

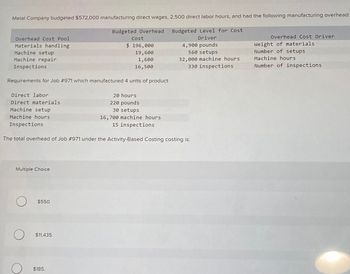

Transcribed Image Text:Metal Company budgeted $572,000 manufacturing direct wages, 2,500 direct labor hours, and had the following manufacturing overhead:

Budgeted Level for Cost

Driver

Overhead Cost Pool

Materials handling

Machine setup

Machine repair

Inspections

Direct labor

Direct materials

Machine setup

Machine hours

Inspections

Requirements for Job # 971 which manufactured 4 units of product:

Multiple Choice

O $550.

O

Budgeted Overhead

The total overhead of Job # 971 under the Activity-Based Costing costing is:

$11,435.

Cost

$ 196,000

19,600

1,600

16,500

$185.

20 hours

220 pounds

30 setups

16,700 machine hours

15 inspections

4,900 pounds

560 setups

32,000 machine hours

330 inspections

Overhead Cost Driver

Weight of materials

Number of setups

Machine hours

Number of inspections

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Multiple Production Department Factory Overhead Rates The total factory overhead for Bardot Marine Company is budgeted for the year at $1,290,000, divided into two departments: Fabrication, $772,500, and Assembly, $517,500. Bardot Marine manufactures two types of boats: speedboats and bass boats. The speedboats require three direct labor hours in Fabrication and two direct labor hours in Assembly. The bass boats require one direct labor hour in Fabrication and four direct labor hours in Assembly. Each product is budgeted for 7,500 units of production for the year. If required, round all per unit answers to the nearest cent. a. Determine the total number of budgeted direct labor hours for the year in each department. Fabrication direct labor hours Assembly direct labor hours b. Determine the departmental factory overhead rates for both departments. Fabrication per dlh Assembly per dlh c. Determine the factory overhead allocated per unit for each product using the department factory…arrow_forwardThe following information for Donoghue Manufacturing Company for the period just ended: Actual: Variable manufacturing overhead $96,000 Fixed manufacturing overhead $90,000 Actual production completed 84,000 units Actual machine hours worked 30,000 hours Standard and Budgeted: Standard variable overhead rate per machine hour $3 Standard fixed overhead rate per machine hour $2 Standard machine processing time make 2 units per hour Budgeted machine hours 41,000 machine hours Budgeted production 82,000 units The fixed overhead budget variance for Donoghue Manufacturing Company is: A. $6,000 U B. $2,000 F C. $8,000 U D. $4,000 F E. None of the above.arrow_forwardsanjuarrow_forward

- Multiple production department factory overhead rates The total factory overhead for Cypress Marine Company is budgeted for the year at $567,500, divided into two Fabrication, $311,250, and Assembly, $256,250. Cypress Marine manufactures two types of boats: speedboats speedboats require two direct labor hours in Fabrication and three direct labor hours in Assembly. The bass boa labor hour in Fabrication and two direct labor hours in Assembly. Each product is budgeted for 5,000 units of pri If required, round all per unit answers to the nearest cent.arrow_forwardFactory depreciation Indirect labor Factory electricity Indirect materials Selling expenses Administrative expenses Total costs Tortilla chips Potato chips Factory overhead is allocated to the three products on the basis of processing hours. The products had the following production budget and processing hours per case: Budgeted Volume Processing Hours (Cases) Per Case Pretzels Total Tortilla chips Potato chips $24,012 59,508 6,000 6,000 1,200 13,200 Pretzels 6,786 14,094 33,408 18,792 $156,600 Total If required, round all per-case answers to the nearest cent. a. Determine the single plantwide factory overhead rate. per processing hour 0.12 0.15 b. Use the overhead rate in (a) to determine the amount of total and per-case overhead allocated to each of the three products under generally accepted accounting principles. Total Per-Case Factory Overhead Factory Overhead 0.10arrow_forwardThe Ring The Bells, Co. collected the following data regarding production of one of its products. Budgeted units 12,500 units Standard direct labor hours per unit of output 1.2 DL hours per unit Predetermined variable factory overhead rate $2.50 Per DL hour Predetermined fixed factory overhead rate $1.75 Per DL hour Actual finished units produced 11,800 units Actual direct labor hours 13,900 hrs. Actual variable overhead costs incurred $ 37,530 Actual fixed overhead costs incurred $ 28,500 Compute the variable overhead cost variance. a. $2,780U b. $30F c. $30U d. $2,130U e. $2,130Farrow_forward

- 23: Siding Company manufactures 3 types of siding for homes: Tin, Wood and Vipak The budgeted factory overhead cost is $3,000,000. Overhead is allocated to the three products on the basis of direct labor hours. The products have the following budgeted production volumes and direct labor hours / unit: Expected Volume Direct Labor Hours / Unit Tin 5,000 units 4,000 units 5.0 Wood 3.0 Vival 2,000 units 7.0 Calculate 1: the Single Plantwide Overhead Rate, and 2: The overhead allocated to each product. Round any answers to 2 decimal places. Hint: you will need to calculate the total activity base as it is not given! Rate: Overhead Per Unit: Tin Wood Vivalarrow_forwardFacebo... PIUK Lea se Lux Corporation uses a job cost system and has two production departments,X and Y. Budgeted manufacturing costs for the year are: Department X DepartmentY on Direct materials $1400,000 $200,000 Direct manufacturing labor $400,000 $1600,000 Manufacturing overhead $1200,000 $800,000 The actual material and labor costs charged to Job #512 were as follows: Total Direct maternals: $50,000 Direct labor: Department X Department Y s 16,000 $24,000 $40,000 Lux applies manufacturing overhead costs to jobs on the basis of direct manufacturing labor cost using departmental rates determined at the beginning of the year. For Department X, the manufacturing overhead allocation rate is: Select one: a. 300% b. 33% C. 100% d. 66%% 23°C uaioarrow_forwardProduction Department 1 (PD1) and Production Department 2 (PD2) had factory overhead budgets of $26,000 and $48,000, respectively. Each department was budgeted for 5,000 direct labor hours of production activity. Product T required 5 direct labor hours in PD1 and 2 direct labor hours in PD2. What is the factory overhead cost associated with Product T, assuming that factory overhead is allocated using the multiple production rate method? a. $40.40 b. $45.20 c. $26.00 d. $58.40arrow_forward

- if job 10 consists of 50 units of product, what is the unit cost of this job?arrow_forwardA Company produces items to order and had the following budgeted overheads for the year on normal activity levels. Department Assembly Machining Painting Packing Labour: Budgeted Overheads Selling and administrative overheads are 10% of Factory Cost. The company received an order for 500 widgets, made as Batch 2024 and incurred the following costs. Assembly Dept: Machining Dept. Painting Dept. Packing Dept. Required: 36.000 86 000 40 000 30.000 Overhead Absorption Base 1500 per labour hours 2.500 per machine hours 1 800 per labour hours 1000 per labour hours 256 hours (2) $4.25 per hour 904 hours $2.50 per hour 180 hours) $3.25 per hour 350 hours @ $5.25 per hour Calculate the OAR's for each department. Calculate the total cost of the Batch showing clearly: i. Prime Cost ii. Factory Cost iii. Total Cost of the Batcharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education