FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

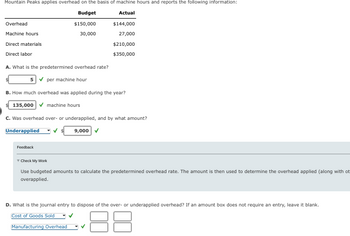

Transcribed Image Text:Mountain Peaks applies overhead on the basis of machine hours and reports the following information:

Budget

Actual

$150,000

30,000

Overhead

Machine hours

Direct materials

Direct labor

A. What is the predetermined overhead rate?

5✓ per machine hour

B. How much overhead was applied during the year?

135,000✔ machine hours

$144,000

27,000

$210,000

$350,000

C. Was overhead over- or underapplied, and by what amount?

9,000 ✓

Underapplied

Feedback

Check My Work

Use budgeted amounts to calculate the predetermined overhead rate. The amount is then used to determine the overhead applied (along with ot

overapplied.

D. What is the journal entry to dispose of the over- or underapplied overhead? If an amount box does not require an entry, leave it blank.

Cost of Goods Sold

18

Manufacturing Overhead

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ABC Company listed the following data for the current year: Budgeted factory overhead $1,134,000 Budgeted direct labor hours 70,000 Budgeted machine hours 25,000 Actual factory overhead 1,100,900 Actual labor hours 71,100 Actual machine hours 24,000 If overhead is applied based on direct labor hours, the overapplied/underapplied overhead is:arrow_forwardMountain tops applies overhead on the basis of direct labor hours and reports the following information: Budget Actual Overhead $450,000 $452, 000 Direct Labor Hours 75,000 77,000 Direct Materials $195,000 Direct Labor 333,000 A. What is the predetermined overhead rate? B. How much overhead was applied during the year? C. Was overhead over applied, or under applied and by how much?arrow_forwardUsing a traditional cost system and applies overhead to production based on machine hours. Estimated overhead cost $150,000 Actual overhead cost $140,000 Estimated machine hours 20,000 hrs Actual machine hours 25,000 Determine the overhead variance for the period? Is it $10,000 overlapped?arrow_forward

- Use three different activities as cost drivers, machine setups, machine hours, and inspections to compute the overhead rate for each activity. Activity Overhead per Activity Annual Usage Machine Setups $75,000 6,000 Machine Hours $85,002 5,484 Inspections 70,000 20,000arrow_forwardAnswer question Darrow_forwardApplying Factory Overhead Salinger Company estimates that total factory overhead costs will be $90,000 for the year. Direct labor hours are estimated to be 15,000. a. For Salinger Company, determine the predetermined factory overhead rate using direct labor hours as the activity base. If required, round your answer to two decimal places. $4 per direct labor hour b. During May, Salinger Company accumulated 660 hours of direct labor costs on Job 200 and 620 hours on Job 305. Determine the amount of factory overhead applied to Jobs 200 and 305 in May. $4 c. Prepare the journal entry to apply factory overhead to both jobs in May according to the predetermined overhead rate. If an amount box does not require an entry, leave it blank. 88arrow_forward

- Mountain Peaks applies overhead on the basis of machine hours and reports the following information: Budget Actual Overhead $420,000 $418,000 Machine hours 70,000 68,000 Direct materials $210,000 Direct labor $350,000 A. What is the predetermined overhead rate? per machine hour B. How much overhead was applied during the year? machine hours C. Was overhead over- or underapplied, and by what amount? D. What is the journal entry to dispose of the over- or underapplied overhead? If an amount box does not require an entry, leave it blank. Accounts Payable Accounts Receivable Cash Cost of Goods Sold Manufacturing Overheadarrow_forwardJ5arrow_forwardUsing the attached, Was the overhead underallocated or overallocated? By how much?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education