FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1. Calculate the balance in Work in Process as of June 30.

$

2. Calculate the balance in Finished Goods as of June 30.

$

3. Calculate the cost of goods sold for June.

tA

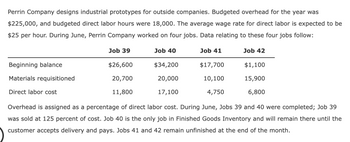

Transcribed Image Text:Perrin Company designs industrial prototypes for outside companies. Budgeted overhead for the year was

$225,000, and budgeted direct labor hours were 18,000. The average wage rate for direct labor is expected to be

$25 per hour. During June, Perrin Company worked on four jobs. Data relating to these four jobs follow:

Beginning balance

Materials requisitioned

Direct labor cost

Job 39

$26,600

20,700

11,800

Job 40

$34,200

20,000

17,100

Job 41

$17,700

10,100

4,750

Job 42

$1,100

15,900

6,800

Overhead is assigned as a percentage of direct labor cost. During June, Jobs 39 and 40 were completed; Job 39

was sold at 125 percent of cost. Job 40 is the only job in Finished Goods Inventory and will remain there until the

customer accepts delivery and pays. Jobs 41 and 42 remain unfinished at the end of the month.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Similar questions

- A company budgets $106,800 for overhead and 7,060 direct labor hours for the year. The company's Basic model uses 2 direct labor hours per unit and its Premium model uses 3 direct labor hours per unit. The direct labor rate is $43 per hour. Direct materials cost $13 per unit for the Basic model and $19 per unit for the Premium model. Enter answers in the tabs below. Required Required Required 1 2 3 Compute overhead. cost per unit for each model. Basic Premium Plantwide Direct Labor Overhead Hours per Unit Rate Overhead Cost per Unitarrow_forwardDelph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 54,000 machine-hours would be required for the period's estimated level of production. It also estimated $1,040,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $5.00 per machine-hour. Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Job D-70 Direct materials cost Direct labor cost Machine-hours Job C-200 Direct materials cost Direct labor cost Machine-hours During the year, the company had no beginning or ending inventories and it…arrow_forwardJob Costs At the end of April, Almerinda Company had completed Jobs 50 and 51. Job 50 is for 23,040 units, and Job 51 is for 26,000 units. The following data relate to these two jobs: On April 6, Almerinda Company purchased on account 60,000 units of raw materials at $12 per unit. On April 21, raw materials were requisitioned for production as follows: 25,000 units for Job 50 at $10 per unit and 27,000 units for Job 51 at $12 per unit. During April, Almerinda Company accumulated 20,000 hours of direct labor costs on Job 50 and 24,000 hours on Job 51. The total direct labor was incurred at a rate of $20.00 per direct labor hour for Job 50 and $22.00 per direct labor hour for Job 51. Almerinda Company estimates that total factory overhead costs will be $1,750,000 for the year. Direct labor hours are estimated to be 500,000. a. Determine the balance on the job cost sheets for Jobs 50 and 51 at the end of April. Job 50 Job 51 b. Determine the cost per unit for Jobs 50 and 51 at the end of…arrow_forward

- Steel Company uses activity-based costing and reports the following for this year. Allocate overhead costs to a job that uses 40 machine hours and 30 direct labor hours. Activity Budgeted Cost Activity Cost Driver Budgeted Activity Usage Cutting $ 56,000 Machine hours (MH) 2,000 machine hours Assembly 240,000 Direct labor hours (DLH) 6,000 direct labor hours Total $ 296,000arrow_forwardABC Company listed the following data for the current year: Budgeted factory overhead $1,134,000 Budgeted direct labor hours 70,000 Budgeted machine hours 25,000 Actual factory overhead 1,100,900 Actual labor hours 71,100 Actual machine hours 24,000 If overhead is applied based on direct labor hours, the overapplied/underapplied overhead is:arrow_forwardKenos Pte Ltd manufactures all types of custom-made furniture. It uses a job-costing system and applies manufacturing overhead on the basis of machine hours. The company's manufacturing overhead budget for the year totalled $2,400,000. It has a maximum capacity of 320,000 machine hours. However, it is budgeted to be able to use 75% of this capacity during this period. On 31 July, Kenos Pte Ltd has the following balances: Work in process inventory -Job 123 -Job 124 Raw materials inventory $13,360 Finished inventory -Job 122 $18,000 $8,620 In August, the following occurred: (i)Raw materials purchased on credit (ii) Raw materials requisitions $23,000 (v) Job number 123 124 125 Indirect labour (vi) -Job number 123 -Job number 124 -Job number 125 -Indirect materials (used in production) (iii)Machine hours, direct labour hours and wages for factory employees (iv)Other overhead incurred: Required: Depreciation (machineries) Depreciation (delivery vans) Machine hours Labour hours 2,400 2,320…arrow_forward

- Vishnuarrow_forwardValdosta Company is working on its costing information for January. Using normal costing, they use one overhead control account and charges overhead to production at 75% of direct labor cost. The company does not formally close the account until the end of the year. The beginning and ending inventories for the month of August are August 1 August 31 Direct Materials $62,000 $67,000 Work in Process $171,000 $145,000 Finished Goods $78,000 $85,000 Production data for the month of August follows: Direct labor $250,000 Actual manufacturing overhead $195,500 Direct materials purchased $163,000 Transportation in $2,000 Valdosta Company's cost of goods transferred to finished goods inventory for August is Group of answer choices $484,000 $495,000 $577,000 $623,500arrow_forwardSilven Company has identified the following overhead activities, costs, and activity drivers for the coming year: Activity Expected Cost Activity Driver Activity Capacity $138,000 Number of setups 10,200 Number of orders 92,400 Machine hours 18,480 Receiving hours phones with the following expected activity demands: Setting up equipment Ordering materials Machining Receiving Silven produces two models of cell Model X 5,000 80 200 6,600 385 Units completed Number of setups Number of orders Machine hours Receiving hours Required: Model Y 10,000 40 400 4,950 770 120 600 11,550 1,155arrow_forward

- (8 Problems 1) On January 1, 2021, Cali Consulting has a $110,000 balance in accounts receivable and a $0 balance in the Allowance for Uncollectible Accounts. During 2021, Cali provides $205,000 of service on account. The company collected $190,000 cash from Accounts Receivable. Uncollectible accounts are estimated to be 3% of sales on account. a. What is the amount of uncollectible accounts expense recognized in 2021? b. What is the amount of cash flows from Operating activities that would appear on the 2021 Cash Flow statement? Show the impact (with amounts) of each of the following items on the horizontal C. Oquation. For the asset section, name the specific accounts impacted. i. Record Sales during the year on account of $205,000. ii. Show the impact of $190,000 cash collected during the year. ii. Establish an Allowance for Uncollectible Accounts at year-end. 3. Study guide - Chapter 5 (with solutions).docx O A 69°F P. f5 f12 6J prt sc I14 &arrow_forwardActivity-Based Costing: Factory Overhead Costs The total factory overhead for Bardot Marine Company is budgeted for the year at $1,347,400, divided into four activities: fabrication, $660,000; assembly, $276,000; setup, $224,400; and inspection, $187,000. Bardot Marine manufactures two types of boats: speedboats am bass boats. The activity-base usage quantities for each product by each activity are as follows: Fabrication Assembly Setup Inspection Speedboat 11,000 dlh 34,500 dlh 79 setups 138 inspections Bass boat 33,000 11,500 581 962 44,000 dlh 46,000 dlh 660 setups 1,100 inspections Each product is budgeted for 6,500 units of production for the year. a. Determine the activity rates for each activity. Fabrication per direct labor hour Assembly %$4 per direct labor hour Setup %$4 per setup Inspection per inspection b. Determine the activity-based factory overhead per unit for each product. Round to the nearest whole dollar. Speedboat per unit Bass boat %$4 per unitarrow_forwardI want answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education