CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

not use ai please

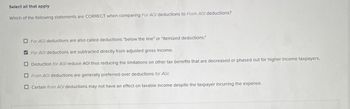

Transcribed Image Text:Select all that apply

Which of the following statements are CORRECT when comparing For AGI deductions to From AGI deductions?

For AGI deductions are also called deductions "below the line" or "itemized deductions."

For AGI deductions are subtracted directly from adjusted gross income.

Deduction for AGI reduce AGI thus reducing the limitations on other tax benefits that are decreased or phased out for higher income taxpayers.

From AGI deductions are generally preferred over deductions for AGI.

Certain from AGI deductions may not have an effect on taxable income despite the taxpayer incurring the expense.

☑☐

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Based solely on the definitions in the chapter, is the sales tax a proportional, regressive, or progressive tax? Explain, and state how the tax might be viewed differently.arrow_forwardIt has been suggested that tax policy favors deductions for AGI compared to deductions from AGI (Itemized Deductions). For this discussion, describe two (2) ways in which deductions for AGI are treated more favorably than itemized deductions. Provide at least two (2) examples of each type of deduction (for AGI and from AGI)arrow_forwardWhich of the following statements is most correct? a.Tax preference items for the alternative minimum tax are always added back to regular taxable income. b.Itemized deductions that are added back to regular taxable income for the alternative minimum tax are preference items. c.Tax preference items for the alternative minimum tax can be an increase or decrease to regular taxable income. d.All taxpayers are able to deduct the full exemption in the calculation of the alternative minimum tax.arrow_forward

- Calculate the federal income tax liability, marginal tax rate, and average tax rate for each of the following scenarios. Assume the following for all scenarios: all income is traditionally earned, the maximum allowable standard deduction is taken, and no other deductions/credits are appliedarrow_forward1. cont... Listed below are items that are commonly accounted for differently for financial reporting purposes than they are for tax purposes.For each item below, indicate whether it involves: 1. A temporary difference that will result in future deductible amounts and, therefore, will usually give rise to a deferred income tax asset. 2. A temporary difference that will result in future taxable amounts and, therefore, will usually give rise to a deferred income tax liability. 3. A permanent difference. (e) Installment sales of investments are accounted for by the accrual method for financial reporting purposes and the installment method for tax purposes. (f) For some assets, straight-line depreciation is used for both financial reporting purposes and tax purposes, but the assets’ lives are shorter for tax purposes. (g)…arrow_forward1.Briefly explain the concepts of temporary difference and permanent difference. 2.Briefly explain the concepts of taxable temporarydifference, deductible temporary difference, deferred tax assets and deferred tax liability. 3.Briefly explain the recognition criteria of deferred tax assets and deferred tax liability. 4.Why is the income taxpayable not the same as income tax expense?arrow_forward

- A purpose of an adjustment to income is to (option: a.reduce gross income? b. help determine gross income? c. reduce tax owed after tax has been determined?). Another purpose of an adjustment to income is to (option: a. help determine adjusted gross income? b. calculate taxable income after agi has been determined? c. be subtracted after agi to help determine taxable income?)arrow_forwardWhat AMT adjustment items are likely to affect all taxpayers who itemize their deductions? Please give examples. Thank you.arrow_forwardWhat are the advantages of claiming the standard deduction versus itemizing deductions on your federal tax return? How will you know which one is the preferred approach?arrow_forward

- In almost all cases, making contributions to an RRSP will provide the deferral of income tax. In some cases, making such contributions may result in avoidance of tax. Explain these statements.arrow_forwardBest options please with explanationarrow_forwardThe benefits of many deductions, credits, or other benefits are limited to taxpayers with Adjusted Gross Income below certain limits. Required: a. Select statements from the below that explains how the limitation (phaseout) process works.multiple choice Taxpayers with AGI in excess of certain specified amounts can utilize the full amount of many deductions, credits, or other tax benefits. Taxpayers with AGI in excess of certain specified amounts can fully utilize deductions, but not credits, or other tax benefits. Taxpayers with AGI less than certain specified amounts can utilize the full amount of many deductions, credits, or other tax benefits. Taxpayers with AGI less than certain specified amounts are prohibited from utilizing the full amount of many deductions, credits, or other tax benefits. b. Select examples of deductions, credits, or other benefits that are limited from the given list. (You may select more than one answer. Single click the box with the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you