FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Σ

10:03

...

23

三

Q

AA 辰

< 1/1 >

S2-10

Cancel

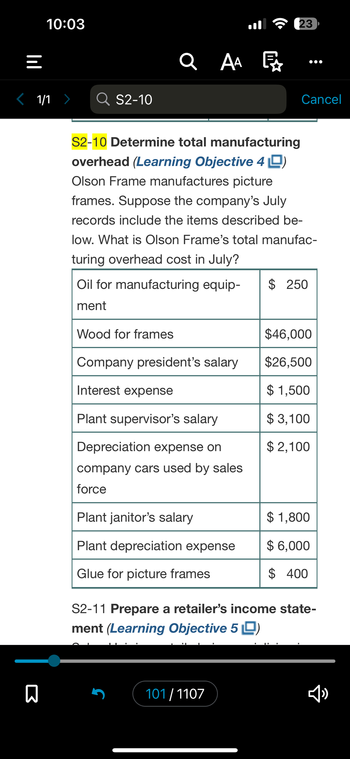

S2-10 Determine total manufacturing

overhead (Learning Objective 4)

Olson Frame manufactures picture

frames. Suppose the company's July

records include the items described be-

low. What is Olson Frame's total manufac-

turing overhead cost in July?

Oil for manufacturing equip-

$ 250

ment

Wood for frames

Company president's salary

Interest expense

Plant supervisor's salary

Depreciation expense on

company cars used by sales.

force

$46,000

$26,500

$ 1,500

$3,100

$ 2,100

Plant janitor's salary

$ 1,800

Plant depreciation expense

$ 6,000

Glue for picture frames

$ 400

S2-11 Prepare a retailer's income state-

ment (Learning Objective 5 )

5

101/1107

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- s6-9 plsarrow_forwardTask 2: CLO4 OBJECTIVE: To enable learners to identify the relevant costs and benefits from costs and revenue information available in the financial database to aid decision making on time. REQUIREMENT: Short term decision making Question Selma Corporation uses Part PB7 in one of its products. The company's Accounting Department reports the following costs to produce 7,000 units of the PB7 that are needed every year. $ per unit Direct materials 7.00 Direct labour 6.00 Variable overhead 5.60 Supervisor's salary Depreciation of special equipment Allocated general overhead 4.70 1.50 5.40 An outside supplier has offered to make the part and sell it to the company for $28.30 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If…arrow_forwardam.113.arrow_forward

- E19-15 Computing and using single plantwide overhead allocation rate Learning Objective 1 Basic $322,000 Koehler makes handheld calculators in two models: basic and professional. Koehler estimated $721,000 of manufacturing overhead and 515,000 machine hours for the year. The basic model actually consumed 230,000 machine hours, and the professional model consumed 285,000 machine hours. Compute the predetermined overhead allocation rate using machine hours (MHr) as the allocation base. How much overhead is allocated to the basic model? To the professional model?arrow_forward8:23 W WY □ s21-1 ⠀⠀⠀ S21-1 Classifying costs Classify each cost by placing an X in the appropriate columns. The first cost is completed as an example. Learning Objective 1 a. Direct materials b. Direct labor c. Variable manufacturing overhead d. Fixed manufacturing overhead C Absorption Costing X QAA 1167/1480 Product Period Product Period Cost Cost Cost Cost Word >> Bit French 49,34% Variable Costing X ||| 0 < : Xarrow_forwardExercise 6-45 (Algo) Predetermined Overhead Rates and Product Profitability (LO 6-3, 4) Social Media, Inc. (SMI) has two services for users. Toot!, which connects tutors with students who are looking for tutoring services, and TiX, which can be used to buy, sell, or exchange event tickets. For the following year, SMI expects the following results. Toot! TiX Total Users 14,900 21,600 36,500 Revenues $ 1,950,000 $ 2,000,000 $ 3,950,000 Engineering hours 10,125 8,125 18,250 Engineering cost $ 830,625 $ 948,750 $ 1,779,375 Administrative costs $ 1,423,500 Required: a. Compute the predetermined overhead rate used to apply administrative costs to the two services assuming SMI uses the engineering hours to allocate administrative costs. b. Based on the rates computed in requirement (a), what is the profit for each service? Required A Compute the predetermined overhead rate used to apply administrative costs to the two services assuming…arrow_forward

- S5-13 Find unit cost and gross profit on a final product (Learning Objective 5) Counter Co. produces Formica countertops in two sequential production departments: Forming and Polishing. The Polishing Department calculated the following costs per equivalent unit (square feet) on its October production cost report: Transferred-in $2.44 Direct Materials Conversion Costs $0.40 $1.66 Cost per equivalent unit: During October, 165,000 square feet were completed and transferred out of the Polishing Department to Finished Goods Inventory. The countertops were subsequently sold for $13.00 per square foot. 1. What was the cost per square foot of the finished product? 2. Did most of the production cost occur in the Forming Department or in the Polishing Department? Explain how you can tell where the most production cost occurred. 3. What was the gross profit per square foot? 4. What was the total gross profit on the countertops produced in October?arrow_forwarddy Home CengageNOWv2| Online teachin x /takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Xander Studios holds a sculpting class for which it charges students $250. The costs consist of the following: Variable costs per student: Sculpting supplies $100 Enrollment costs 50 Fixed costs for the course: Instructor's salary $1,000 Rental cost of the classroom 500 The break-even number of students is Oa. 2 ОБ. 12 Oc. 20 Od. 11arrow_forwardhttps://camdenccinstructure.com/courses/3788/assignments/3. sions Question 4 rences View Policies orations Current Attempt in Progress PLUS Support Coronado Industries produces corn chips. The cost of one batch is below: Central се 365 $17 Direct materials Direct labor 12 ges 10 Variable overhead za Fixed overhead 14 An outside supplier has offered to produce the corn chips for $26 per batch. How much will Coronado Industries save if it accepts the offer? O $27 per batch O $3 per batch e $17 per batch O $13 per batch hp salarrow_forward

- A ezto.mheducation.com tte.edu S Module 2- Video Lecture: Fundamentals. Assignments: 202180-Fall 2021-ACCT-2 M Question 1- Chapter 2 Lab Day - Connect 2 Lab Day i Saved Hel Direct labor-hours Machine-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour Variable manufacturing overhead per direct labor-hour Department Cutting 6,700 64,300 $ 390,000 $ 3.00 Finishing 61,000 3,000 $ 514,000 $ 4.75 Required: 1. Compute the predetermined overhead rate for each department. 2. The job cost sheet for Job 203, which was started and completed during the year, showed the following: Department Cutting Finishing Direct labor-hours Machine-hours Direct materials Direct labor cost 3 82 ces 16 $ 760 $ 69 4 $ 390 $ 368 Using the predetermined overhead rates that you computed in requirement (1), compute the total manufacturing cost assigned to Job 203. 3. Would you expect substantially different amounts of overhead cost to be assigned to some jobs if the company…arrow_forwardA v2.cengagenow.com A Chapter 23 Pre CengageNOwv2 | Online teaching and learning resource from Cengage Learning h eBook E Print Item Single Plantwide Factory Overhead Rate Scrumptious Snacks Inc. manufactures three types of snack foods: tortilla chips, potato chips, and pretzels. The company has budgeted the following costs for the upcoming period: Factory depreciation $29,957 Indirect labor 74,241 Factory electricity 8,466 Indirect materials 17,584 Selling expenses 41,679 Administrative expenses 23,445 Total costs $195,372 Factory overhead is allocated to the three products on the basis of processing hours. The products had the following production budget and processing hours per case: Budgeted Volume Processing Hours (Cases) Per Case Tortilla chips 7,200 0.10 Potato chips 7,200 0.15 Pretzels 5,100 0.12 Total 19,500 If required, round all per-case answers to the nearest cent. a. Determine the single plantwide factory overhead rate. X per processing hour b. Use the overhead rate in (a)…arrow_forwardhUrl=https%253A%252F%252F sive Problems - 10% semester grade i Saved Fill in the missing amounts in each of the eight case situations below. Each case is independent of the others. Required: a. Assume that only one product is being sold in each of the four following case situations: b. Assume that more than one product is being sold in each of the four following case situations: Complete this question by entering your answers in the tabs below. Required A Required B Assume that more than one product is being sold in each of the four following case situations: (Loss amounts should be indicated by a minus sign.) Case #1 Case #2 Case #3 Case #4 Sales 442,000 198,000 306,000 Variable expenses 128,700 82,620 Fixed expenses 57,000 470,000 Net operating income (loss) $ 42,120 87 740 $. 5,380 Contribution margin ratio (percent) 36 % 79 % 0. Required A %24 %24 %24 %24arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education