Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

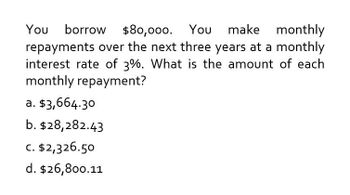

Transcribed Image Text:You borrow $80,000. You make monthly

repayments over the next three years at a monthly

interest rate of 3%. What is the amount of each

monthly repayment?

a. $3,664.30

b. $28,282.43

c. $2,326.50

d. $26,800.11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- If Bergen Air Systems takes out a $100,000 loan, with eight equal principal payments due over the next eight years, how much will be accounted for as a current portion of a noncurrent note payable each year?arrow_forwardMarathon Peanuts converts a $130,000 account payable into a short-term note payable, with an annual interest rate of 6%, and payable in four months. How much interest will Marathon Peanuts owe at the end of four months? A. $2,600 B. $7,800 C. $137,800 D. $132,600arrow_forwardNeed helparrow_forward

- Correct answerarrow_forwardYour client deposits $5 million in a savings account that pays 5 percent per year compounded quarterly. What will be the value of this deposit after 2.5 years? A. $5.625 million. b. $5.649 million. c. $5.661 millionarrow_forwardIf you borrow $7,300 at $800 interest for one year, what is your effective interest rate for the following payment plans? Note: Input your answers as a percent rounded to 2 decimal places. a. Annual payment b. Semiannual payments c. Quarterly payments d. Monthly payments Effective Rate of Interest % % % %arrow_forward

- If you borrow $7,500 at $550 interest for one year, what is your effective interest rate for the following payment plans? (Input your answers as a percent rounded to 2 decimal places.) a. Annual payment b. Semiannual payments c. Quarterly payments d. Monthly payments Effective Rate of Interest % % %arrow_forwardIf you borrow $5,300 at $400 interest for one year, what is your annual interest cost for the following payment plan? (Round the final answers to 2 decimal places.) a. Annual payment b. Semiannual payments c. Quarterly payments d. Monthly payments Effective rate % op % %arrow_forwardYour goal is to accumulate $60,000 in seven years' time. What monthly deposit must you make into a savings account to reach your goal? Interest rates are 12% p.a. compounded monthly. a. $1,059.16 b. $714.29 c. $5,947.06 d. $459.16arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning