Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Best options please with explanation

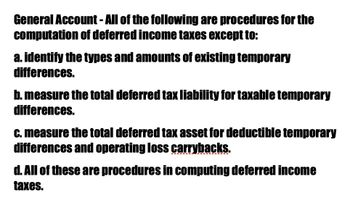

Transcribed Image Text:General Account - All of the following are procedures for the

computation of deferred income taxes except to:

a. identify the types and amounts of existing temporary

differences.

b. measure the total deferred tax liability for taxable temporary

differences.

c. measure the total deferred tax asset for deductible temporary

differences and operating loss carrybacks.

d. All of these are procedures in computing deferred income

taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Definitions The FASB has defined several terms in regard to accounting for income taxes. Below are various code letters (for terms) followed by definitions. 1. The deferred tax consequences of future deductible amounts and operating loss carryforwards 2. A difference between the tax basis of an asset or liability and its reported amount in the financial statements that will result in taxable or deductible amounts in future years when the reported amount of the asset or liability is recovered or settled, respectively 3. Temporary difference that results in taxable amounts in future years when the related asset or liability is recovered or settled, respectively 4. The future effects on income taxes, as measured by the applicable enacted tax rate and provisions of the enacted tax low, resulting from temporary differences and operating loss carryforwards at the end of the current year 5. The change during the year in a corporations deferred tax liabilities and assets 6. The deferred tax consequences of future taxable amounts 7. The portion of o deferred tax asset for which it is more likely than not that a tax benefit will not be realized 8. Temporary difference that results in deductible amounts in future years when the related asset or liability is recovered or settled, respectively 9. The sum of income tax payable and deferred tax expense (or benefit) 10. The amount of income taxes paid or payable (or refundable) for the current year 11. An excess of tax deductible expenses over taxable revenues in a year that may be carried forward to reduce taxable income in a future year 12. The excess of taxable revenues over tax deductible expenses and exemptions for the year 13. Income tax expense divided by income before income taxesarrow_forward1. Which statement is true about intraperiod tax allocation? a. It arises because certain revenue and expense items appear in the income statement either before or after they are included in the tax return b. It is required for the cumulative effect of accounting changes but not for prick period adjustments c. The purpose is to allocate income tax expense evenly over a number of accounting periods d. The purpose is to relate the income tax expense to the items which affect the amount of tax 2. Which temporary difference would result in a deferred tax asset? a. Tax penalty or surcharge b. Dividend received on share investment c. Excess tax depreciation over accounting depreciation d. Rent received in advance included in taxable income but deferred for financial accounting 3. Which temporary difference would result in a deferred tax liability? a. Interest revenue on municipal bonds b. Accrual of warranty expense c. Excess tax depreciation over…arrow_forwardDefinitions The FASB has defined several terms in regard to accounting for income taxes. Below are various code letters (for terms) followed by definitions. Code Letter Term Code Letter Term A. Future deductible amount H Deferred tax consequences B Income tax payable (or refund) I Future taxable amount Operating loss carryback Deferred tax liability D Valuation allowance K Temporary difference E Deferred tax asset Income tax expense (or benefit) F Operating loss carryforward M Deferred tax expense (or benefit) Taxable income Required: Indicate which term belongs with each definition by choosing the correct term. 1. The deferred tax consequences of future deductible amounts and operating loss carryforwards 2. A difference between the tax basis of an asset or liability and its reported amount in the financial statements that will result in taxable or deductible amounts in future years when the reported amount of the asset or liability is recovered or settled, respectively X 3. Temporary…arrow_forward

- In relation to accounting for income taxes, which one of the following statements is correct? a. Tax expense is the sum of current tax expense plus deferred tax expense. b. All movements in deferred tax assets and liabilities are recognised in the statement of profit or loss and other comprehensive income. c. Current tax expense is the sum of tax expense plus deferred tax expense. d. Deferred tax liabilities are determined from deductible temporary differences.arrow_forwardDescribe the types of temporary differences that cause deferred tax assets and determine the amounts needed to record periodic income taxes.arrow_forward1. The amount of income taxes that relate to financial income subject to tax is reported on the income statement as A. long-term deferred income taxes (credit) C. income tax expense B. current deferred income taxes (debit) D. income tax payable 2. An item that would create a permanent difference in pretax financial and taxable income would be A. using accelerated depreciation for tax purposes & straight line depreciation for book purposes. B. using the percentage of completion method on long-term construction contracts. C. purchasing equipment previously leased with an operating lease in prior years. D. paying fines for violation of laws. 3. Which of the following is the most likely item to result in a deferred tax asset? A. using completed contract method of recognizing construction revenue tax purposes, but using percentage of completion method for financial reporting purposes. B. using accelerated depreciation for tax purposes but straight-line depreciation for accounting purposes.…arrow_forward

- Indicate the type of Deferred Tax account created by Prepaid Expenses and Accrued Revenues, respectively. Select one: O a Asset Asset Ob. Liability, Liability Oc Asset, Liability O d. Liability, ASsetarrow_forwardWhich option is the correct definition of tax base? Select one: a. Tax base is the amount the asset or liability is recorded at in the accounting records. b. Tax base is a comparing the balance sheet derived using accounting rules with balance sheet that would be derived from taxation rules c. Tax base is the recognition of assets and liabilities in the balance sheet based on the differences between accounting and tax values of assets and liabilities. d. Tax base is defined as the amount that is attributed to an asset or liability for tax purposes.arrow_forwardRequirements: Compute for the following: a Income tax expense, Current tax expense and Deferred tax a. expense/benefit b. Current tax liability c Deferred tax liability and Deferred tax asset d. Provide the journal entry. C.arrow_forward

- A purpose of an adjustment to income is to (option: a.reduce gross income? b. help determine gross income? c. reduce tax owed after tax has been determined?). Another purpose of an adjustment to income is to (option: a. help determine adjusted gross income? b. calculate taxable income after agi has been determined? c. be subtracted after agi to help determine taxable income?)arrow_forwardJustification for the method of determining periodic deferred tax expense is based on the concept of? Cost Principle Going Concern Assumption Conservatism Matching Principlearrow_forwardPROBLEM 3: EXERCISES 1. Park Co. has the following information for the current year: Pretax income 900,000 Penalty on late filing of income tax return Interest on borrowings incurred to acquire tax- 30,000 exempt securities Interest income on government securities Excess of tax depreciation over book depreciation Excess of revenue recognized over taxable income Excess of provision over actual expenditures Advanced rent received (taxable upon receipt) Unrealized loss on change in fair value of investment Temporary differences as at the beginning of the year 3,000 9,000 60,000 45,000 54,000 12,000 18,000 Income tax rate 30%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning