SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN: 9780357391266

Author: Nellen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

needful solution wanted

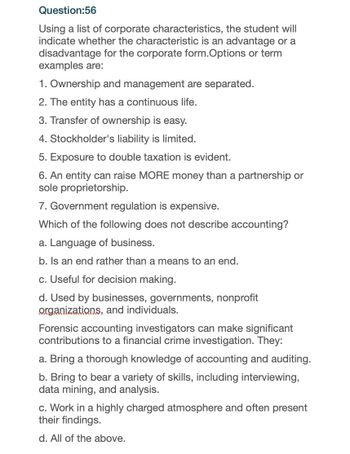

Transcribed Image Text:Question:56

Using a list of corporate characteristics, the student will

indicate whether the characteristic is an advantage or a

disadvantage for the corporate form. Options or term

examples are:

1. Ownership and management are separated.

2. The entity has a continuous life.

3. Transfer of ownership is easy.

4. Stockholder's liability is limited.

5. Exposure to double taxation is evident.

6. An entity can raise MORE money than a partnership or

sole proprietorship.

7. Government regulation is expensive.

Which of the following does not describe accounting?

a. Language of business.

b. Is an end rather than a means to an end.

c. Useful for decision making.

d. Used by businesses, governments, nonprofit

organizations, and individuals.

Forensic accounting investigators can make significant

contributions to a financial crime investigation. They:

a. Bring a thorough knowledge of accounting and auditing.

b. Bring to bear a variety of skills, including interviewing,

data mining, and analysis.

c. Work in a highly charged atmosphere and often present

their findings.

d. All of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- givel correct answeer for allarrow_forwardsolve all multiple questionsarrow_forwardMatch each corporate characteristic 1 through 8 with the description that best relates to it. Characteristic Descriptions 1. Transferability of ownership 2. Ability to raise large capital amounts 3. Duration of life 4. Legal status Entity with similar rights as individual 5. Ease of formation High because buying stock is attractive 6. Government regulation Indefinite 7. Mutual agency More severe than partnerships and proprietorships 8. Owner authority and control TT TT Oarrow_forward

- 2. Limited liability is an important feature of: A. CorporationsB. Both partnerships and corporationsC. Sole proprietorshipsD. Partnerships 4. The ultimate financial goal of a corporation is to: A. maximize the value of the corporation to the stockholders.B. increase size of the firm.C. minimize stockholder risk.D. maximize profit. 7. Shareholders of a corporation may be, among others, A. pension funds.B. individuals, pension funds, and insurance companies.C. individuals and pension funds.D. individuals.arrow_forwardplz helparrow_forwardB1.arrow_forward

- Next to each corporate characteristic 1 through 8, enter the letter of the description that best relates to it. 1. Owner authority and control 2. Ease of formation 3. Transferability of ownership 4. Ability to raise large capital amounts 5. Duration of life 6. Owner liability 7. Legal status 8. Tax status of income a. Requires government approval b. Corporate income is taxed c. Separate legal entity d. Readily transferred e. One vote per share f. High ability g. Unlimited h. Limitedarrow_forwardThe ability of any stockholder to transfer stock to another person without the knowledge or the consent of the other stockholders and without disturbing the normal activities of the corporation is called a. unlimited life. b. suitability for large scale operations. c. taxation of corporate earnings. d. transferable ownership units.arrow_forwardIdentify the advantages of forming a business as an S Corporation. Multiple Choice O owners avoid double taxation and owners have limited liability treated as a separate legal entity and owners avoid double taxation owners have limited liability and corporation's earnings are tax free owner is personally responsible for debts of the business and earnings are reported directlarrow_forward

- question attached thanks for the help great greatly appreciated!arrow_forwardWhich of the following characteristics of a corporation limits a stockholder's loss to the amount of his or her investment in the stock of the corporation? Question 7Answer a. Separate legal entity b. Separation of ownership and management c. Transferability of ownership d. Limited liabilityarrow_forwardwithdrawals. Pre-Assessment 1. Give at least 10 sole proprietorship establishment you are familiar with. Forms of Business Organization 1. Sole Proprietorship is a business organization owned by one person. It is owner of the sole proprietorship is the pronrietor In mort caror tho pronearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you