SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Provide Value For Blank of Question

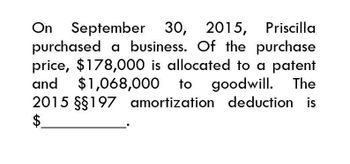

Transcribed Image Text:On September 30, 2015, Priscilla

purchased a business. Of the purchase

price, $178,000 is allocated to a patent

and $1,068,000 to goodwill. The

2015 §§197 amortization deduction is

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardOn September 30, 2015, Priscilla purchased a business. Of the purchase price, $178,000 is allocated to a patent and $1,068,000 to goodwill. The 2015 § 197 amortization deduction is $__________.(Account)arrow_forwardLO.7 On October 1, 2019, Priscilla purchased a business. Of the purchase price, 60,000 is allocated to a patent and 375,000 is allocated to goodwill. Calculate Priscillas 2019 197 amortization deduction.arrow_forward

- On May 1, 2015, Zoe Inc. purchased Branta Corp. for $15,000,000 in cash. They only received $12,000,000 in net assets. In 2016, the market value of the goodwill obtained from Branta Corp. was valued at $4,000,000, but in 2017 it dropped to $2,000,000. Prepare the journal entry for the creation of goodwill and the entry to record any impairments to it in subsequent years.arrow_forwardOn January 1, 2015, Moose Co. purchased for $360,000 a patent that had been granted two years earlier. On January 1, 2017, legal costs of $64,000 were incurred in a successful defense of the patent. Assuming the maximum period allowable is used for patent amortization, what is Moose's patent amortization expense for 2017? $21,555 $20,000 $18,000 $24,000arrow_forwardTroy Aikman Corporation purchased a patent from Salmon Company on Jaunary 1, 2017, for $54,000. The patent has a remaining legal life of 16 years Troy Aikman feels the patent will be useful for 10 years. Prepare Troy Aikmans Journal entry to record the amortization of the patent in 2017 O Patent Expense $5.400 Cash $5.400 O Patent Expense $5 400 Patent $5.400 O Patent $5,400 Patent Expense $5,400 O None of the Abovearrow_forward

- Megha Nhon Corp., a vat registered taxpayer made the following acquisition of equipment from vat registered suppliers (net of vat) during 2021 and 2022: Date Purchase price Useful life (yrs) Oct. 1, 2021 2,000,000 6 Apr. 1, 2022 2,500,000 2 The equipment acquired on Oct. 2021 was sold on Apr. 2022. How much is the creditable input vat on Apr. 2022? P216,000 P324,000 P516,000 P300,000arrow_forwardOriole Industries purchased Pharoah, Inc. on June 30, 2014 and recorded goodwill of $68, 200 on this purchase. The goodwill has an indefinite life. How much is goodwill amortization expense for 2014? Goodwill amortization expense for 2014arrow_forwardRich corporation purchasesd a limited solve this general accounting questionarrow_forward

- Assume that Timberline Corporation has 2022 taxable income of $246,000 for purposes of computing the §179 expense. It acquired the following assets in 2022: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Asset Purchase Date Basis Furniture (7-year) December 1 $ 432,000 Computer equipment (5-year) February 28 96,000 Copier (5-year) July 15 36,000 Machinery (7-year) May 22 486,000 Total $ 1,050,000 What would Timberline's maximum depreciation deduction be for 2022 assuming no bonus depreciation?arrow_forwardAssume that Timberline Corporation has 2022 taxable income of $246,000 for purposes of computing the §179 expense. It acquired the following assets in 2022: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Asset Purchase Date Basis Furniture (7-year) December 1 $ 432,000 Computer equipment (5-year) February 28 96,000 Copier (5-year) July 15 36,000 Machinery (7-year) May 22 486,000 Total $ 1,050,000 What would Timberline's maximum depreciation deduction be for 2022 if the machinery cost $3,560,000 instead of $486,000 and assuming no bonus depreciation?arrow_forwardIf Ivanhoe paid $20,000 to a real estate broker on January 1, 2025, as a fee for finding the lessor, what is the initial measuremen of the right-of-use asset? (Round answers to O decimal places, e.g. 5,275.) Right-of-use asset $ 94178arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning