Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Need solution this question general accounting

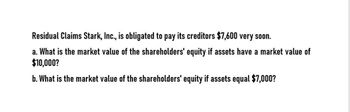

Transcribed Image Text:Residual Claims Stark, Inc., is obligated to pay its creditors $7,600 very soon.

a. What is the market value of the shareholders' equity if assets have a market value of

$10,000?

b. What is the market value of the shareholders' equity if assets equal $7,000?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Presuming the company sells for $100,000,000.00 but also has $10,000,000.00 of debt on the balance sheet, what will the owners receive in proceeds?arrow_forwardEdwards Construction currently has debt outstanding with a market value of $155,000 and a cost of 10 percent. The company has EBIT of $15,500 that is expected to continue in perpetuity. Assume there are no taxes. a-1. What is the value of the company's equity? (Do not round intermediate calculations. Leave no cell blank - be certain to enter "0" wherever required.) a- What is the debt-to-value ratio? (Do not round intermediate calculations and round 2. your answer to the nearest whole number, e.g., 32.) b. What are the equity value and debt-to-value ratio if the company's growth rate is 5 percent? (Do not round intermediate calculations and round your "Debt-to- value" answer to 3 decimal places, e.g., 32.161.) c. What are the equity value and debt-to-value ratio if the company's growth rate is 7 percent? (Do not round intermediate calculations and round your "Debt-to- value" answer to 3 decimal places, e.g., 32.161.)arrow_forwardAssume that XYZ Company has a loan agreement that states that it must maintain a fixed-charge coverage ratio greater than or equal to 1.0 They have net income of $75, noncash charges of $25, current loan maturities of $60, stock repurchases of $10, and replacement capital expenditures of $20. Which of the following statements is true? 1) Multiple choice question. - Their fixed-coverage ratio is 1.1. - Their fixed-coverage ratio is 2.0. - They have violated their affirmative covenant since their fixed-coverage charge is less than 1.0. -They can pay a dividend of no more than $20 to remain within the covenant. 2) The net worth safety margin can be calculated as the difference between a firm's Multiple choice question. - actual minimum net worth and covenant minimum net worth. - actual maximum net worth and covenant maximum net worth. - covenant minimum net worth and covenant maximum net worth. - actual minimum net worth and actual maximum net worth. 3) Which of the following are true of…arrow_forward

- Edwards Construction currently has debt outstanding with a market value of $104,000 and a cost of 12 percent. The company has EBIT of $12,480 that is expected to continue in perpetuity. Assume there are no taxes. a-1. What is the value of the company's equity? (Do not round intermediate calculations. Leave no cell blank - be certain to enter "O" wherever required.) a- What is the debt-to-value ratio? (Do not round intermediate calculations and round 2. your answer to the nearest whole number, e.g., 32.) b. What are the equity value and debt-to-value ratio if the company's growth rate is 6 percent? (Do not round intermediate calculations and round your "Debt-to- value" answer to 3 decimal places, e.g., 32.161.) c. What are the equity value and debt-to-value ratio if the company's growth rate is 10 percent? (Do not round intermediate calculations and round your "Debt-to- value" answer to 3 decimal places, e.g., 32.161.) Answer is complete but not entirely correct. a-1. Value of equity…arrow_forwardThomas Company issues spok to new investors. $32.000. Required: What is the effect of this transaction on individual asset accounts, individual liability accounts, the Capital Stock account, and the Retained Earnings account? Check all that apply. Aa asset account ineases An aset ccou decases Alabilay account increases O A lahlity account decreases. Capital Stok increases. O Capital Sock decreases. Retained Earminggs increase ORetained Eamings decrease. Clear Undo Help Neat I dont knowarrow_forwardEdwards Construction currently has debt outstanding with a market value of $104,000 and a cost of 12 percent. The company has EBIT of $12,480 that is expected to continue in perpetuity. Assume there are no taxes. a-1. What is the value of the company's equity? (Do not round intermediate calculations. Leave no cell blank - be certain to enter "0" wherever required.) a- What is the debt-to-value ratio? (Do not round intermediate calculations and round 2. your answer to the nearest whole number, e.g., 32.) b. What are the equity value and debt-to-value ratio if the company's growth rate is 6 percent? (Do not round intermediate calculations and round your "Debt-to- value" answer to 3 decimal places, e.g., 32.161.) c. What are the equity value and debt-to-value ratio if the company's growth rate is 10 percent? (Do not round intermediate calculations and round your "Debt-to- value" answer to 3 decimal places, e.g., 32.161.) Answer is complete but not entirely correct. a-1. Value of equity…arrow_forward

- Edwards Construction currently has debt outstanding with a market value of $116,000 and a cost of 12 percent. The company has EBIT of $13,920 that is expected to continue in perpetuity. Assume there are no taxes. a-1. What is the value of the company's equity? (Do not round intermediate calculations. Leave no cell blank - be certain to enter "0" wherever required.) a- What is the debt-to-value ratio? (Do not round intermediate calculations and round 2. your answer to the nearest whole number, e.g., 32.) b. What are the equity value and debt-to-value ratio if the company's growth rate is 5 percent? (Do not round intermediate calculations and round your "Debt-to- value" answer to 3 decimal places, e.g., 32.161.) c. What are the equity value and debt-to-value ratio if the company's growth rate is 8 percent? (Do not round intermediate calculations and round your "Debt-to- value" answer to 3 decimal places, e.g., 32.161.) Answer is complete but not entirely correct. a-1. Value of equity…arrow_forwardI want to correct answer general accountingarrow_forwardSouthwestern Wear Inc. has the following balance sheet: The trustees costs total 281,250, and the firm has no accrued taxes or wages. The debentures are subordinated only to the notes payable. If the firm goes bankrupt and liquidates, how much will each class of investors receive if a total of 2.5 million is received from sale of the assets?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning