Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

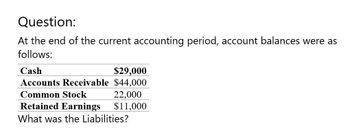

What was the Liabilities?

Transcribed Image Text:Question:

At the end of the current accounting period, account balances were as

follows:

Cash

$29,000

Accounts Receivable $44,000

Common Stock

22,000

Retained Earnings

$11,000

What was the Liabilities?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- (c) What is the balance of accounts receivable on it December 31 balance sheet? Estimating Uncollectible Accounts and Reporting Accounts ReceivableLaFond Company analyzes its accounts receivable at December 31, and arrives at the age categories below along with the percentages that are estimated as uncollectible. Age Group Accounts Receivable Estimated Loss % 0-30 days past due $ 180,000 1% 31-60 days past due 40,000 2 61-120 days past due 22,000 5 121-180 12,000 10 Over 180 days past due 8,000 25 Total accounts receivable $ 262,000arrow_forwardWhat is the net realizable value of accounts receivable at the end of year, given the following information:Balance in Accounts Receivable at end of year, $104,000Balance in Allowance for Doubtful Accounts, beginning of year, $2,000 debitWrite-offs during year, $5,000Bad debt expense for year, $9,000Recoveries during year of accounts previously written-off, $2,000arrow_forwardItem Prior year Current year Accounts payable 8,112.00 7,889.00 Accounts receivable 6,029.00 6,526.00 Accruals 981.00 1,445.00 Cash ??? ??? Common Stock 10,050.00 11,831.00 COGS 12,659.00 18,136.00 Current portion long-term 5,054.00 5,053.00 debt Depreciation expense 2,500 2,814.00 Interest expense 733 417 Inventories 4,101.00 4,816.00 Long-term debt 14,355.00 13,032.00 Net fixed assets 51,776.00 54,131.00 Notes payable 4,395.00 9,850.00 Operating expenses (excl. 13,977 depr.) 18,172 Retained earnings 28,273.00 29,816.00 Sales 47,524 Taxes 2,084 2,775 What is the firm's cash flow from operations? Submit Answer format: Number: Round to: 0 decimal places.arrow_forward

- Item Prior year Current year Accounts payable 8,198.00 7,775.00 Accounts receivable 6,030.00 6,768.00 Accruals 1,007.00 1,602.00 Cash ??? ??? Common Stock 10,168.00 12,293.00 COGS 12,621.00 18,231.00 Current portion long-term 4,953.00 5,046.00 debt Depreciation expense 2,500 2,756.00 Interest expense 733 417 Inventories 4,136.00 4,819.00 Long-term debt 14,434.00 13,704.00 Net fixed assets 50,920.00 54,636.00 Notes payable 4,385.00 9,940.00 Operating expenses (excl. depr.) 13,977 18,172 Retained earnings 28,358.00 30,071.00 Sales 35,119 47,773.00 Тахes 2,084 2,775 What is the firm's total change in cash from the prior year to the current year? Submit Answer format: Number: Round to: 0 decimal places.arrow_forwardWhat was the percentage change in accounts receivable on these general accounting question?arrow_forwardBrickman’s ending balance of Accounts Receivable is $19,500. Use the data in the preceding question to compute the net realizable value of Accounts Receivable at year-end. $16,800 $19,500 $17,400 $17,900arrow_forward

- Category Prior Year Current Year Accounts payable ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 431,516.41 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 55,946.66 Interest expense 40,500 41,874.31 Inventories 279,000 288,000 Long-term debt 336,467.85 401,942.46 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 161,499.58 Retained earnings 306,000 342,000 Sales 639,000 854,554.01 Taxes 24,750 48,384.56 ??? What is the current year's return on equity (ROE)? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign re rounded to 4 decimal places (ex: 0.0924))arrow_forwardWhat is its accounts receivable turnover for the period on this general accounting question?arrow_forwardCash and accounts receivable for Adams Company are as follows: Current Year Prior Year Cash $88,172 $65,800 Accounts receivable (net) 32,424 57,900 What are the amounts and percentages of increase or decrease that would be shown with horizontal analysis? Account Dollar Change Percent Change Cash $fill in the blank 1 fill in the blank 2 % Accounts Receivable $fill in the blank 4 fill in the blank 5 %arrow_forward

- Category Prior Year Current Year Accounts payable ??? ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 431,139.00 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 54,349.00 Interest expense 40,500 41,741.00 Inventories 279,000 288,000 Long-term debt 337,728.00 398,725.00 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 162,280.00 Retained earnings 306,000 342,000 Sales 639,000 847,106.00 Taxes 24,750 48,618.00 What is the current year's return on assets (ROA)? (Round to 4 decimal places.)arrow_forwardCategory Prior Year Current Year Accounts payable ??? ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 428,571.00 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 54,035.00 Interest expense 40,500 42,155.00 Inventories 279,000 288,000 Long-term debt 339,577.00 401,377.00 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 162,171.00 Retained earnings 306,000 342,000 Sales 639,000 849,094.00 Taxes 24,750 47,192.00 What is the current year's entry for long-term debt on a common-sized balance sheet? (ROUND TO 4 DECIMAL PLACES.)arrow_forwardItem Prior year Current year Accounts payable 8,109.00 7,758.00 Accounts receivable 6,059.00 6,782.00 Accruals 1,036.00 1,609.00 Cash ??? ??? Common Stock 11,891.00 11,189.00 COGS 12,683.00 18,018.00 Current portion long-term debt 4,980.00 4,993.00 Depreciation expense 2,500 2,813.00 Interest expense 733 417 Inventories 4,192.00 4,777.00 Long-term debt 13,329.00 13,523.00 Net fixed assets 50,636.00 54,376.00 Notes payable 4,329.00 9,999.00 Operating expenses (excl. depr.) 13,977 18,172 Retained earnings 28,278.00 29,801.00 Sales 35,119 47,221.00 Taxes 2,084 2,775 What is the firm's total change in cash from the prior year to the current year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning