FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

General finance

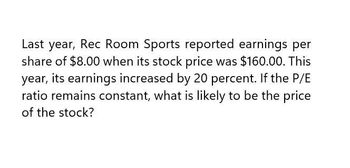

Transcribed Image Text:Last year, Rec Room Sports reported earnings per

share of $8.00 when its stock price was $160.00. This

year, its earnings increased by 20 percent. If the P/E

ratio remains constant, what is likely to be the price

of the stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Last year, Rec Room Sports reported earnings per share of $7.80 when its stock price was $140.40. This year. its earnings increased by 25 percent. If the P/E ratio remains constant, what is likely to be the price of the Stock? (Round your answer to 2 declmal places.) Pice bf thssocearrow_forwardLast year, Big W Company reported earnings per share of $2.50 when its stock was selling for$50.00. If its earnings this year increase by 10 percent and the P/E ratio remains constant, whatwill be the price of its stock? Explain.arrow_forwardLast year, Big W Company reported earnings per share of $3.50 when its stock was selling for $87.50. If its earnings this year increase by 10 percent and the P/E ratio remains constant, what will be the price of its stock? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Stock Pricearrow_forward

- What is the premium for growth on the stock on these financial accounting question?arrow_forwardWhat is the expected price of this stock one year from now on these financial accounting question?arrow_forwardApple Inc. (AAPL) is expected to pay a dividend of $1.59 at the end of the year. AAPL’s dividend payout ratio and return on equity (ROE) are 41.27% and 6.86%, respectively. Other things held constant, what would AAPL’s stock price be if the required rate of return is 6.47%? A. $93.14 B. $84.97 C. $72.26 D. $65.13arrow_forward

- What is the current price of the stock on these financial accounting question?arrow_forwardFester Industries’ common stock is currently selling for $30.00 per share. Next year’s dividend (D1) is expected to be $1.26. If the required return on Fester’s common stock is 9.20%, what was the most recent dividend that Fester paid (D0)?arrow_forwardFinancial analysts forecast Safeco Corp's (SAF) growth rate for the future to be 8 percent. Safeco's recent dividend was $1.85. What is the value of Safeco stock when the required return is 10 percent? (Round your answer to 2 decimal places.) Value of stockarrow_forward

- A stock is selling today for $75 per share. At the end of the year, it pays a dividend of $6 per share and sells for $87. A. What is the total rate of return on the stock? B. What are the dividend yield and percentage capital gain? C. Now suppose the year-end stock price after the dividend is paid is $72. What are the dividend yield and percentage capital gain in this case?arrow_forwardALPHO Inc. has paid annual dividends of $1.25 and $1.62, over the past two years. Dividends in the future are expected to be $2.00 and $2.45 over the next two years, then grow at a constant rate of 4%. Which one of the following formulas should be used to compute the value of the stock today? P0= D1/(1+k)1+ D2/(1+k)2 + ... + Dn/(1+k)n + Pn/(1+k)n P0= D/k P0= D1/(1+k)n+ g P0= D1/(k-g)arrow_forwardRise Above This Corp. currently has an EPS of $3.47 and the benchmark PE for the company is 19. Earnings are expected to grow at 6 percent per year. What is your estimate of the current stock price? What is the target stock price in one year? Assuming the company pays no dividends, what is the implied return on the company’s stock over the next year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education