EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

I want to correct answer general accounting

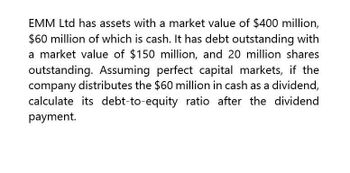

Transcribed Image Text:EMM Ltd has assets with a market value of $400 million,

$60 million of which is cash. It has debt outstanding with

a market value of $150 million, and 20 million shares

outstanding. Assuming perfect capital markets, if the

company distributes the $60 million in cash as a dividend,

calculate its debt-to-equity ratio after the dividend

payment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume Lavender Corporation has a market value of $4 billion of equity and a market value of $19.8 billion of debt. What are the weights in equity and debt that are used for calculating the WACC?arrow_forwardAlpha Corporation has average annual free cashflows to the equity holder and to the firmof P3,000,000 and P3,350,000 respectively. Assuming that the weighted average cost ofcapital and actual return of on assets is 16.75% while the market return on Alpha's debt is7%, what is the value of its equity? a. P34,358,974.36 b.P15,000,000.00 c.P17,910,447.76 d.P20,000,000.00arrow_forwardThe calculation of WACC involves calculating the weighted average of the required rates of return on debt and equity, where the weights equal the percentage of each type of financing in the firm's overall capital structure. re . has $3.9 million of debt, $1 million of preferred stock, and $1.2 million of common equity. What would be its weight on preferred stock? Ip Is is the symbol that represents the before-tax cost of debt in the weighted average cost of capital (WACC) equation. rd 0.13 0.64 0.16 0.14arrow_forward

- The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm' s overall capital structure. is the symbol that represents the before-tax cost of debt in the weighted average cost of capital (WACC) equation. Mitchell Co. has $1.1 million of debt, $2 million of preferred stock, and $3.3 million of common equity. What would be its weight on preferred stock? 0.28 0.25 0.17 0.31arrow_forwardThe calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm’s overall capital structure. is the symbol that represents the before-tax cost of debt in the weighted average cost of capital (WACC) equation. Wyle Co. has $1.4 million of debt, $2.5 million of preferred stock, and $3.3 million of common equity. What would be its weight on debt? 0.28 0.32 0.19 0.46arrow_forwardThe calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm's overall capital structure. is the symbol that represents the cost of preferred stock in the weighted average cost of capital (WACC) equation. Wyle Co. has $2.7 million of debt, $2.5 million of preferred stock, and $2.1 million of common equity. What would be its weight on common equity? 0.34 O 0.37 O 0.31 O 0.29arrow_forward

- The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm's overall capital structure. is the symbol that represents the cost of raising capital through retained earnings in the weighted average cost of capital (WACC) equation. Bryant Co. has $2.7 million of debt, $1 million of preferred stock, and $1.2 million of common equity. What would be its weight on debt? O 0.55 0.18 O 0.22 0.20arrow_forwardThe calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm's overall capital structure. re Is Id Ip is the symbol that represents the cost of raising capital through retained earnings in the weighted average cost of capital (WACC) equation. Co. has $2.7 million of debt, $3 million of preferred stock, and $1.2 million of common equity. What would be its weight on debt? 0.34 0.17 0.47 O 0.39arrow_forwardThe calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm’s overall capital structure. (rs, rd, rp, re) is the symbol that represents the cost of raising capital by issuing new stock in the weighted average cost of capital (WACC) equation. Avery Co. has $2.7 million of debt, $1.5 million of preferred stock, and $2.2 million of common equity. What would be its weight on preferred stock? 0.23 0.21 0.42 0.18arrow_forward

- The calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm's overall capital structure. is the symbol that represents the cost of raising capital through retained earnings in the weighted average cost of capital (WACC) equation. Raymond Co. has $1.1 million of debt, $1.5 million of preferred stock, and $1.2 million of common equity. What would be its weight on preferred stock? O 0.31 O 0.43 O 0.32 O 0.39arrow_forwardBiotec has estimated the costs of debt and equity capital for various proportions of debt in its capital structure: % of Debt Cost of Debt (%) Cost of Equity (%) 35 5.4 13.8 40 5.6 14.0 45 5.9 14.3 50 6.4 14.7 If Biotec pays a current dividend of $1.00 and expects dividends to grow at a constant rate of 7%, what is Biotec's stock price if it obtains its optimal capital structure?arrow_forwardThe calculation of WACC involves calculating the weighted average of the required rates of return on debt, preferred stock, and common equity, where the weights equal the percentage of each type of financing in the firm’s overall capital structure. Q1. ________is the symbol that represents the cost of preferred stock in the weighted average cost of capital (WACC) equation. Q2. Avery Co. has $3.9 million of debt, $2 million of preferred stock, and $2.2 million of common equity. What would be its weight on debt? a. 0.27 b. 0.25 c. 0.48 d. 0.20 Q1. Option 1 rS or Option 2 rD or Option 3 rP or Option 4 rE Please provide the correct answers. Thank you!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT