Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

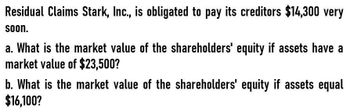

Residual claims stark, inc. is obligated to pay its creditors 14300 very soon

Transcribed Image Text:Residual Claims Stark, Inc., is obligated to pay its creditors $14,300 very

soon.

a. What is the market value of the shareholders' equity if assets have a

market value of $23,500?

b. What is the market value of the shareholders' equity if assets equal

$16,100?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardNeed help with this accounting questionsarrow_forwardDirections: Click the Case Link above and use the information provided in Revolutionary Designs, Inc., Part B, to answer this question: What is the impact on Revolutionary Design's adjusted debt ratio (total liabilities less subordinated debt) to adjusted tangible net worth (tangible net worth plus subordinated debt) if we assume that the owner debt will no longer be subordinated in 20Y3? Adjusted debt to adjusted tangible net worth will increase from approximately 2.7 to approximately 3.8 in 2013. Adjusted debt to adjusted tangible net worth will improve from approximately 3.5 to approximately 2.6 in 20Y3. Adjusted debt to adjusted tangible net worth will increase from approximately 3.5 to approximately 3.8 in 20Y3. Bookmark for reviewarrow_forward

- What asset turnover ratio is necessary to achieve an ROE of 18% ?? General accountingarrow_forward2. If XYZ Company Acid-test ratio is computed as 1.7. Which statement interprets the acid-test ratio of XYZ company a. For every dollar of XYZ Company's current liabilities, the company has $1.70 of very liquid assets to cover its immediate obligations b. For every dollar of XYZ Company's current asset, the company has $1.70 of very liquid assets to cover its immediate obligations c. For every dollar of XYZ Company's total asset, the company has $1.70 of very liquid assets to cover its immediate obligations d. For every dollar of XYZ Company's total liabilities, the company has $1.70 of very liquid assets to cover its immediate obligationsarrow_forwardListed below are the current liability section and Note 7 of the Year 7 balance sheet of Joli Roma Corporation (the Company), a major oil company. $ millions Year 7 Year 6 Current Liabilities Current portion of long-term obligations Short-term obligations Accounts payable Accrued liabilities Taxes payable (including income taxes) $175 $89 691 530 2,996 3,196 1,046 1,099 1,289 997 $6,197 $5,911 Note 7 Short-Term Obligations The Company's "short-term obligations" consist of notes payable and commercial paper. Notes payable as of December 31, Year 7, totaled $102 million at an average annual interest rate of 5.7%, compared with $29 million at an average annual interest rate of 5.7% at year-end Year 6. Commercial paper borrowings at December 31, Year 7, were $839 million at an average annual interest rate of 5.7% compared with $260 million at an average annual interest rate of 5.9% as of December 31, Year 6. Bank lines of credit available to support existing commercial paper borrowings of…arrow_forward

- Use the following information from separate companies a through d: Net Income (Loss) Interest Expense Income Taxes a. $ 111, 000 $ 59, 940 $ 27, 750 b. 105, 600 25, 344 38,016 c. 94, 350 25, 475 39, 627 d . 114, 100 4,564 54,768 Compute times interest earned. Which company indicates the strongest ability to pay interest expense as it comes due?arrow_forwardAssume that XYZ Company has a loan agreement that states that it must maintain a fixed-charge coverage ratio greater than or equal to 1.0 They have net income of $75, noncash charges of $25, current loan maturities of $60, stock repurchases of $10, and replacement capital expenditures of $20. Which of the following statements is true? 1) Multiple choice question. - Their fixed-coverage ratio is 1.1. - Their fixed-coverage ratio is 2.0. - They have violated their affirmative covenant since their fixed-coverage charge is less than 1.0. -They can pay a dividend of no more than $20 to remain within the covenant. 2) The net worth safety margin can be calculated as the difference between a firm's Multiple choice question. - actual minimum net worth and covenant minimum net worth. - actual maximum net worth and covenant maximum net worth. - covenant minimum net worth and covenant maximum net worth. - actual minimum net worth and actual maximum net worth. 3) Which of the following are true of…arrow_forwardAssume you are given the following relationships for the Haslam Corporation: Sales/total assets 1.7 Return on assets (ROA) 4% Return on equity (ROE) 6% Calculate Haslam's profit margin and liabilities-to-assets ratio. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: % Liabilities-to-assets ratio: % Suppose half of its liabilities are in the form of debt. Calculate the debt-to-assets ratio. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT