Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

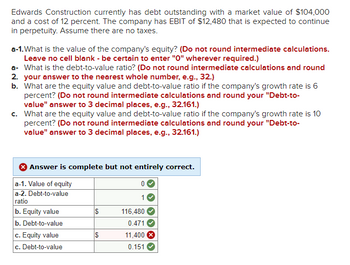

Transcribed Image Text:Edwards Construction currently has debt outstanding with a market value of $104,000

and a cost of 12 percent. The company has EBIT of $12,480 that is expected to continue

in perpetuity. Assume there are no taxes.

a-1. What is the value of the company's equity? (Do not round intermediate calculations.

Leave no cell blank - be certain to enter "O" wherever required.)

a- What is the debt-to-value ratio? (Do not round intermediate calculations and round

2. your answer to the nearest whole number, e.g., 32.)

b. What are the equity value and debt-to-value ratio if the company's growth rate is 6

percent? (Do not round intermediate calculations and round your "Debt-to-

value" answer to 3 decimal places, e.g., 32.161.)

c. What are the equity value and debt-to-value ratio if the company's growth rate is 10

percent? (Do not round intermediate calculations and round your "Debt-to-

value" answer to 3 decimal places, e.g., 32.161.)

Answer is complete but not entirely correct.

a-1. Value of equity

a-2. Debt-to-value

ratio

0

1

b. Equity value

116,480

b. Debt-to-value

c. Equity value

c. Debt-to-value

0.471

$

11,400 x

0.151

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Calculate the aftertax cost of debt under each of the following conditions. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) a b с Yield 8.5% 14.5% 12.0% Corporate tax rate 23% 37% 43% Cost of debt % % %arrow_forwardClayton Industries has the following account balances: Current assets Noncurrent assets $ 22,000 Current liabilities 74,000 Noncurrent liabilities Stockholders' equity $ 9,000 51,000 36,000 The company wishes to raise $35,000 in cash and is considering two financing options: Clayton can sell $35,000 of bonds payable, or it can issue additional common stock for $35,000. To help in the decision process, Clayton's management wants to determine the effects of each alternative on its current ratio and debt-to-assets ratio. Required a-1. Compute the current ratio for Clayton's management. Note: Round your answers to 2 decimal places. Currently If bonds are issued If stock is issued Current Ratio to 1 to 1 to 1 a-2. Compute the debt-to-assets ratio for Clayton's management. Note: Round your answers to 1 decimal place. Currently If bonds are issued If stock is issued Debt to Assets Ratio % % % b. Assume that after the funds are invested, EBIT amounts to $14,900. Also assume the company pays…arrow_forwardOnce Bitten Corp. uses no debt. The weighted average cost of capital is 9 percent. If the company's EBIT is $1,980,000 in perpetuity and there are no taxes, what is the company worth? (Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, e.g. 1,234,567.) Note: For simplicity, in this chapter we typically assume that net capital spending equals depreciation, and net working capital remains constant. This means that EBIT (net of any taxes) will equal CFFA. Company's Value %24arrow_forward

- Edwards Construction currently has debt outstanding with a market value of $155,000 and a cost of 10 percent. The company has EBIT of $15,500 that is expected to continue in perpetuity. Assume there are no taxes. a-1. What is the value of the company's equity? (Do not round intermediate calculations. Leave no cell blank - be certain to enter "0" wherever required.) a- What is the debt-to-value ratio? (Do not round intermediate calculations and round 2. your answer to the nearest whole number, e.g., 32.) b. What are the equity value and debt-to-value ratio if the company's growth rate is 5 percent? (Do not round intermediate calculations and round your "Debt-to- value" answer to 3 decimal places, e.g., 32.161.) c. What are the equity value and debt-to-value ratio if the company's growth rate is 7 percent? (Do not round intermediate calculations and round your "Debt-to- value" answer to 3 decimal places, e.g., 32.161.)arrow_forwardDon't give solution in image format..arrow_forward(5 points) Which of the following is true of the straight-line method for amortizing premiums and discounts on long-term debt? (LE 3) O The method can be used by any company for any debt. O The journal entries are the same for every payment. O The method is preferred by FASB. O The premium or discount amortized away is the plug figure in the journal entry. EEarrow_forward

- The Supple Hardware Company has $2,000,000 in current assets and $600,000 in current liabilities. Its initial inventory level is $450,000, and it will raise funds as additional short-term notes payable and use them to increase inventory. How much can Supple's current liabilities (notes payable) increase without violating a contractual agreement (the debt covenant) with its bondholders that requires a minimum current ratio of 2 to 1? Compute the dollar value of 1) inventory, 2) total current assets, and 3) total current liabilities after the maximum new financing has been obtained and the funds allocated.arrow_forwardCompany X pays interest to the amount of R1 500 a year on total liabilities of R10 000. It can also issue bonds with a YTM of 12%. What will the relevant before tax cost of debt be when calculating that WACC for the company? a. 18% b. 12% c. 15% d. 8%arrow_forward! Required information [The following information applies to the questions displayed below.] Thrillville has $39.3 million in bonds payable. One of the contractual agreements in the bond is that the debt to equity ratio cannot exceed 2.0. Thrillville's total assets are $79.3 million, and its liabilities other than the bonds payable are $9.3 million. The company is considering some additional financing through leasing. Required: 1. Calculate total stockholders' equity using the balance sheet equation. (Enter your answer in millions rounded to 1 decimal place (i.e., $5,500,000 should be entered as 5.5).) Stockholders' Equity minusarrow_forward

- Hardevarrow_forwardEdwards Construction currently has debt outstanding with a market value of $116,000 and a cost of 12 percent. The company has EBIT of $13,920 that is expected to continue in perpetuity. Assume there are no taxes. a-1. What is the value of the company's equity? (Do not round intermediate calculations. Leave no cell blank - be certain to enter "0" wherever required.) a- What is the debt-to-value ratio? (Do not round intermediate calculations and round 2. your answer to the nearest whole number, e.g., 32.) b. What are the equity value and debt-to-value ratio if the company's growth rate is 5 percent? (Do not round intermediate calculations and round your "Debt-to- value" answer to 3 decimal places, e.g., 32.161.) c. What are the equity value and debt-to-value ratio if the company's growth rate is 8 percent? (Do not round intermediate calculations and round your "Debt-to- value" answer to 3 decimal places, e.g., 32.161.) Answer is complete but not entirely correct. a-1. Value of equity…arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education