Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Please need answer

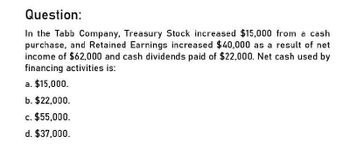

Transcribed Image Text:Question:

In the Tabb Company, Treasury Stock increased $15,000 from a cash

purchase, and Retained Earnings increased $40,000 as a result of net

income of $62,000 and cash dividends paid of $22,000. Net cash used by

financing activities is:

a. $15,000.

b. $22,000.

c. $55,000.

d. $37,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Statement of Cash Flows The following are Mueller Companys cash flow activities: a. Net income, 68,000 b. Increase in accounts receivable, 4,400 c. Receipt from sale of common stock, 12,300 d. Depreciation expense, 11,300 e. Dividends paid, 24,500 f. Payment for purchase of building, 65,000 g. Bond discount amortization, 2,700 h. Receipt from sale of long-term investments at cost, 10,600 i. Payment for purchase of equipment, 8,000 j. Receipt from sale of preferred stock, 20,000 k. Increase in income taxes payable, 3,500 l. Payment for purchase of land, 9,700 m. Decrease in accounts payable, 2,900 n. Increase in inventories, 10,300 o. Beginning cash balance, 18,000 Required: Prepare Mueller Company's statement of cash flows.arrow_forwardChasse Building Supply Inc. reported net cash provided by operating activities of $243,000, capital expenditures of $112,900, cash dividends of $35,800, and average maturities of long-term debt over the next 5 years of $122,300. What is Chasses free cash flow and cash flow adequacy ratio? a. $94,300 and 0.77, respectively c. $130,100 and 1.06, respectively b. $94,300 and 0.82, respectively d. $165,900 and 1.36, respectivelyarrow_forwardStatement of cash flowsdirect method applied to PR 13-1A The comparative balance sheet of Livers Inc. for December 31, 20Y3 and 20Y2, is as follows: Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: A. The investments were sold for 175,000 cash. B. Equipment and land were acquired for cash. C. There were no disposals of equipment during the year. D. The common stock was issued for cash. E. There was a 90,000 debit to Retained Earnings for cash dividends declared. Instructions Prepare a statement of cash flows, using the direct method of presenting cash flows from operating activities.arrow_forward

- Effect of transactions on cash flows State the effect (cash receipt or cash payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired 500,000 of bonds, on which there was 4,000 of unamortized discount, for 510,000. b. Sold 20,000 shares of 5 par common stock for 30 per share. c. Sold equipment with a book value of 68,900 for 72,400. d. Purchased land for 825,000 cash. e. Purchased a building by paying 30,000 cash and issuing a 570,000 mortgage note payable. f. Sold a new issue of 400,000 of bonds at 98. g. Purchased 10,000 shares of 10 par common stock as treasury stock at 22.50 per share. h. Paid dividends of 1.25 per share. There were 1,000,000 shares issued and 180,000 shares of treasury stock.arrow_forwardQuestion: In the Tabb Company, Treasury Stock increased $15,000 from a cash purchase, and Retained Earnings increased $40,000 as a result of net income of $62,000 and cash dividends paid of $22,000. Net cash used by financing activities is: a. $15,000. b. $22,000. c. $55,000. d. $37,000.arrow_forwardWhat is the firm's cash flow from operations?arrow_forward

- Chapter 13 Statement of Cash Flows-Direct Method The comparative balance sheet of Canace Products Inc. for December 31, 20Y6 and 20Y5, is as follows: Dec. 31, 20Y6 Dec. 31, 20Y5 Assets Cash $287,620 $265,700 Accounts receivable (net) 104,190 95,430 Inventories 294,120 282,540 Investments 109,460 Land 150,860 Equipment 324,520 249,790 Accumulated depreciation (75,970) (67,360) Total assets $1,085,340 $935,560 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $196,450 $184,310 Accrued expenses payable (operating expenses) 19,540 24,320 Dividends payable 10,850 8,420 Common stock, $10 par 58,610 45,840 Paid-in capital: Excess of issue price over par-common stock 220,320 127,240 Retained earnings 579,570 545,430 Total liabilities and stockholders' equity $1,085,340 $935,560 The income statement for the year ended December 31, 20Y6, is as follows: Sales $1,730,890 Cost of goods sold 712,700 Gross profit $1,018,190 Operating expenses: Depreciation expense $8,610…arrow_forward.arrow_forwardThe following is an extract from the financial statements of Pompeii at 31 October: 20X7 20X6 $00 $000 Equity and liabilities: Share capital 120 80 Share premium 60 40 Retained earnings 85 68 265 188 Non-current liabilities: Bank loan 100 150 365 338 What Pompeii's net cash inflow or outflow from financing activities to include in the statement of cash flows for the year ended 31 October 20X7?arrow_forward

- Effect of Transactions on Cash Flows State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $220,000 of bonds, on which there was $2,200 of unamortized discount, for $229,000. b. Sold 12,000 shares of $15 par common stock for $23 per share. c. Sold equipment with a book value of $47,400 for $68,300. d. Purchased land for $436,000 cash. e. Purchased a building by paying $58,000 cash and issuing a $110,000 mortgage note payable. f. Sold a new issue of $240,000 of bonds at 97. g. Purchased 3,300 shares of $25 par common stock as treasury stock at $48 per share. h. Paid dividends of $2.50 per share. There were 28,000 shares issued and 4,000 shares of treasury stock. a. b. C. d. e. f. Effect Cash payment Cash receipt Cash receipt Cash payment ✓ Cash payment - ✓ Cash receipt ✔ ✓ ✓ g. Cash payment -✔ h. Cash payment Amount 229,000 ✓ 161,000 X 100000arrow_forwardEffect of Transactions on Cash Flows State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $220,000 of bonds, on which there was $2,200 of unamortized discount, for $229,000. b. Sold 7,000 shares of $15 par common stock for $30 per share. c. Sold equipment with a book value of $51,800 for $74,600. d. Purchased land for $362,000 cash. e. Purchased a building by paying $75,000 cash and issuing a $120,000 mortgage note payable. f. Sold a new issue of $150,000 of bonds at 98. g. Purchased 4,400 shares of $15 par common stock as treasury stock at $28 per share. h. Paid dividends of $1.60 per share. There were 34,000 shares issued and 5,000 shares of treasury stock. Effect Amount a. b. C. d. e. f. g. h.arrow_forwardEffect of Transactions on Cash Flows State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $300,000 of bonds, on which there was $4,000 of unamortized discount, for $303,000.b. Sold 40,000 shares of $6 par common stock for $18 per share.c. Sold equipment with a book value of $28,400 for $31,500.d. Purchased land for $290,000 cash.e. Purchased a building by paying $40,000 cash and issuing a $490,000 mortgage note payable.f. Sold a new issue of $600,000 of bonds at 98.g. Purchased 15,000 shares of $30 par common stock as treasury stock at $45 per share.h. Paid dividends of $1.50 per share. There were 800,000 shares issued and 90,000 shares of treasury stock. Effect Amount a. $ b. $ c. $ d. $ e. $ f. $ g. $ h. $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning