Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Provide answer the question

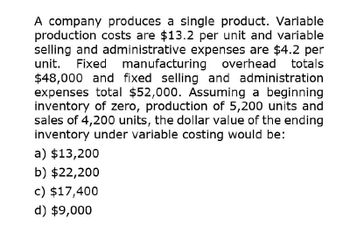

Transcribed Image Text:A company produces a single product. Variable

production costs are $13.2 per unit and variable

selling and administrative expenses are $4.2 per

unit. Fixed manufacturing overhead totals

$48,000 and fixed selling and administration

expenses total $52,000. Assuming a beginning

inventory of zero, production of 5,200 units and

sales of 4,200 units, the dollar value of the ending

inventory under variable costing would be:

a) $13,200

b) $22,200

c) $17,400

d) $9,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Total costs for ABC Distributing are $250,000 when the activity level is 10,000 units. If variable costs are $5 per unit, what are their fixed costs? $240,000 $200,000 $260,000 Their fixed costs cannot be determined from the information presented.arrow_forwardRose Company has a relevant range of production between 10,000 and 25.000 units. The following cost data represents average cost per unit for 15,000 units of production. Using the cost data from Rose Company, answer the following questions: If 10,000 units are produced, what is the variable cost per unit? If 18,000 units are produced, what is the variable cost per unit? If 21,000 units are produced, what are the total variable costs? If 11,000 units are produced, what are the total variable costs? If 19,000 units are produced, what are the total manufacturing overhead costs incurred? If 23,000 units are produced, what are the total manufacturing overhead costs incurred? If 19,000 units are produced, what are the per unit manufacturing overhead costs incurred? If 25,000 units are produced, what are the per unit manufacturing overhead costs incurred?arrow_forwardBaxter Company has a relevant range of production between 15,000 and 30,000 units. The following cost data represents average variable costs per unit for 25,000 units of production. Using the costs data from Rose Company, answer the following questions: A. If 15,000 units are produced, what is the variable cost per unit? B. If 28,000 units are produced, what is the variable cost per unit? C. If 21,000 units are produced, what are the total variable costs? D. If 29,000 units are produced, what are the total variable costs? E. If 17,000 units are produced, what are the total manufacturing overhead costs incurred? F. If 23,000 units are produced, what are the total manufacturing overhead costs incurred? G. If 30,000 units are produced, what are the per unit manufacturing overhead costs incurred? H. If 15,000 units are produced, what are the per unit manufacturing overhead costs incurred?arrow_forward

- Grand Canyon Manufacturing Inc. produces and sells a product with a price of 100 per unit. The following cost data have been prepared for its estimated upper and lower limits of activity: Overhead: Selling and administrative expenses: Required: 1. Classify each cost element as either variable, fixed, or semi-variable. (Hint: Recall that variable expenses must go up in direct proportion to changes in the volume of activity.) 2. Calculate the break-even point in units and dollars. (Hint: First use the high-low method illustrated in Chapter 4 to separate costs into their fixed and variable components.) 3. Prepare a break-even chart. 4. Prepare a contribution income statement, similar in format to the statement appearing on page 540, assuming sales of 5,000 units. 5. Recompute the break-even point in units, assuming that variable costs increase by 20% and fixed costs are reduced by 50,000.arrow_forwardThe following product Costs are available for Haworth Company on the production of chairs: direct materials, $15,500; direct labor, $22.000; manufacturing overhead, $16.500; selling expenses, $6,900; and administrative expenses, $15,200. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 7,750 equivalent units are produced, what is the equivalent material cost per unit? If 22,000 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardSuppose that a company has fixed costs of $18 per unit and variable costs $9 per unit when 15,000 units are produced. What are the fixed costs per unit when 12,000 units are produced?arrow_forward

- The following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forwardRex Industries has two products. They manufactured 12,539 units of product A and 8.254 units of product B. The data are: What is the activity rate for each cost pool?arrow_forwardCool Pool has these costs associated with production of 20,000 units of accessory products: direct materials, $70; direct labor, $110; variable manufacturing overhead, $45; total fixed manufacturing overhead, $800,000. What is the cost per unit under both the variable and absorption methods?arrow_forward

- The following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardA company had income of P50,000 using variable costing for a given period. Beginning and ending inventories for that period were 13,000 units and 18,000 units, respectively. Ignoring income taxes, if the fixed overhead application rate were P2.00 per unit, what would the income have been using absorption costing?arrow_forwardCompany A has the following documents: - Unit production cost 1,000 VND/product (including variable production cost 800 VND/product); - Sales and corporate management expenses are 500 VND/item (in which variable sales and corporate management costs are 120 VND/item); - Production level in the period is 2,000 products; Consumption during the period is 1,500 products. Total fixed costs for the period are (note that production prices are calculated based on production level, selling costs are calculated based on consumption level): a. 970.000₫ b. 870.000 d 1.060.000₫ d. 1.160.000₫arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning