EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

None

Transcribed Image Text:and

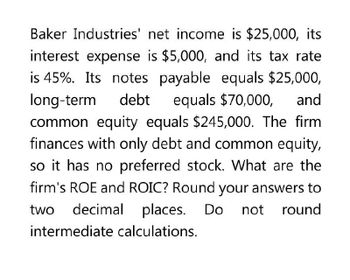

Baker Industries' net income is $25,000, its

interest expense is $5,000, and its tax rate

is 45%. Its notes payable equals $25,000,

long-term debt equals $70,000,

common equity equals $245,000. The firm

finances with only debt and common equity,

so it has no preferred stock. What are the

firm's ROE and ROIC? Round your answers to

two decimal places. Do not round

intermediate calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Need answer pleasearrow_forwardWhat is its debt to capital ratio on these financial accounting question?arrow_forwardY3K, Incorporated, has sales of $7,475, total assets of $3,525, and a debt - equity ratio of .34. Assume the return on equity is 20 percent. What is its net income? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forward

- Ladders, Inc. has a net profit margin of 5.2% on sales of $50.6 million. It has book value of equity of $38.1 million and total book liabilities of $30.9 million. What is Ladders' ROE? ROA? Note: Assume the value of Interest Expense is equal to zero. What is Ladders' ROE? Ladders' ROE is enter your response here %. (Round to two decimal places.) Part 2 What is Ladders' ROA? Ladders' ROA is enter your response here %. (Round to two decimal places.)arrow_forwardWhat is the net income?arrow_forwardNakamura, Incorporated, has a total debt ratio of .56, total debt of $316,000, and net income of $38,500. What is the company's return on equity? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Return on equity %arrow_forward

- Folic Acid Inc. has $28 million in earnings, pays $3.8 million in interest 1 bondholders, and $2.4 million in dividends to preferred stockholders. What are the common stockholders' residual claims to earnings? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places (e.g., $1.23 million should be entered as "1.23").) Residual claims to earnings millionarrow_forwardA firm has an ROE of 2%, a debt/equity ratio of 0.4, and a tax rate of 40%, and pays an interest rate of 7% on its debt. What is its operating ROA? (Do not round intermediate calculations. Round your answer to 2 decimal places.).arrow_forwardIf you give me wrong answer, I will give you unhelpful ratearrow_forward

- Portneuf Industries has a debt-equity ratio of 1.5. Its WACC is 8.4%, and its cost of debt is 5.9%. The corporate tax rate is 35%. (Do not round intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places.) a. What is the company's cost of equity capital? Cost of equity capital b. What is the company's unlevered cost of equity capital? Unlevered cost of equity capital 2.65 % c-1. What would the cost of equity be if the debt-equity ratio were 2? Cost of equity 2.65 % Cost of equity 0.73 % c-2. What would the cost of equity be if the debt-equity ratio were 1.0? Cost of equity c-3. What would the cost of equity be if the debt-equity ratio were zero? 11.5% %arrow_forwardBitters Co.'s net income is $14,000, the market value of common stock is $160,000, and the book value of common stockholders' equity is $100,000. What is the Price to Book Ratio for Bitters Co.? (Round your answer to two decimal places, X.XX.) Group of answer choices 1.60 0.14 0.63 7.14arrow_forwardY3K, Inc., has sales of $3,300, total assets of $1,520, and a debt-equity ratio of 1.35. If its return on equity is 14 percent, what is its net income? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT