Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Bolsa corporation produces high quality leather belts.

Transcribed Image Text:Question: 2.7

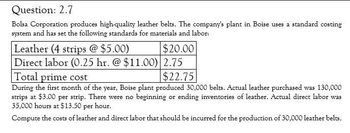

Bolsa Corporation produces high-quality leather belts. The company's plant in Boise uses a standard costing

system and has set the following standards for materials and labor:

Leather (4 strips @ $5.00)

$20.00

Direct labor (0.25 hr. @ $11.00) 2.75

Total prime cost

$22.75

During the first month of the year, Boise plant produced 30,000 belts. Actual leather purchased was 130,000

strips at $3.00 per strip. There were no beginning or ending inventories of leather. Actual direct labor was

35,000 hours at $13.50 per hour.

Compute the costs of leather and direct labor that should be incurred for the production of 30,000 leather belts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cozy, Inc., manufactures small and large blankets. It estimates $350,000 in overhead during the manufacturing of 75,000 small blankets and 25,000 large blankets. What is the predetermined overhead rate if a small blanket takes 1 machine hour and a large blanket takes 2 machine hours?arrow_forwardBox Springs. Inc., makes two sizes of box springs: queen and king. The direct material for the queen is $35 per unit and $55 is used in direct labor, while the direct material for the king is $55 per unit, and the labor cost is $70 per unit. Box Springs estimates it will make 4,300 queens and 3,000 kings in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardCaseys Kitchens makes two types of food smokers: Gas and Electric. The company expects to manufacture 20,000 units of Gas smokers, which have a per-unit direct material cost of $15 and a per-unit direct labor cost of $25. k also expects to manufacture 50,000 units of Electric smokers, which have a per-unit material cost of $20 and a per-unit direct labor cost of $45. Historically, it has used the traditional allocation method and applied overhead at a rate of $125 per machine hour. It was determined that there were three cost pools, and the overhead for each cost pool is as follows: The cost driver for each cost pool and its expected activity is as follows: A. What is the per-unit cost for each product under the traditional allocation method? B. What is the per-unit cost for each product under ABC costing? C. Compared to ABC costing, was each products overhead under- or over applied? D. How much was overhead under- or over applied for each product?arrow_forward

- Tri-bikes manufactures two different levels of bicycles: the Standard and the Extreme. The total overhead of $300,000 has traditionally been allocated by direct labor hours, with 150.000 hours for the Standard and 50,000 hours for the Extreme. After analyzing and assigning costs to two cost pools, it was determined that machine hours is estimated to have $200,000 of overhead, with 4,000 hours used on the Standard product and 1,000 hours used on the Extreme product. k was also estimated that the setup cost pool would have $100000 of overhead, with 1,000 hours for the Standard and 1,500 hours for the Extreme. What is the overhead rate per product, under traditional and under ABC costing?arrow_forwardCozy, Inc., manufactures small and large blankets. It estimates $950,000 in overhead during the manufacturing of 360,000 small blankets and 120,000 large blankets. What is the predetermined overhead rate if a small blanket takes 2 hours of direct labor and a large blanket takes 3 hours of direct labor?arrow_forwardSmokeCity, Inc., manufactures barbeque smokers. Based on past experience, SmokeCity has found that its total annual overhead costs can be represented by the following formula: Overhead cost = 543,000 + 1.34X, where X equals number of smokers. Last year, SmokeCity produced 20,000 smokers. Actual overhead costs for the year were as expected. Required: 1. What is the driver for the overhead activity? 2. What is the total overhead cost incurred by SmokeCity last year? 3. What is the total fixed overhead cost incurred by SmokeCity last year? 4. What is the total variable overhead cost incurred by SmokeCity last year? 5. What is the overhead cost per unit produced? 6. What is the fixed overhead cost per unit? 7. What is the variable overhead cost per unit? 8. Recalculate Requirements 5, 6, and 7 for the following levels of production: (a) 19,500 units and (b) 21,600 units. (Round your answers to the nearest cent.) Explain this outcome.arrow_forward

- Use the following information for Exercises 9-63 and 9-64: Palladium Inc. produces a variety of household cleaning products. Palladiums controller has developed standard costs for the following four overhead items: Next year, Palladium expects production to require 90,000 direct labor hours. Exercise 9-64 Performance Report Based on Actual Production Refer to the information for Palladium Inc. above. Assume that actual production required 93,000 direct labor hours at standard. The actual overhead costs incurred were as follows: Required: Prepare a performance report for the period based on actual production.arrow_forwardUse the following information for exercise: Cinturon Corporation produces high-quality leather belts. The company's plant in Newcastle uses a standard costing system and has set the following standards for materials and labour: Leather (3 strips @ $4) $12.00 Direct labour (0.75 hr @ $18 13.50 Total prime cost $25.50 During the first month of the year, the Newcastle plant produced 92 000 belts. Actual leather purchased was 287 500 strips at $3.60 per strip. There were no beginning or ending inventories of leather. Actual direct labour was 78 200 hours at $18.50 per hour. BUDGET VARIANCES, MATERIALS AND LABOUR Refer to the information for Cinturon Corporation above. REQUIRED: 1 Compute the costs of leather and direct labour that should be incurred for the production of 92 000 leather belts. 2 Compute the total budget variances for materials and labour. 3 Would you consider these variances material with a need for investigation? Explain.arrow_forwardAnswer complete question, answer in text form please (without image)arrow_forward

- Alpesharrow_forwardJust need to know if I got the right answer 1. Doogan Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Price or Rate Direct materials 9.2 grams $ 3.80 per gram Direct labor 0.3 hours $ 38.00 per hour Variable overhead 0.3 hours $ 8.80 per hour The company produced 7,000 units in January using 41,110 grams of direct material and 2,560 direct labor-hours. During the month, the company purchased 46,200 grams of the direct material at $3.50 per gram. The actual direct labor rate was $37.30 per hour and the actual variable overhead rate was $8.60 per hour. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The variable overhead rate variance for January is: A.$420U B $512U C.$420F D. $512F I got $512Farrow_forwardCinturon Corporation produces high-quality leather belts. The company's plant in Boise uses a standard costing system and has set the following standards for materials and labor: Leather (3 strips @ $6.00) $18.00 Direct labor (0.25 hr. @ $10.00) 2.50 Total prime cost $20.50 During the first month of the year, the Boise plant produced 49,000 belts. Actual leather purchased was 100,000 strips at $3.90 per strip. There were no beginning or ending inventories of leather. Actual direct labor was 33,000 hours at $13.50 per hour. Required: 1. Compute the costs of leather and direct labor that should be incurred for the production of 49,000 leather belts. Materials $fill in the blank 1 Labor $fill in the blank 2 2. Compute the total budget variances for materials and labor. Total Budget Variance Materials $fill in the blank 3 Labor $fill in the blank 5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning