Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Kindly help me with accounting questions

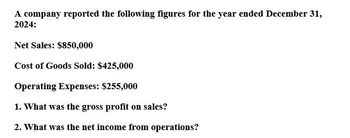

Transcribed Image Text:A company reported the following figures for the year ended December 31,

2024:

Net Sales: $850,000

Cost of Goods Sold: $425,000

Operating Expenses: $255,000

1. What was the gross profit on sales?

2. What was the net income from operations?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information is available for Cooke Company for the current year: The gross margin is 40% of net sales. What is the cost of goods available for sale? a. 5840,000 b. 960,000 c. 1,200,000 d. 1,220,000arrow_forwardThe following selected information is taken from the financial statements of Arnn Company for its most recent year of operations: During the year, Arnn had net sales of 2.45 million. The cost of goods sold was 1.3 million. Required: Note: Round all answers to two decimal places. 1. Compute the current ratio. 2. Compute the quick or acid-test ratio. 3. Compute the accounts receivable turnover ratio. 4. Compute the accounts receivable turnover in days. 5. Compute the inventory turnover ratio. 6. Compute the inventory turnover in days.arrow_forwardJuroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: 1. Calculate the return on sales. (Note: Round the percent to two decimal places.) 2. CONCEPTUAL CONNECTION Briefly explain the meaning of the return on sales ratio, and comment on whether Juroes return on sales ratio appears appropriate.arrow_forward

- Last year, Nikkola Company had net sales of 2,299,500,000 and cost of goods sold of 1,755,000,000. Nikkola had the following balances: Refer to the information for Nikkola Company above. Required: Note: Round answers to one decimal place. 1. Calculate the average inventory. 2. Calculate the inventory turnover ratio. 3. Calculate the inventory turnover in days. 4. CONCEPTUAL CONNECTION Based on these ratios, does Nikkola appear to be performing well or poorly?arrow_forwardA classified income statement showed net sales of $630,000, cost of goods sold of $342,000, and total operating expenses of $192,000 for the fiscal year ended June 30, 2019. 1. What was the gross profit on sales? 2. What was the net income from operations?arrow_forwardFor the fiscal year, sales were $191,350,000 and the cost of merchandise sold was $114,800,000.a. What was the amount of gross profit?b. If total operating expenses were $18,250,000, could you determine net income?c. Is Customer Refunds Payable an asset, liability, or owner’s equity account, and what is its normal balance?d. Is Estimated Returns Inventory an asset, liability, or owner’s equity account, and what is its normal balance?arrow_forward

- Please provide answer as per possible fastarrow_forwardCalculate it's gross profit? General accountingarrow_forwardAssume the following sales data for a company: Current year $778,795 Preceding year 600,257 What is the percentage increase in sales from the preceding year to the current year?arrow_forward

- Concord, Inc. has the following Income Statement (in millions): CONCORD, INC. Income Statement For the Year Ended December 31, 2026 Net Sales $145 Cost of Goods Sold 87 Gross Profit Operating Expenses Net Income 58 O 66.7% 40.0% 100.0% 60.0% 39 $19 Using vertical analysis, what percentage is assigned to gross profit?arrow_forward??arrow_forwardTamarisk, Inc. has the following Income Statement (in millions): TAMARISK, INC.Income StatementFor the Year Ended December 31, 2023 Net Sales $174 Cost of Goods Sold 101 Gross Profit 73 Operating Expenses 40 Net Income $ 33 Using vertical analysis, what percentage is assigned to net sales?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning